Rate hikes will be far fewer than the markets currently expect.

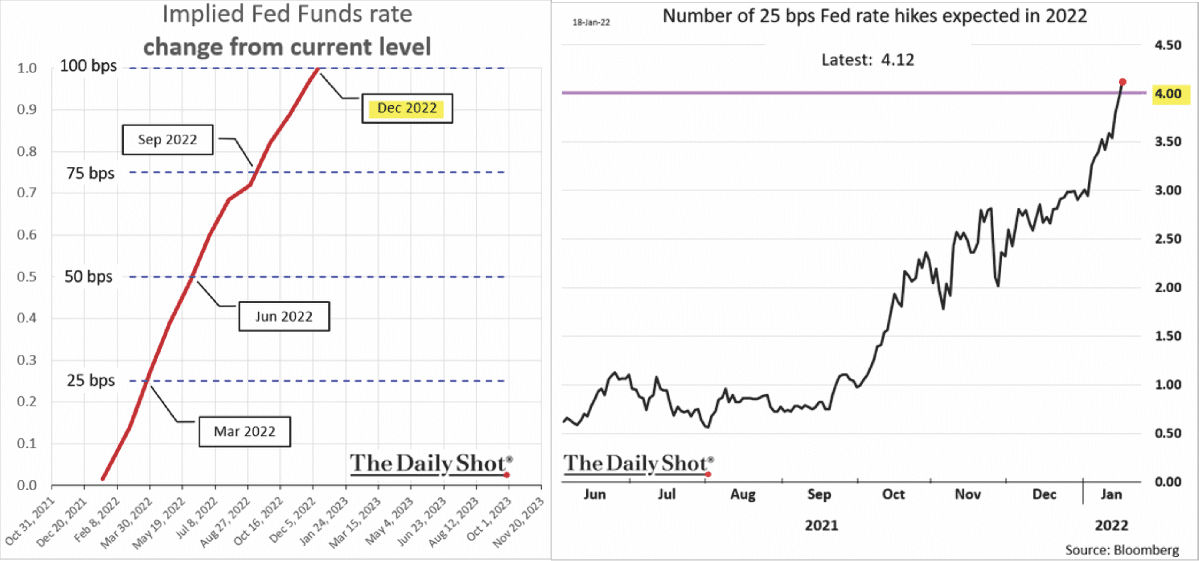

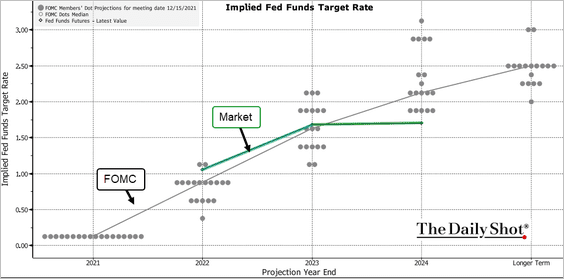

Currently, with inflation pushing more than 7%, the highest level in decades, it is not surprising to see the market “pricing in” a more aggressive rate-hiking campaign by the Federal Reserve. As shown via the Daily Shot, the markets expect a certainty of 4-rate hikes in 2022.

As Michael Lebowitz previously discussed, such is essential because the market tends to UNDER-estimate the Fed. To wit:

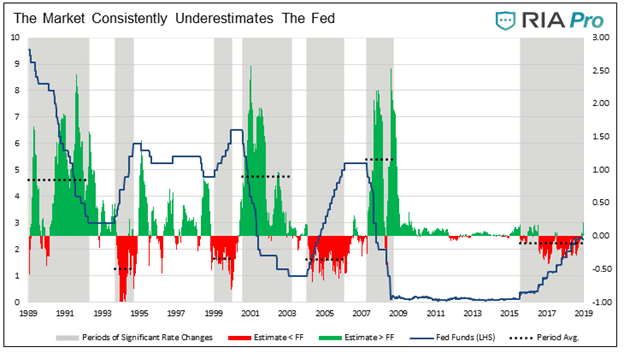

“The graph below shows how much the Fed Funds futures market consistently over or underestimates what the Fed does. The green areas and dotted lines quantify how much the market underestimates how much the Fed ultimately reduces rates. The red shaded areas and dotted lines are akin to today’s potential rising rate situation. They show estimates for rate cuts fall short of the Fed’s actual actions.”

“As shown in the graphs above, the market has underestimated the Fed’s intent to raise and lower rates every single time they changed the course of monetary policy meaningfully. The dotted lines highlight that the market has underestimated rate cuts by 1% on average, but at times during the last three rate-cutting cycles, market expectations were short by over 2%. The market has underestimated rate increases by about 35 basis points on average.”

Notably, the market’s margin of error for rate hikes is more accurate than when the Fed is cutting.

Walking Into A Liquidity Trap

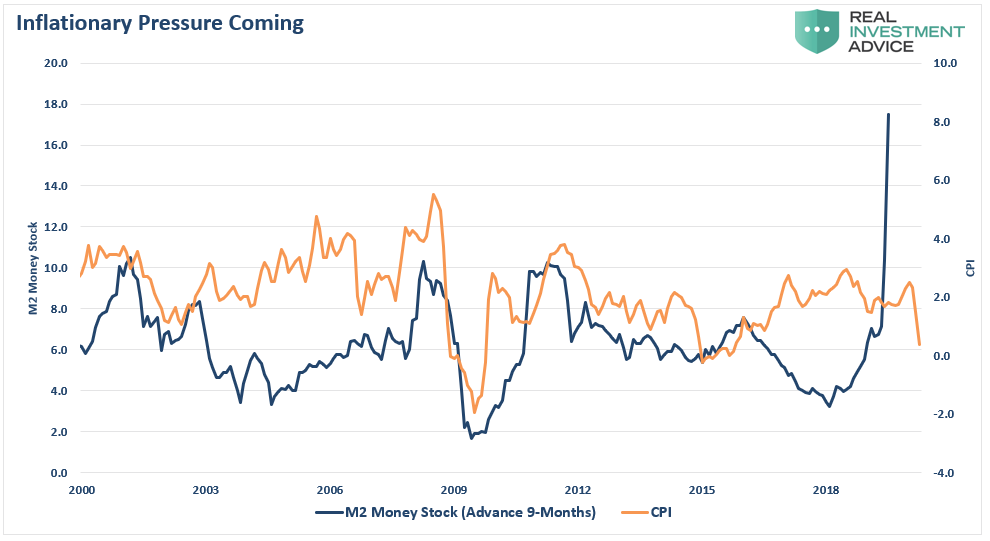

In July 2020, we suggested the massive surge of monetary liquidity would lead to a rise in inflation in roughly 9-months. To wit:

“While ‘deflation’ is the overarching threat longer-term, the Fed is also potentially confronted by a shorter-term “inflationary” threat.

"The ‘unlimited QE’ bazooka is dependent on the Fed needing to monetize the deficit to support economic growth. However, if the goals of full employment and economic growth quickly come to fruition, the Fed will face an ‘inflationary surge.”’

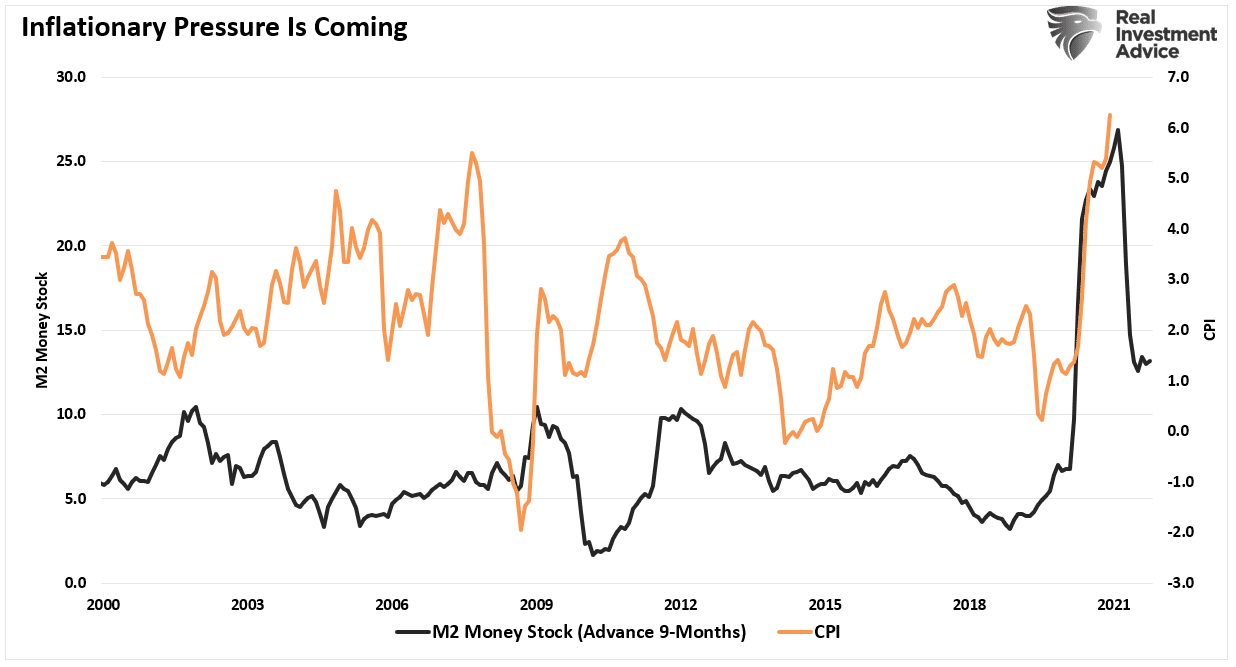

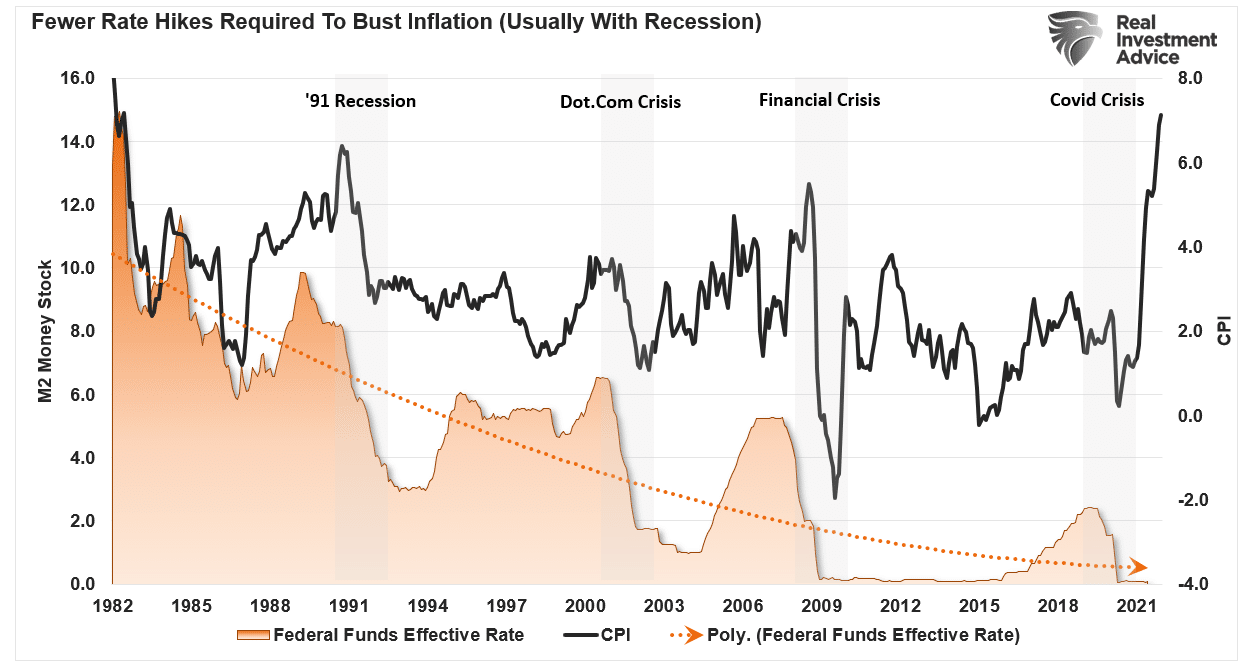

I have updated that chart below. Not surprisingly, inflation surged almost exactly 9-months later. So while many, including the Fed, are suggesting inflation will remain rampant in 2022, the M2 Money Stock indicator is suggesting “disinflation” is more likely.

As we stated in 2020:

“Should such an outcome occur, it will push the Fed into a very tight corner. The surge in inflation will limit the ability to continue “unlimited QE” without further exacerbating inflation.

"It’s a no-win situation for the Fed.“

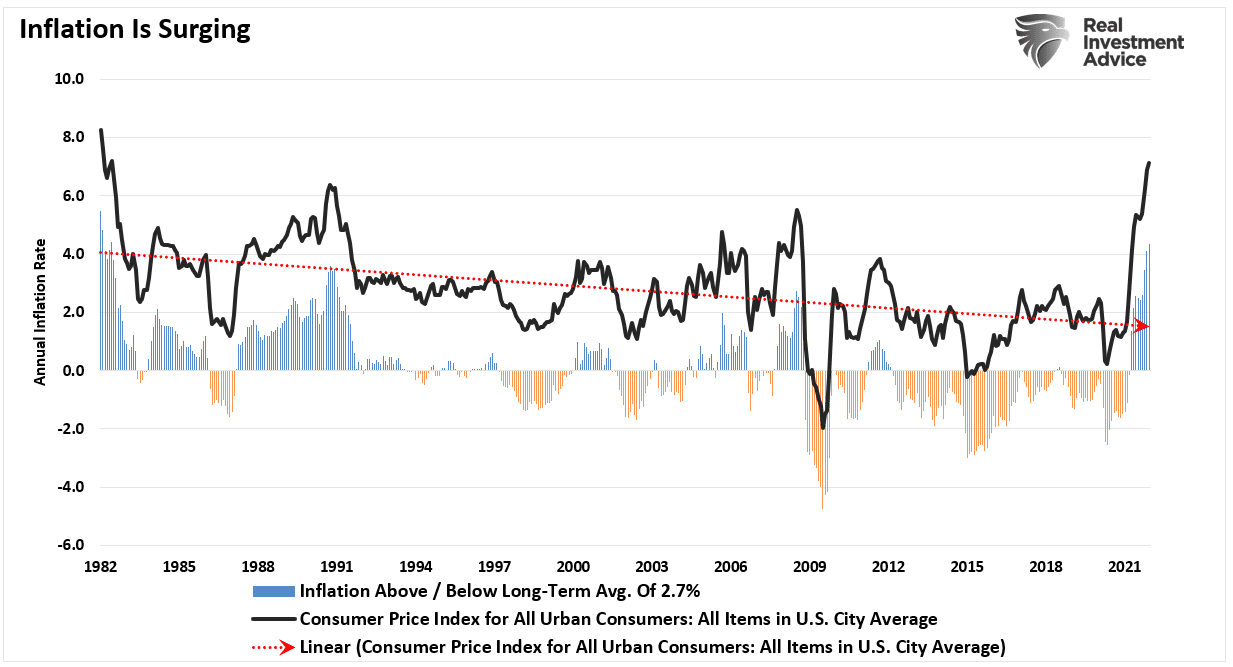

As shown, with inflation running well above their target of 2%, much less the long-term average of 2.7%, the Fed is now getting pushed into aggressively hiking rates.

The problem, of course, is that deflation pressures are likely to return sooner than expected, given the contraction in liquidity. Such was a point made by David Rosenberg recently.

“This time next year, demand is going to be quite a bit weaker. Recurring large rounds of fiscal stimulus have been the key component of demand growth, and that is going to decline. People have not appreciated the extent of the fiscal boost on aggregate demand. That [demand] is going to dissipate substantially. At the same time, supply will come back on stream. We know that because that is what history tells us.“

Fed Rate Hikes Likely Short-Lived

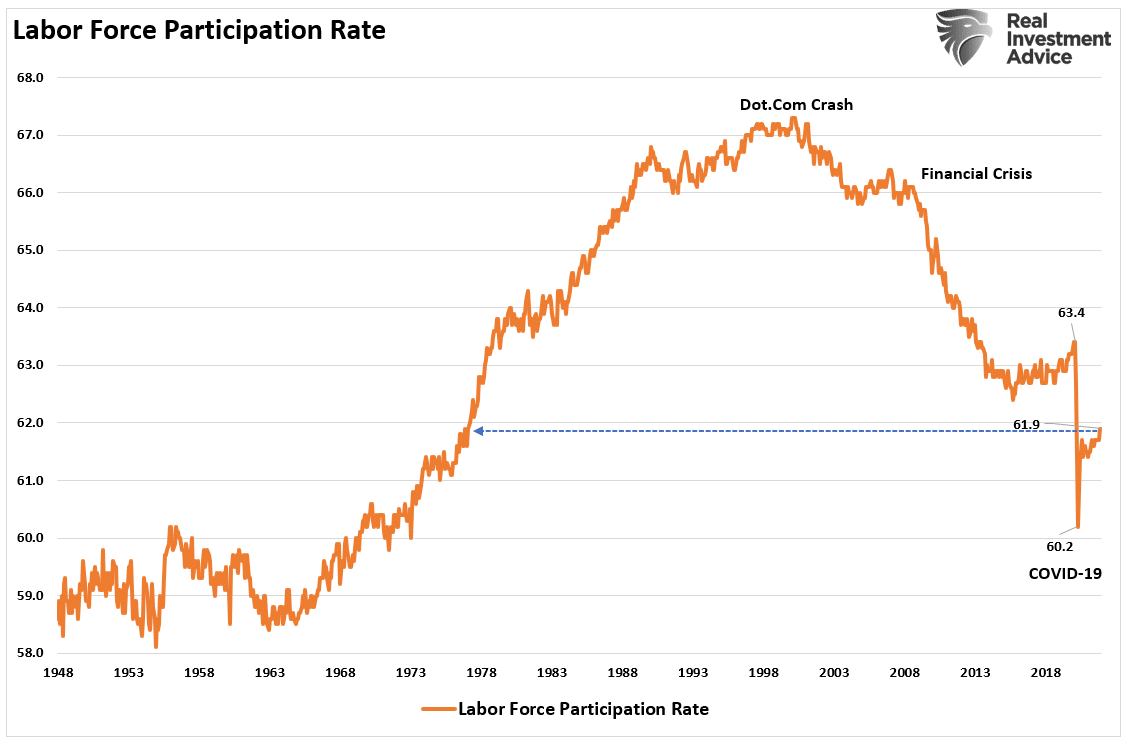

David is correct. The massive liquidity dump created a demand surge amid a shutdown of the economy due to the COVID pandemic. In the future, both will reverse. We also know that disinflationary pressures will resurface due to the labor force participation rate. While the employment rate may be nearing the Fed’s target of “full employment,” the participation rate tells a very different story.

If the participation rate is correct and remains low, the economy is weaker than headline numbers suggest. Moreover, if the Fed aggressively tightens monetary policy in an already overleveraged economy, such will likely slow growth rates quicker than anticipated.

That market is already suspecting such is the case predicting an end to rate hikes by the end of 2022.

That last point is essential.

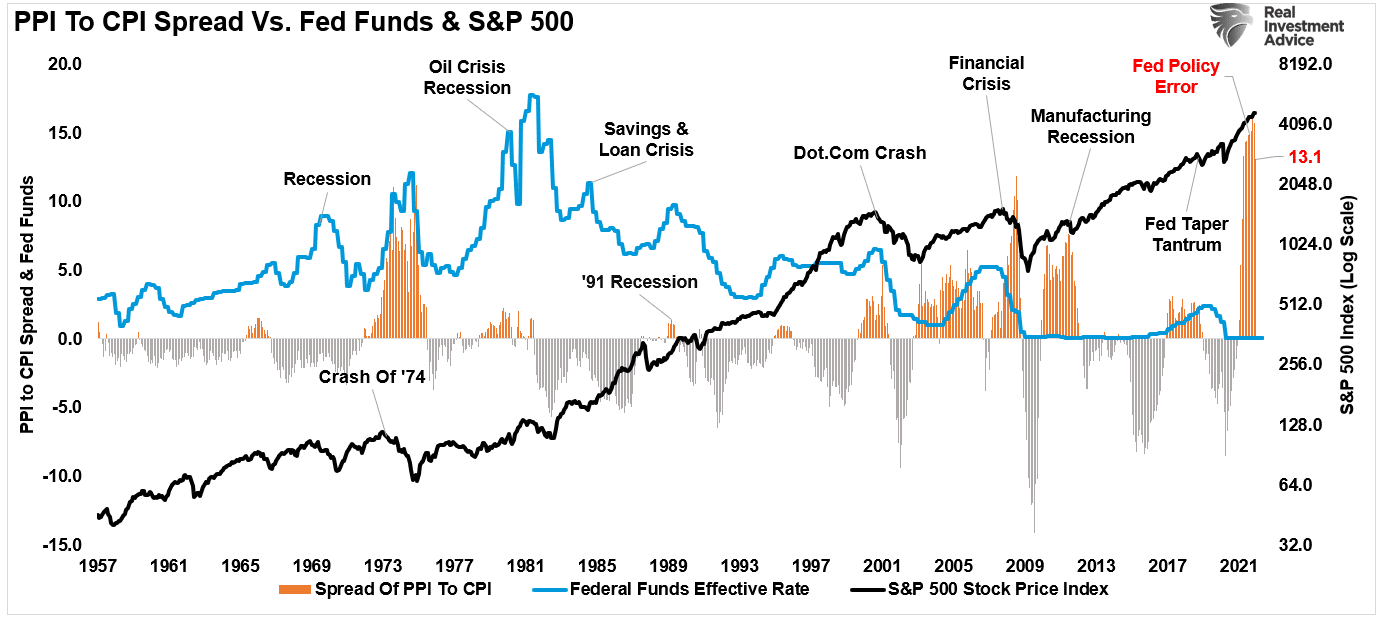

As shown below, since 1982, every time the Fed has started a rate hike campaign, there were two outcomes:

- Each round of rate hikes ended in a recession, crisis, or bear market; and,

- The level at which higher rates sparked an economic or market crisis was consistently lower than the last.

Again, with a market and economy more heavily levered than ever, the peak of the Fed’s rate hike cycle will likely be lower once again.

A Policy Mistake In The Making

As noted, the Fed is in a tough spot. While they should be aggressively tightening policy, they are also aware of the ramifications of losing market stability.

If the Fed raises rates to break the inflation surge, such also retards economic growth. Higher rates historically equate to more negative market outcomes. Such is particularly true when valuations become elevated and low rates support the bullish thesis.

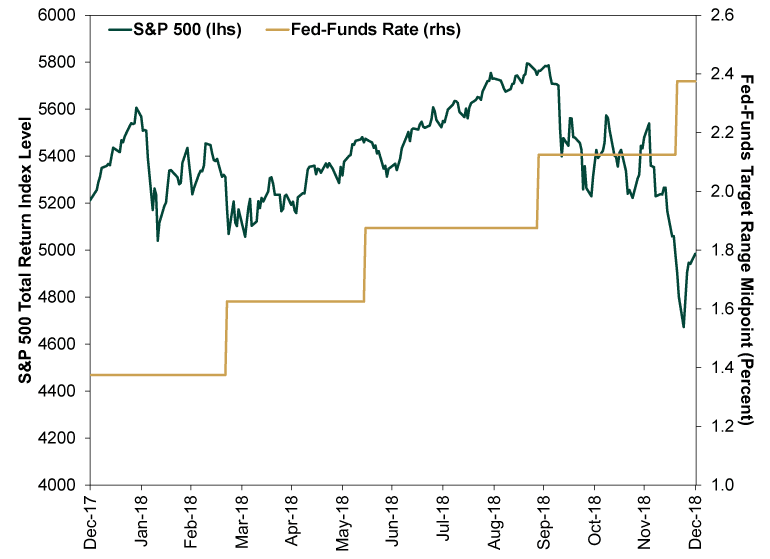

The most significant risk to investors is the Fed’s ability to “jawbone” the markets to maintain financial stability when reversing monetary accommodation. Such is the same environment we saw in 2018 where the Fed uttered the words “we are nowhere close to the neutral rate.”

Two months later, and 20% lower in the markets, Jerome Powell discovered he had magically reached the “neutral rate” and needed to ease off on monetary tightening.

Of course, in 2018, Powell didn’t have 7% inflation to deal with.

This time could indeed be different.

The Lesser Of Two Evils

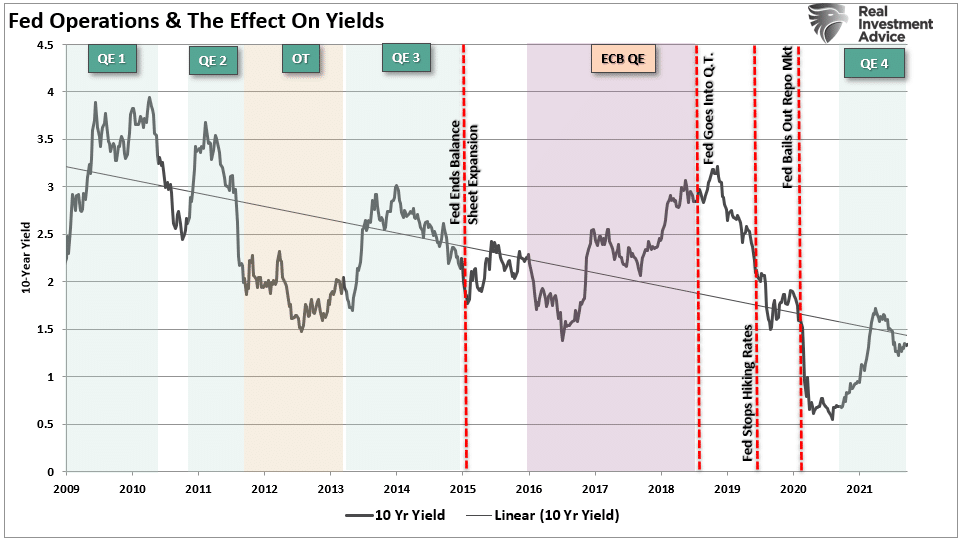

Once again, bond yields are confounding the “bears” by remaining low while inflation surges. As noted, the bond market suggests that the surge in economic growth and inflation will fade along with monetary liquidity. As we said previously:

“However, over the last decade, a reversal in Fed policy has repeatedly provided bond-buying opportunities. In the past, rates rose during QE programs as money rotated out of the “safety of bonds” back into equities (risk-on.).

"When those programs ended, rates fell as investors reversed their risk preferences.“

Even before the Fed begins to taper and hike rates, investors’ risk preferences are changing. The Fed will likely exacerbate the problem further by removing monetary accommodation precisely at the wrong time.

While the Fed likely understands they should not be aggressively hiking rates, the consensus view is they will remain on their current path. While raising rates will accelerate a potential recession and a significant market correction, it might be the ‘lesser of two evils from the Fed’s perspective.

Being caught near the “zero bound” at the onset of a recession leaves few options to stabilize an economic decline.

Unfortunately, we doubt the Fed has the stomach for “financial instability.” As such, we doubt they will hike rates as much as the market currently expects.