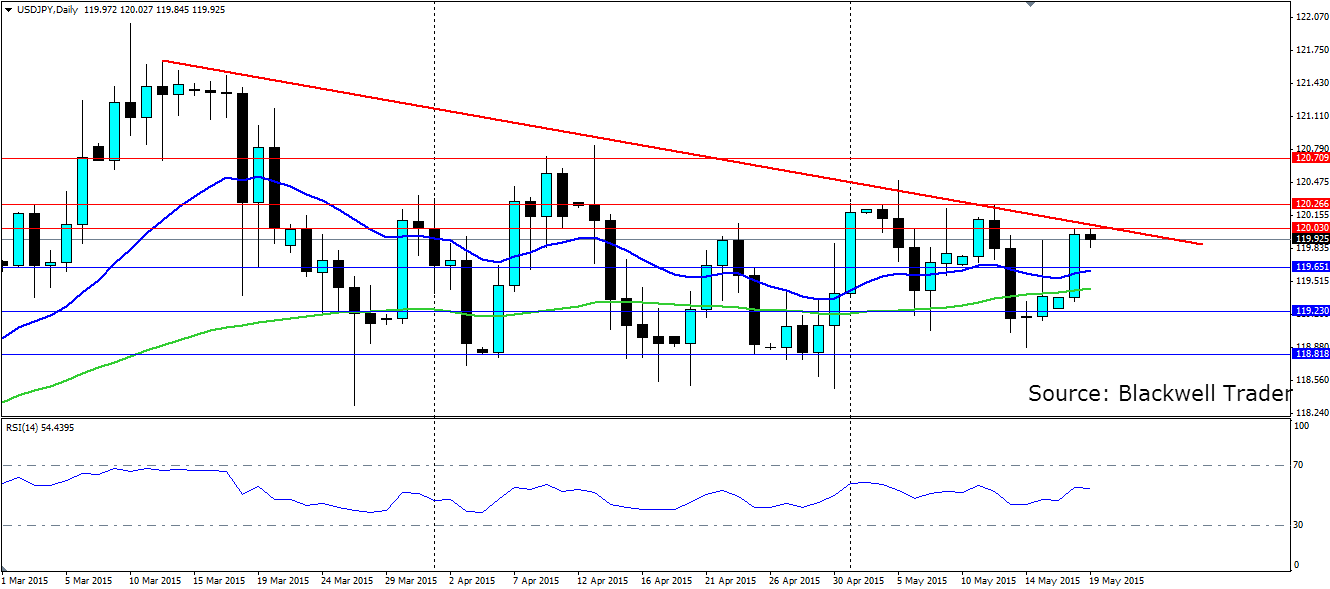

The yen is in a very clear range pattern with a slight bearish bias along the top side. Another rejection from here would confirm a continuation of the range pattern that will likely take the pair back to the lower reaches.

The yen is once again at the top of the short term range and looking like heading back down towards the recent lows. The consolidation has come with lower highs, which puts a slight bearish bias on the USD/JPY pair in the medium term, with the trend line acting firm. It is likely we will see a wave downward form in the next few candles, which will be confirmed when we have a close below the current short term support.

The RSI has started to take a downturn as the price stalls at the current top. It has followed each wave in price and certainly has room to move lower at the current position. Watch for the 100 day SMA which is looking decidedly flat, but will nonetheless act as a point of interest for the price.

The next 48 hours will see some news events that could shift the pair, especially with Japanese GDP figures due. Further to that the FOMC Meeting Minutes are due followed by JPY Manufacturing PMI. The end of the week will be a busy one for the US dollar with Unemployment claims, Home Sales, Manufacturing Index, and CPI figures.

Resistance is found at the current high at 120.03, with further resistance at previous highs120.26 and 120.70. Support is found at 119.65, 119.23 and 118.81. As above the 100 day SMA will likely act as dynamic support and further dynamic support will be found at the bottom of the range which has a slight bullish bias.