Ramco-Gershenson Properties Trust (NYSE:RPT) announced the closure of its $350-million amended and restated unsecured revolving loan facility. The extended credit facility will improve the company’s liquidity position.

The credit facility is slated to mature in September 2021 and can be extended by up to one year through two six-month options. The revised loan is priced at LIBOR plus 135 basis points (bps), in line with the company’s existing pricing grid. In addition, an accordion feature, which can potentially increase the total debt capacity to $650 million, is attached to the credit facility.

The aforementioned credit facility provides Ramco-Gershenson a cheaper line of credit and enables the company to stretch the maturities of its debts. This, in turn, will help improve its maturity profile.

The inflated credit facility also offers greater financial flexibility and will complement Ramco-Gershenson’s short- and long-term business plans. This will likely help the company execute its growth strategies, and drive the net asset value and dividend growth.

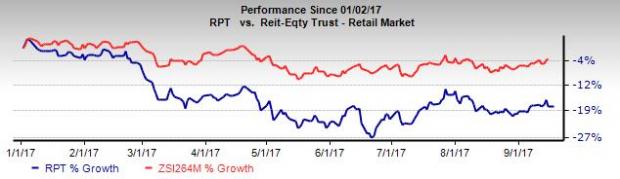

However, due to the gloomy environment in the retail real estate market, shares of Ramco-Gershenson have underperformed the industry it belongs to, year to date. The company’s shares have declined 18.5%, while the industry incurred a loss of 3.7%, during this time period.

Ramco-Gershenson currently carries a Zacks Rank #3 (Hold). The Zacks Consensus Estimate for the third quarter and full-year 2017 earnings remained unchanged at 34 cents and $1.37, respectively, over the past month. Moreover, the company has an expected long-term growth rate of 3.3%.

Key Picks

Better-ranked stocks in the REIT space include Getty Realty Corporation (NYSE:GTY) , Seritage Growth Properties (NYSE:SRG) and Communications Sales & Leasing, Inc. (NASDAQ:UNIT) . While Getty Realty flaunts a Zacks Rank #1 (Strong Buy), Seritage and Communications Sales & Leasing carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Getty Realty’s FFO per share estimates for the current year moved 3.1% upward to $2 in a month’s time.

Over the last 60 days, Seritage’s FFO per share estimates for full-year 2017 inched up 0.5% to $2.01.

Communications Sales & Leasing’s 2017 FFO per share estimates climbed 14.4% to $2.54 during the same time frame.

Note: All EPS numbers presented in this write up represent funds from operations (“FFO”) per share. FFO, a widely used metric to gauge the performance of REITs, is obtained after adding depreciation and amortization and other non-cash expenses to net income.

New Report: An Investor’s Guide to Cybersecurity

Cyberattacks have become more frequent and destructive than ever. In fact, they’re expected to cause $6 trillion per year in damage by 2020.

The cybersecurity industry is expanding quickly in response to these threats. In fact, a projected $170 billion per year will be spent to protect consumer and corporate assets. Zacks has just released Cybersecurity: An Investor’s Guide to Locking Down Profits which reveals 4 promising investment candidates.

Download the new report now>>

Ramco-Gershenson Properties Trust (RPT): Free Stock Analysis Report

Getty Realty Corporation (GTY): Free Stock Analysis Report

Seritage Growth Properties (SRG): Free Stock Analysis Report

Communications Sales & Leasing,Inc. (UNIT): Free Stock Analysis Report

Original post

Zacks Investment Research

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Ramco-Gershenson (RPT) Closes $350M Amended Credit Facility

Published 09/17/2017, 11:03 PM

Updated 07/09/2023, 06:31 AM

Ramco-Gershenson (RPT) Closes $350M Amended Credit Facility

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.