Much Needed Relief but Only Time Will Tell if This Lasts

There was a palpable sense of relief in financial markets yesterday as bond yields retraced a good chunk of their recent drop, credit indices a good chunk of their widening, and stock indices a good chunk of their recent sell-off. Markets closer to the epicenter of the crisis remain far from last week’s levels. For instance, the KBW US regional bank index is still severely depressed, reflecting in part the more durable challenge to their profitability and funding mix that this crisis has caused.

Treasury yields are also much below their level of a week ago, especially at the front end, when Powell firmly put a 50bp hike at the March meeting on the table. Even after their rebound, yields still reflect an uneasy average of two radically different scenarios. Scenario one, which we will call business as usual, is where yesterday’s upside surprise in core CPI piles pressure on the Fed to continue its hiking cycle, even if at a 25bp-per-meeting clip. The second scenario reflects a tail risk where the contagion from SVB’s failure results in a durable tightening of financial conditions, and so reduces the need for further hikes, and perhaps even necessitates cuts to cushion the blow to financial markets.

Clearly, the latter seems far-fetched but the speed at which events unfolded requires us to stay vigilant. Much depends on anecdotal evidence of deposit flow and funding levels of US regional banks. Sentiment among large depositors in particular is very difficult to predict.

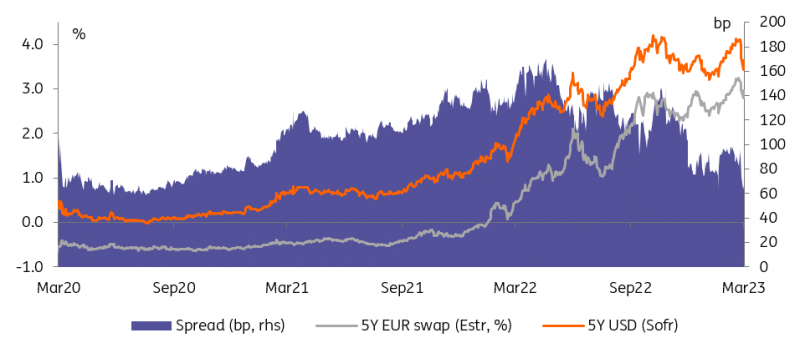

US banking troubles have accelerated the narrowing of dollar-euro rate differentials that we were expecting

Source: Refinitiv, ING

ECB Staying the Course but US Contagion Further up the Curve

Markets largely see the ECB staying the course and hiking by 50bp at tomorrow’s meeting. US banking stress makes an already tricky communication exercise even more difficult for markets to trade. Somehow, contagion to European markets has so far been limited. Whilst some indicators of euro bank funding have tightened, this was from far too easy levels.

Broader indicators of non-bank funding stress have been less impacted. It should be said, however, that a greater proportion of funding to the eurozone economy is intermediated by banks. Bottom line is that the ECB is in a determined fight with inflation and it can ill afford the distraction, so we’re inclined to think it’ll stick to that battle for now.

Farther afield, if the recent crisis shaves a few hikes off the Fed’s tightening path, it makes sense that markets expect this to translate into lower pressure on the ECB to hike. By chief economist Philip Lane’s own admission, the euro weakness is less of a concern now for the inflation outlook (compared to inflation expectations and wages) but the read-across from Fed policy to ECB cannot be totally dismissed. In any case, the recent events, a potentially earlier end to the Fed’s hiking cycle reinforce our view that the rates differential between the euro and dollar will narrow.

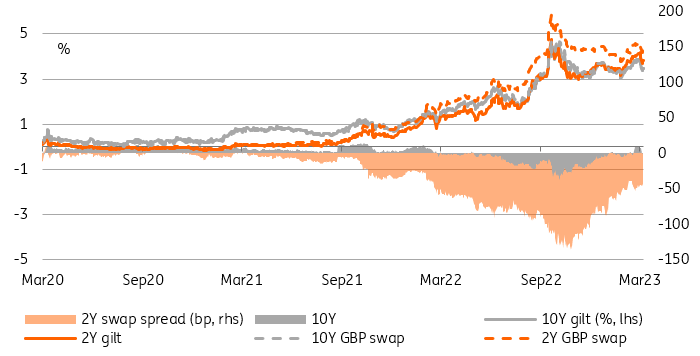

The New DMO Remit Should Accelerate the Re-tightening of Gilt Swap Spreads

Source: Refinitiv, ING

Disclaimer: This publication has been prepared by ING solely for information purposes, irrespective of a particular user's means, financial situation, or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal, or tax advice, or an offer or solicitation to purchase or sell any financial instrument. Read more