The Canadian dollar’s slide was halted Friday by a surprisingly good jobs report. In February, Canada created 105,000 full-time positions! Even with a loss of 95,000 part-time jobs, the net gain of 15,000 jobs remains well above expectations. We are seeing a faster pace of job creation over the past 6 months (+219,000) and a statistical correction would not be surprising next month.

In the United States, the jobs report was also very solid (+235,000).

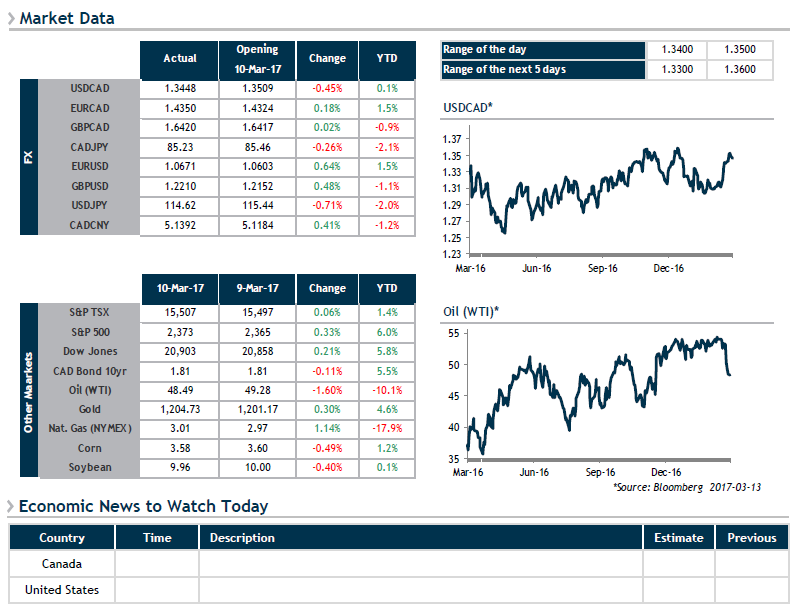

The U.S. Federal Reserve (Fed) is now gearing up (with 100% certainty according to markets) to raise interest rates on Wednesday. Anything less than a glowing statement accompanying the decision could be viewed as a disappointment. It should be remembered that inflation has still not reached the Fed’s target! With a USD/CAD pair close to the top of the 1.3000-1.3500 range, sellers should think about hedging their receivables and future sales (we were under 1.3000 at the start of February), especially if budget rates are around 1.2500-1.3000.

The new Trump administration may also have surprises in store for us at the next G20 summit, which kicks off Friday. Treasury Secretary Mnuchin could talk about countries that are keeping their currencies undervalued. Have a great week!