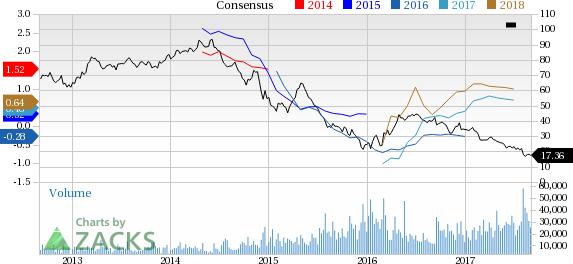

It has been about a month since the last earnings report for Range Resources Corporation (NYSE:RRC) . Shares have lost about 14.5% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important drivers.

Range Resources Misses on Q2 Earnings, Revenues Beat

Range Resources reported second-quarter 2017 adjusted earnings of 6 cents per share which lagged the Zacks Consensus Estimate of 8 cents. However, the company incurred a loss of 14 cents per share in the year-ago quarter. The year-over-year improvement is mainly due to an increase in production and higher price realizations, partially offset by higher expenses.

Total revenue of $673.1 million beat the Zacks Consensus Estimate of $525.9 million and also jumped 561% year over year from $101.8 million.

Operational Performance

The company’s second-quarter production averaged almost 1,944.5 million cubic feet equivalent per day (MMcfe/d). Natural gas made up for 67.5% of the total production, while natural gas liquids (NGLs) and oil accounted for the remaining 32.5%. Total production volume improved 37% from the year-earlier quarter due to the company’s highly successful drilling program.

On a year-over-year basis, oil production increased 24%, while NGL production rose 24%. Moreover, natural gas production jumped 44% year over year.

The company’s total price realization (including the effects of hedges and derivative settlements) averaged $1.80 per Mcfe, up 25% year over year. Of this, NGL prices surged 21% to $6.88 per barrel while crude oil prices rose 21% to $48.82 per barrel, both on a year-over-year basis. Natural gas prices were up 28% year over year to $1.74 per Mcf.

Expenses

Total second-quarter 2017 expense was $545.9 million, up 20% year over year.

Financials

At the end of the quarter, the company had long-term debt of approximately $3,848.6 million with a debt-to-capitalization ratio of 40.5%. The company incurred expenditures of $280 million in the second quarter for drilling and the completion of 35 wells.

Guidance

For the third quarter of 2017, the company estimates production of 1.97 billion cubic feet equivalent (Bcfe) per day. Fourth-quarter production is estimated at 2.2 Bcfe per day, up 17% from prior-year quarter. This will result in annual production growth of 30%, which has decreased from earlier guidance of 33–35%. The decline is mainly due to early 2017 production results from North Louisiana, along with non-recurring timing delays on several well pads in southwest Pennsylvania.

The company’s 2017 capital budget is set at $1.15 billion. It is to be noted that almost 67% of the budget will be allocated for the Marcellus region, while the remaining will be spent for North Louisiana.

How Have Estimates Been Moving Since Then?

Following the release, investors have witnessed a downward trend in fresh estimates. There have been five revisions lower for the current quarter.

VGM Scores

At this time, the stock has an average Growth Score of C, though it is lagging a lot on the momentum front with an F. However, the stock was allocated a grade of C on the value side, putting it in the middle 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of D. If you aren't focused on one strategy, this score is the one you should be interested in.

Zacks' style scores indicate that the company's stock is suitable for value and growth investors.

Outlook

Estimates have been broadly trending downward for the stock. The magnitude of this revision also indicates a downward shift. Notably, the stock has a Zacks Rank #1 (Strong Buy). We are expecting an above average return from the stock n the next few months.

Range Resources Corporation (RRC): Free Stock Analysis Report

Original post

Zacks Investment Research