Global markets were dominated by political events overnight with Theresa May and Donald Trump comments the primary drivers of price action

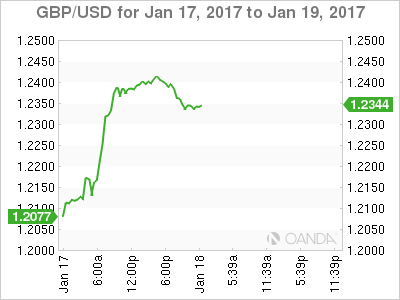

UK Prime Minister May’s anticipated speech on the government’s Brexit strategy sent the markets into a tizzy overnight. Lots of opinion on this one, but let us keep in mind that, from an economic perspective, there are no winners in this debate.

The markets underwent an epiphany of sorts when May announced that it was her intention to put any deal before Parliament. This proposal should theoretically soften the Brexit blow for anti-Brexit Regions and constituents as they now feel they have at least a representative voice in the matter, even if May continues to drive home the idea that the UK will not be seeking single market access.

PM May’s announcement that both houses of Parliament will vote on the final Brexit deal is positive for the pound, as the process, at a minimum, should ensure that the most severe outcomes are avoided. Well, at least that is the thought.

The result was a rampageous spike in cable, as leveraged massive short pound positioning unwound.

While May was forthcoming with a post-Brexit roadmap, she has certainly not diminished the odds of the most economically disruptive version of Brexit, no single market access.

We find ourselves weighing through the political malaise this morning not only from the Brexit fallout, but also dealing with the latest musings from President-elect Donald “The Dollar Slayer” Trump.

He thinks the USD is too strong due to China and short-term traders, who were looking for any excuse to sell dollars and thought this unprecedented presidential USD verbal intervention was sufficient reason. I believe it is flimsy at best, but his comments regarding “The Most Important Thing Nobody Is Talking About”: “the “Border Tax Proposal”; likely caught the attention of longer term players.

Keep in mind that the markets have been unambiguous in their view that the proposed border tax adjustment would cause the USD to rally substantially. Traders had assumed Trump was backing the deal, but now there is an element of uncertainty. However, let’s face it, the tax is coming in one form or another.

Indeed, the possibility exists for further event position risk unwind. Given the idea of the US adding an enormous amount of fiscal stimulus in a tepid global growth environment, one would assume that US capital inflows on higher bond yields, would support the view of a stronger USD.

Very puzzling markets indeed.

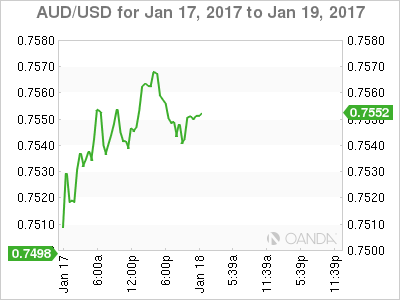

Australian Dollar

AUD continues to trade constructively with the Trump Trade unwind as iron ore and copper continuing to trade higher. We have cleared the critical .7525 but sense an apprehension to take this trade aggressively higher.

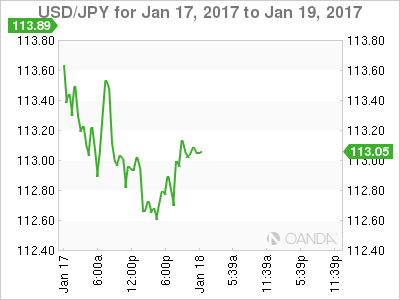

Japanese Yen

USDJPY remains heavy post-Trump comments. USDJPY support around 113.00 quickly gave way, and the floodgates opened. However, given the yen's tight correlation with US fixed income, dealers are keeping an eye on US Treasury yields. Key support area comes in at 112.15. While I think the Trump reflationary trade has sprung some major leaks, I view the recent dollar move as corrective within the context of a longer-term USD bull run.

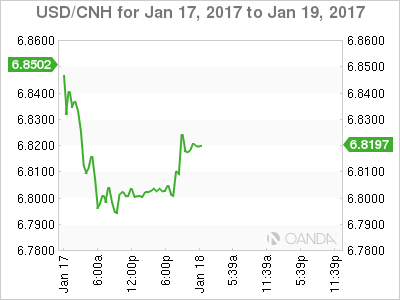

Chinese Yuan

The offshore yuan rallied massively against the USD, at one time testing below the 6.8 handle. Apparently, lower is the path of least resistance in the wake of President-elect Trump’s negative USD comments. Despite the easing in funding conditions, dealers expressed little appetite for short yuan positions overnight, but given that we are now back to the early January levels, it will be interesting to see how this support level holds up. I think longer term bullish USD bias will re-emerge, but it is very much predicated on US fiscal spend and US tax reform.