Does a 1.7% US Treasury yield look right after Friday's payrolls report?

This is a boom period for the US economy.

Granted, it is all about emerging from a hole of Covid-19 induced despair, but it will still manifest a near 10% expansion of nominal GDP in the space of just one year. And that is an actual expansion; none of that annualized malarky.

We chose the nominal measure of expansion purposely, as it includes inflation. So too do market rates.

In that respect, we can and should compare a 10% nominal GDP expansion with the 1.7% yield on the 10-Year US Treasury and conclude that the latter looks quite low. It is, in fact, quite remarkable how market rates have managed to remain relatively subdued. Yes, the 10-year rate is up from a low of 50 basis points, but the absolute level is not that remarkable (apart from being very low versus nominal GDP expansion).

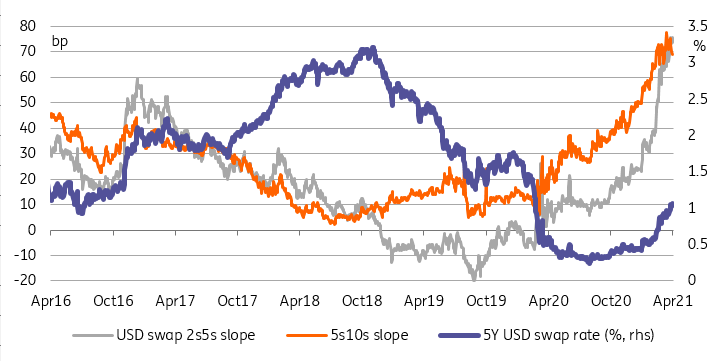

5-year has cheapened on the curve but rates are a long way from 'normalised'

Source: Refinitiv, ING

The structure of the curve has become more bearish, signaling further rises in rates

A notable occurrence in the wake of Friday's payrolls report is the 5-year area finally traded absolutely cheap to the curve. It had been cheapening for a number of months but was only getting less rich. At the close on Friday, it was finally trading cheap to the curve. This is important as a cheap 5-year and/or a cheapening in the 5-year typically correlates with a move higher in market rates. The 5-year has considerable room to cheapen some more, which suggests that market rates have plenty of room to rise.

On the curve itself, the 2/5-year continues to stretch steeper, while the flattening of the curve has not just been on the 10/30-year segment, but has filtered down to the 5/10-year segment. The flattening on the 5/10yr is a reflection of a need for the 5-year to cheapen some more. The 5/10yr is prone to some re-steepening should the 10-year really shift higher in the coming weeks and months. Meanwhile the 10/30-year is on a structural flattening trend.

The other clear move has been the injection of life into the fed funds strip. An end 2022 rate hike is now clearly being played with as a live possibility. This is quite deviant from what the Federal Reserve has been intimating. And the market record here is not great. The last time the Fed had rates at zero the market continually discounted that the Fed would hike 18 months out, and that continued for seven years before it finally materialised.

In the end, the Fed will decide. But the Fed has quite some verbal convictions to walk back if they were to go as soon as 18 months from now.

Today's events and market view

Out of today’s raft of PMI Services data in Europe, Spain and Italy’s will be the first readings. A third Covid-19 wave is likely to have prevented sentiment in the sector from emulating the optimism seen in manufacturing. We guess expectations for relatively soft readings are well shared, but the discrepancy with the US ISM for instance should help cement expectations of divergence between USD and EUR rates this quarter.

Italy (7Y/50Y) and Portugal (10-year) have mandated banks for syndicated deals yesterday. We expect both to price today. That two erstwhile peripheral issuers feel confident launching deals on the same day speaks to the more favourable environment for spread and duration issuance created by faster ECB purchases in Q2. We expect the re-widening in Italy-Germany spreads yesterday to be promptly reversed.

As the US economic recovery gathers pace, so increases the pressure on the Fed to acknowledge better economic prospects. We doubt today's FOMC minutes will show cracks in the dovish consensus, but comments from board members Robert Kaplan, Mary Daly, and Thomas Barkin's comments could help the Treasury market price an earlier start to tapering than the early 2022 consensus.

Original Post

Content Disclaimer: The information in the publication is not an investment recommendation and it is not an investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument.

This publication has been prepared by ING solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. Read more