The prospect for a rate hike is resonating in the Treasury market. Is this another head fake? Or is the Federal Reserve truly ready to embrace another round of policy tightening?

No one knows for sure at this point, including the Fed’s voting members. Much depends on how the economic reports fare between now and the December 13-14 FOMC meeting, when the central bank is expected to raise rates, based on Fed funds futures. No change is expected at the November 1-2 meeting, however.

Yesterday’s release of FOMC minutes for September 20-21 fueled speculation that the central bank is close to raising its policy rate. “Among the participants who supported awaiting further evidence of continued progress toward the Committee’s objectives, several stated that the decision at this meeting was a close call,” the minutes reported.

“The probability of a rate hike is very likely by the end of the year,” advises Randall Kroszner, a former Fed governor who’s currently an economics professor at the University of Chicago. “Unless there’s some major shock, I think they’re pretty much on track to move in December.”

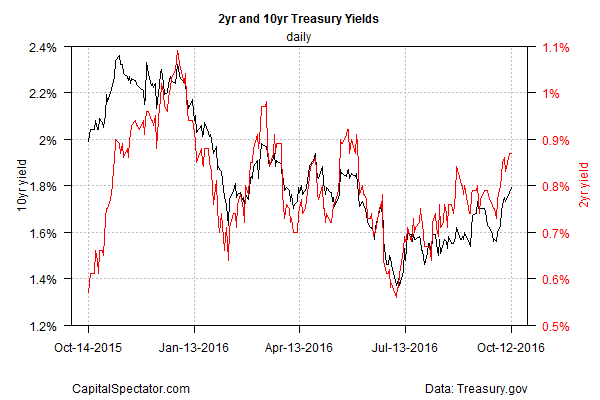

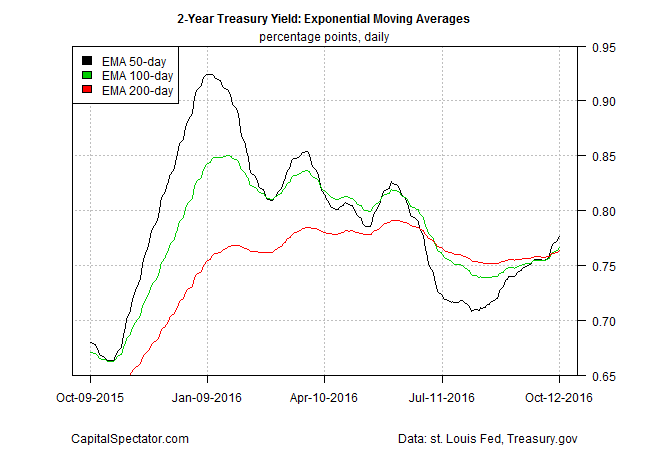

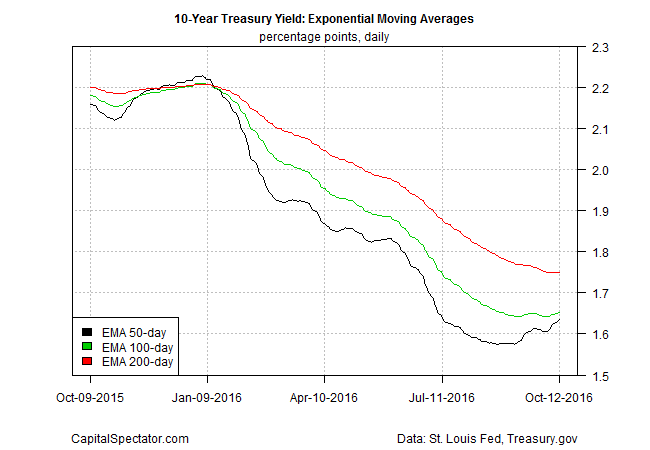

Meanwhile, let’s look at the numbers from several perspectives for additional perspective, starting with key Treasury yields. As the first chart below shows, an upward bias is conspicuous these days in the policy sensitive 2-year yield and benchmark 10-year yield.

The 2-year yield ticked up to a new four-month high yesterday (October 12), reaching 0.87%, based on daily data from Treasury.gov. Ditto for the 10-year yield, which touched 1.79% on Wednesday.

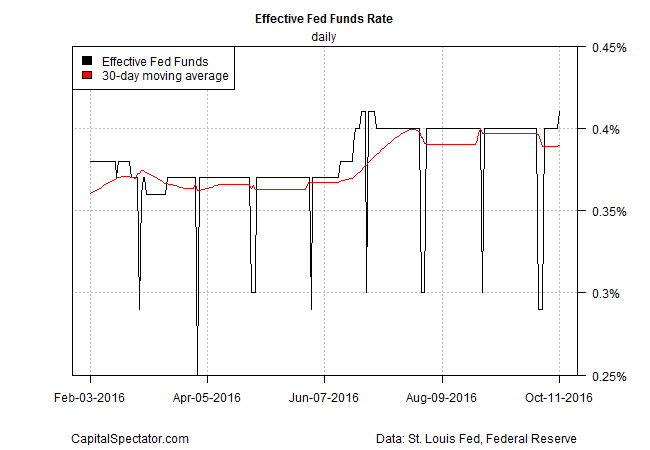

Note, too, that the effective Fed funds rate perked up to 0.41% on Tuesday (October 11) to a three-month high. Is this an early sign that the Fed is laying the groundwork for a rate hike?

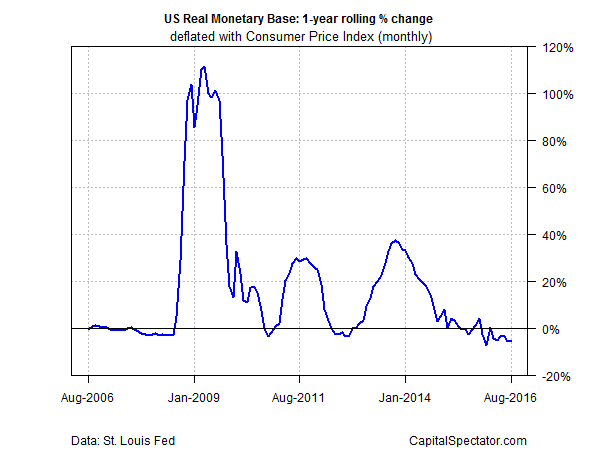

Policy certainly looks relatively tight via the year-over-year change in real M0 money supply. This measure of the monetary base (aka high-powered money) has remained negative for six straight months through August—the longest stretch of contraction in four years for the monthly data.

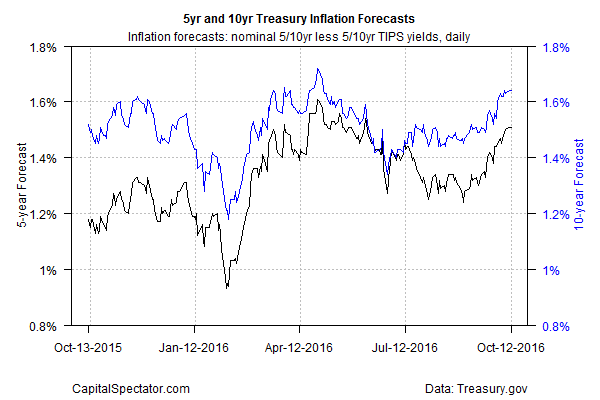

The market’s outlook on inflation is ticking higher lately, based on the yield spread between nominal and inflation-indexed Treasuries. The implied inflation rate via the 5-year maturities, for instance, is currently at 1.51%–the highest since May.

Meanwhile, the 2-year yield’s upside momentum appears to be strengthening. The rate’s 50-day exponential moving average (EMA) recently broke above its 100- and 200-day EMAs for the first time since the summer.

The 10-year’s EMAs, however, are still reflecting a downside bias, although it appears that the tide may be turning.

If the Fed is still on the fence about the timing of the next rate hike, the incoming economic data may be the factor that shifts sentiment decisively, one way or the other. The next major release: tomorrow’s retail sales data for September.

Based on Econoday.com’s consensus forecast, the numbers are on track to boost the odds for a rate hike. Economists are looking for a strong rebound in spending: +0.6% for the monthly comparison vs. a 0.3% loss in August. If the forecast holds, the year-over-year pace will firm up to a 2.7% advance, the highest since June.

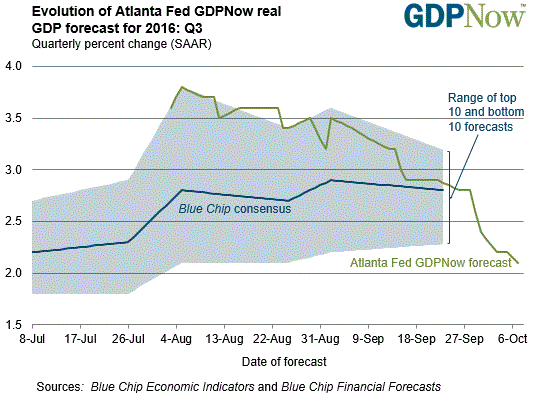

But there’s a whiff of deceleration in the air when it comes to projecting third-quarter GDP, which is scheduled for release on October 28. The Atlanta Fed’s GDPNow model is estimating (as of October 7) a healthy rebound to a 2.1% pace (seasonally adjusted annual rate), which is roughly double the gain in each of the previous three quarters.

But as the chart below shows, the Q3 estimates have been losing altitude. It’s unclear if the slide will continue, but if it does the current outlook for expecting a rate hike will suffer.

The bottom line? To borrow the phrase from the latest Fed minutes, it’s still too close to call.