Rare Element Resources (REE) is well positioned to benefit from the global move to de-risk access to rare earth oxides (REOs) by diversifying production away from China. REE is in the process of developing the Bear Lodge REO project in Wyoming, US. The project is large, with expected output of 10,400tpa of REOs over a potential 40-year life of mine. The ore body is enriched with REOs considered critical by the US Energy and Defence departments, underpinning the investment case. REE has developed a proprietary extraction technology, which should improve product quality and reduce the concentrate price discount. However, it has yet to sign up an off-take partner. Our DCF-based company valuation, at a 10% discount rate, is US$5.39/share.

Bear Lodge project: Critical rare earth enrichment

REE’s Bear Lodge project is scheduled for start-up in late 2016 (first revenues 2017) and is planned to include a mine, a physical upgrade plant (PUG) and a hydrometallurgical concentrate plant (hydromet plant), which incorporates new proprietary REO concentration technology. The ore body, which contains 944Mlb (428Mkg) TREO, is enriched with critical rare earth element neodymium and heavy rare earth element europium. There is additional mineralisation already identified that could lead to resource expansion over time.

Capable of funding its exploration programme

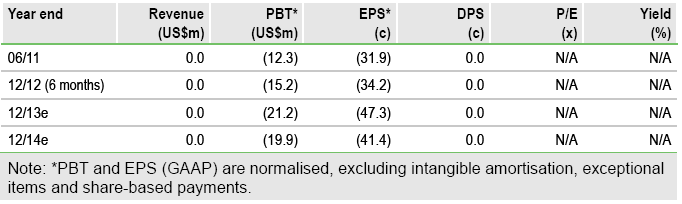

No production revenues are expected before scheduled start-up in late 2016. However, the group had cash of US$29m (US$0.65/share) at 30 June 2013, suggesting that the 2013/14 exploration and evaluation programme is fully funded. We forecast project capex of US$400m, with the bulk of the spending in 2016. REE has yet to sign an off-take partner, which would support its project funding requirement, but may be able to tap into Wyoming state development bonds.

Valuation: Based on pre-feasibility study

Our PFS-based DCF (at a 10% real discount rate) valuation for the project is US$905m. This translates into US$5.39/share, assuming a 50% split debt/equity financing structure for the project. Our estimated valuation, including the newly developed oxalate precipitation stage of the hydromet process, is US$7.23/share. However, these valuations are likely to change as the feasibility study progresses and the capex requirements of the new technology is quantified over the next 18 months.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Rare Element Resources

Bear Lodge rare earth oxide project

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.