7% US inflation confirms swifter action by the Fed, but focus should shift to the balance sheet, bringing the long-end into play again. As policies shift we don't think we have seen the end of higher rates yet, also in EUR where seasonally high issuance adds to the pressure. Periphery spreads have coped fairly well despite being the focus of recent new deals

Confirmation of rather sooner quantitative tightening

The US inflation rate having now accelerated to 7% – its highest level since 1982 – has made for some catchy headlines, but soaring prices are not new and the Fed has already, even if somewhat belated, pivoted to fight them. Rates markets were thus unfazed by this latest data point. 5y5y inflation swaps were little changed on the day, and if anything, the decline in rates yesterday suggests that markets were even positioned for a larger inflation shock than implied by the consensus.

7% figure comes as a confirmation that the Fed will have to embark on a significant policy tightening

Until the 7% figure comes as a confirmation that the Fed will have to embark on a significant policy tightening in the months and quarters ahead. Following Fed Chair Powell’s appearance before the Senate on Tuesday, Lael Brainard’s confirmation hearing today for Vice President of the Fed should now see a usually outspoken dove brandishing her inflation fighting credentials. Perhaps she will even reveal more detail about the Fed’s balance sheet reduction plans, ie, quantitative tightening. Her colleague Loretta Mester, sitting on the hawkish end of Fed officials, yesterday called for swifter policy tightening, a rate hike in March, and leaving also the option on the table of actively selling assets from the balance sheet, rather than just letting them roll off as they mature.

'Faster and sooner' Quantitative Tightening may be a sign that the Fed wants a steeper curve

Quantitative Tightening (QT) should put more focus on the back end of the curve again

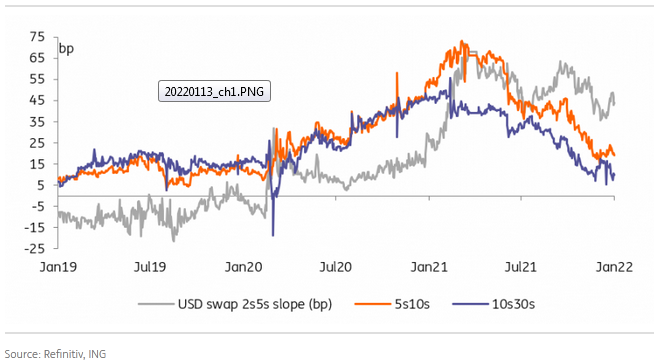

The US front end currently already discounts some six 25bp hikes over the next two years, between three to four already this year. We have argued earlier that attention shifting towards quantitative tightening should put more focus on the back end of the curve again. It will be interesting to see whether the breather in 10Y UST yields after the strong sell-off since mid-December will prompt more fixed rate receiving and buying, preventing a short-term move higher. Still, in our view the 1.7% level from 10Y yields in light of the current macro backdrop is the anomaly and further curve steepening should lie ahead.

Periphery EGBs relatively resilient despite waning ECB support and issuance

EUR rates have moved lower yesterday in sympathy with the US, even outperforming. In the grander scheme though yields are still significantly higher from where they were just a few weeks ago, more than 30bp for the 10Y Bund yield since mid-December. Shifts in the policy stance given more persistent price pressures is one reason, but seasonally higher issuance activity at the start of the year is adding to the upward pressure.

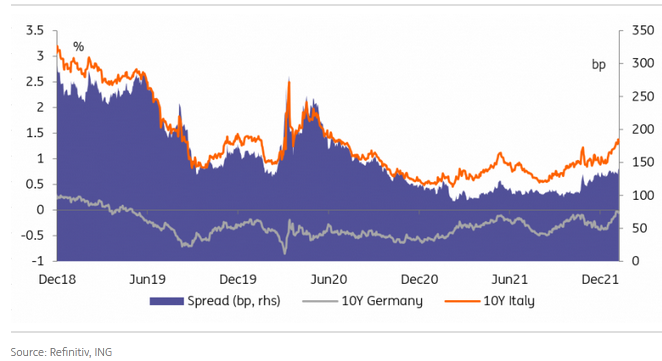

Despite higher yields and high issuance, performance of the periphery has been relatively robust

It is worth highlighting though that the syndicated deals in the eurozone government bond space have been centred in the eurozone periphery, starting with last week’s 30Y Italian bond and continuing this week with 10Y Spain, 20Y Portugal and the 10Y Ireland bond announced just yesterday. Despite higher yields and high issuance, performance of the periphery so far has been relatively robust. The 10Y Italy-Bund spread briefly moved towards the 140bp level in the wake of the 30Y issue but has since recovered towards 135bp. It is still the highest level since late 2020, but it has to be seen against the prospect of central bank buying support about to be pared back and also a more uncertain political backdrop in Italy nowadays.

Periphery spreads are holding well considering tapering, supply, and political risk

It may be that the ECB is taking the supply seasonality into consideration when conducting asset purchases. Arguably extrapolating from just the first data point for the year is a stretch, but buying under the pandemic emergency purchase programme (PEPP) in the first days of the year was relatively decent and could imply monthly buying still surpassing €50 bn in January.

The Italian presidential election is a source of uncertainty over the next weeks

The politics surrounding the Italian presidential election process in particular continue to be a source of uncertainty over the next weeks. And we would not dismiss wider spreads, especially if snap elections were the result of current Prime Minister Draghi moving to become President of the Republic. He is the glue of the current coalition, but some argue he is already losing grip as the general elections early next year are slowly moving into view. And having him as President for a term of 7 years could provide a stability anchor well past the next elections.

US Treasury will reopen the 30Y bond for US$22bn.

Supply remains one of the main theme in EUR government bond markets with Ireland having announced a new 10Y bond and Italy auctioning a moderate up to €6-7bn in 3Y and 7Y bonds. On the ECB speakers front we will hear from VP Luis de Guindos and board member Elderson.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more