The road seemed especially long on Tuesday, given the explosive rally (against my gazillion shorts). I definitely retreated to some degree, but I certainly am still in the game. I went from about 175% margined to about 130%. This soldier is somewhat wounded.

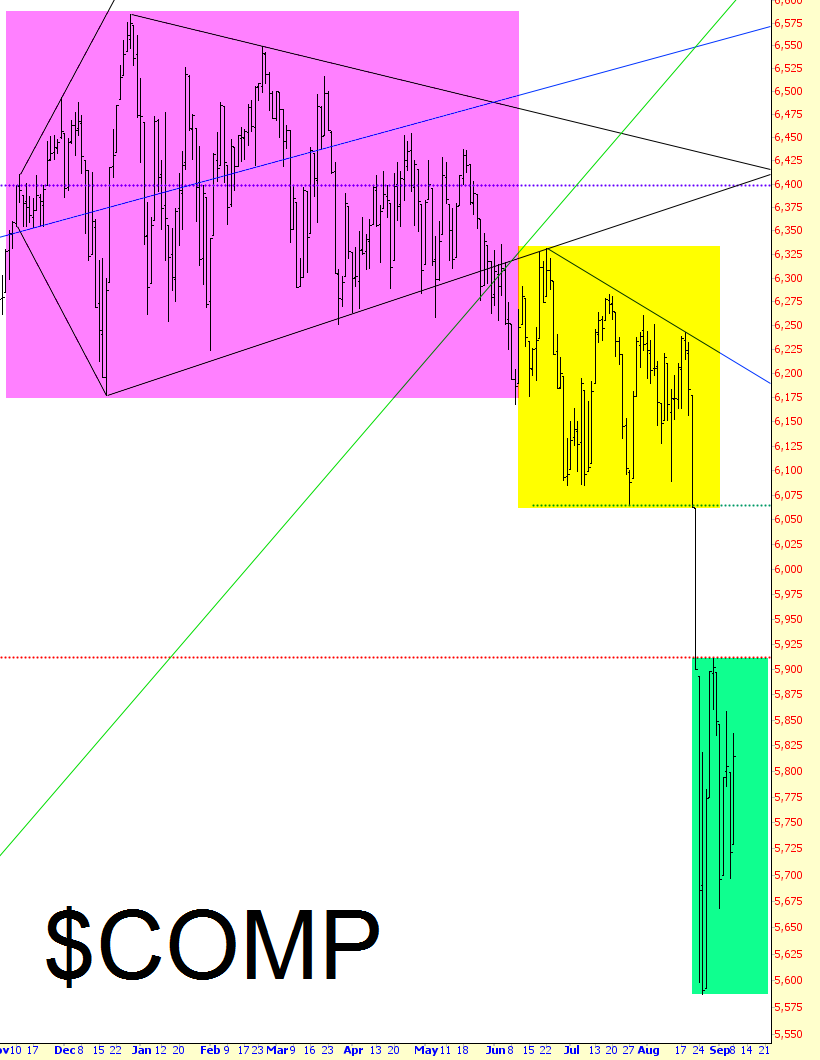

My view of the market is of three different ranges, expressed below by way of the Dow Jones Composite average. The topmost portion, in magenta, is the “ichthus” pattern, which we followed for months. Once it broke, we created a new range, shaded in yellow, which was a right triangle pattern.

That one broke – and with quite a bit of gusto – during the two-day “crash” we saw in August, which thrust us into the newest and lowest range, tinted in green. That’s where we’re trapped now and the one in which we’ll violently move up and down (and up in a big way Tuesday).

Range-bound markets drive me nuts, but last time I checked, there wasn’t anything I could really do about it. The next big question is which way we thrust out of this most recent range.

The risk for the bears, of course, is a continued series of big actions by central banks (which has already been led by China) and some kind of FOMC news next Thursday, which is perceived as bullish. This could send us straight back up to the resistance beneath that yellow range.

What I’d prefer, of course, is yet another breakdown. We might stay hamstrung in the “green zone” until after the Fed makes its move (which I’m guessing will be along the lines of “we’re still not raising rates, but we will when the data tells us it’s the right time”). Which is just what they’ve been saying for all eternity.

In sum, not a good day for me at all, but it’s important we keep our eyes on the big picture.