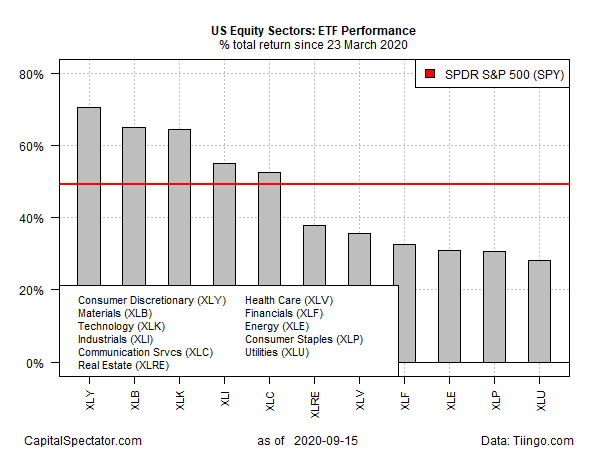

Since the US stock market hit bottom on March 23, the subsequent rally has been swift but uneven. An elite set of sectors have outperformed the broad market, based on a set of ETFs through Tuesday's close. The majority, however, are still playing catch-up.

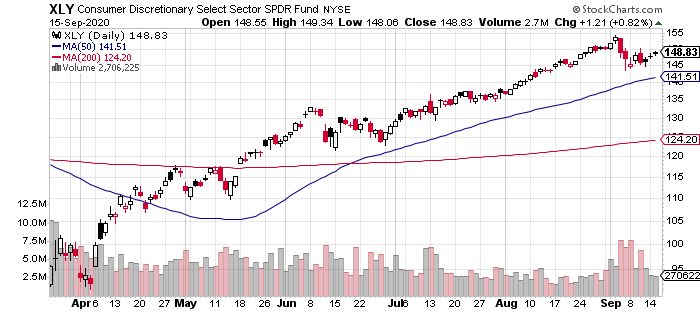

The good news from a sector perspective: everything has bounced since the darkest point for the stock market during the coronavirus crash in late-March. The leading bounce is currently held by Consumer Discretionary Select Sector (NYSE:XLY), which is up nearly 71% since Mar. 23.

Topped up with the likes of Amazon (NASDAQ:AMZN), Home Depot (NYSE:HD) and McDonald’s (NYSE:MCD), XLY’s portfolio of consumer discretionary shares has been red hot since the market crashed. By contrast, so-called consumer staples—often considered a relatively defensive corner of the market—has lagged its discretionary brethren.

Consumer Staples Select Sector (NYSE:XLP) is up 30.7% from the previous market bottom. That’s a respectable gain in the grand scheme of six-month results, but in relative terms for this year it’s near the bottom – only the utility sector’s 20.1% bounce (via Utilities Select Sector (NYSE:XLU)) since Mar. 23 is weaker.

The overall market, meanwhile, is ahead by more than 43% for the post-crash rally, based on SPDR S&P 500 (NYSE:SPY). Although the results vary widely by sector, SPY’s strong gain is a reminder that equity beta still has the capacity to lift all boats, albeit unevenly.

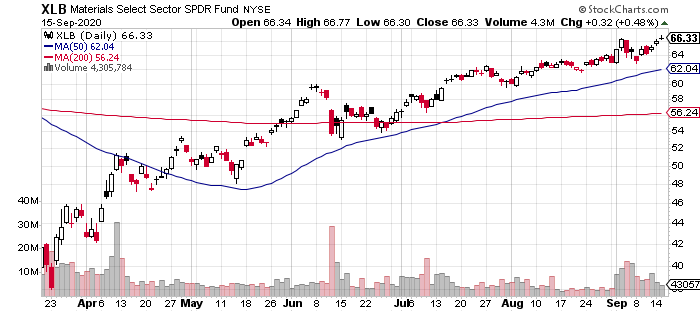

Perhaps the surprise rally of late is the strong run for materials stocks. As the second-strongest gainer since Mar. 23, Materials Select Sector (NYSE:XLB) is higher by 65.0%. But in terms of setting new highs, XLB is in a class by itself these days. Indeed, XLB ticked up yesterday, closing at a new high on Sep. 15. At the moment, this is the only sector fund on our list that’s reached previously virgin price terrain.