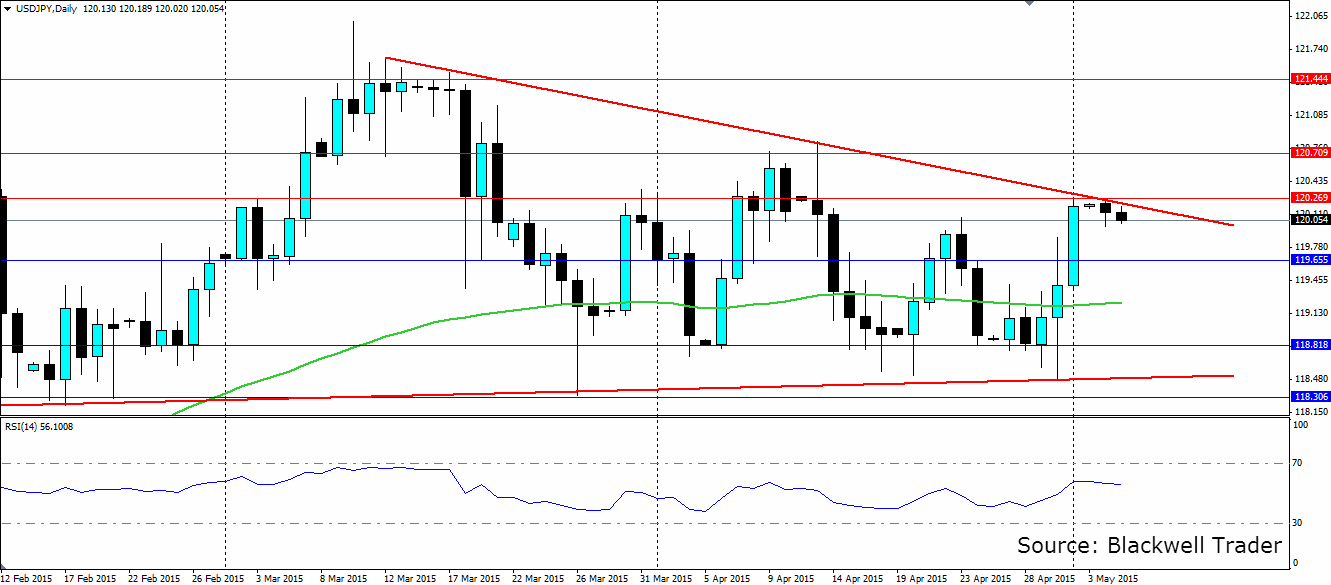

The yen is in a very clear range pattern with a slight bearish bias along the top side. A rejection from here would confirm a continuation of the range pattern that will likely take the pair back to the lower reaches.

The yen is at the top of the short term range but in the middle of the long term range. The consolidation has come with lower highs which puts a slight bearish bias on the USD/JPY pair in the medium term, but an upside push is certainly possible. It is likely we will see a wave downward form in the next few candles, which will be confirmed when we have a close below the current short term support.

The RSI has started to take a downturn as the price stalls at the current top. It has followed each wave in price and certainly has room to move lower at the current position. Watch for the 100 day SMA which is looking decidedly flat, but will nonetheless act as a point of interest for the price.

Resistance is found at the current high at 120.26, with further resistance at previous highs 120.70 and 121.44. Support is found at 119.65, 118.81 and 118.30. As above the 100 day SMA will likely act as dynamic support and further dynamic support will be found at the bottom of the range which has a slight bullish bias.