Rapid7 Inc (NASDAQ:RPD) stock appreciated by over 630% between February 2016 and July 2019. The price climbed from $9.05 to $66.01 in less than four years on the back of strong secular growth in the cyber security industry.

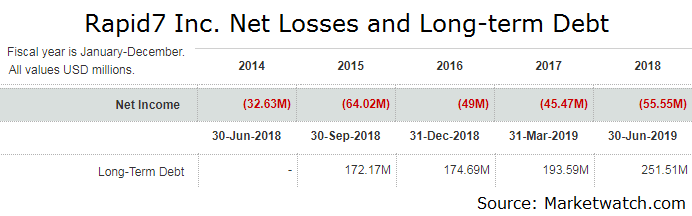

However, Rapid7 hasn’t been able to capitalize on the vast opportunities in the space. The company posted annual losses in each of the past five years and its debt load went from zero to over $250 million in the last five quarters. It looks like Rapid7’s business is deteriorating rapidly.

Rapid7 stock makes it look as if the fundamentals don’t matter. Of course, they do, and when optimism runs out the price can decline just as quickly. Just ask GoPro and Fitbit investors.

So let’s search for price patterns formed by investor psychology instead. The Elliott Wave chart below suggests the bear market might have begun already.

The daily chart of Rapid7 visualizes the stock’s entire rally from $9.05 in February 2016. It can be seen as a textbook five-wave impulse, labeled 1-2-3-4-5. The five sub-waves of waves 3 and 5 are also clearly visible. In addition, the market took the guideline of alternation into account since wave 2 is a flat correction, while wave 4 is a sharp zigzag.

Rapid7 is Vulnerable on Every Front

This chart spells trouble for the bulls who have been high on hopeium for some time now. According to the Elliott Wave theory, a three-wave correction in the opposite direction follows every impulse. RPD‘s impulsive structure looks complete, meaning a significant selloff can now be expected.

If this count is correct, the market is finally ready to admit its mistake. The support area of wave 4 near $27 a share is a natural bearish target. Rapid7 can lose roughly 50% of its market value from current levels.