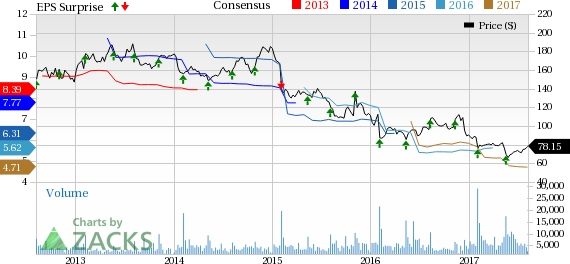

Ralph Lauren Corporation (NYSE:RL) reported first-quarter fiscal 2018 adjusted earnings of $1.11 per share that fared better than the Zacks Consensus Estimate of 96 cents and increased 4.7% from $1.06 reported in the prior-year quarter. Notably, this marked the company’s 10th straight quarter of earnings beat.

On a reported basis, the company posted earnings per share of 72 cents, against a loss of 27 cents in the prior-year quarter. Reported earnings for the quarter primarily included restructuring and other charges associated with the company’s Way Forward plan, which was announced in Jun 2016.

In the quarter under review, Ralph Lauren adopted the Accounting Standard Update (ASU) 2016-09 for the accounting of employee share-based payments, which was recently issued by the Financial Accounting Standards Board. Including the effect of this accounting standard, effective tax rate in the quarter was 31%, while it was 32% on excluding the same. In the first quarter of fiscal 2017, reported and adjusted tax rates were 33% and 29%, respectively.

Following the earnings beat, the company’s shares have moved up nearly 8% in the pre-market trading session. Let's see if this can revive the stock that has declined 13.5% year to date, underperforming the industry's fall of 2.1%.

Revenues

Net revenue of this luxury apparel retailer was down 13.2% year over year to $1,347.1 million, and it missed the Zacks Consensus Estimate of $1,349 million. The decline was in line with the company’s guidance and resulted from its initiatives to improve quality of sales, soft demand and distribution and brand exits.

Currency impacted revenues by nearly 130 basis points (bps). On a currency-neutral basis, revenues fell nearly 12% in the quarter.

Segment Details

During fourth-quarter fiscal 2017, this New York-based company altered its reportable segments to North America, Europe and Asia. Earlier, the company would report under the Wholesale, Retail and Licensing divisions. Notably, this change stemmed from the operational amendments made by the company as part of its Way Forward Plan.

North America: During the first quarter, revenues at this segment slumped 17% to $710 million owing to lower retail and wholesale sales. This was attributable the same factors which dented overall sales of the company. On a currency-neutral basis, comparable store sales at this division tumbled 8%. This included a 4% drop in stores and 22% plunge in e-Commerce sales. Lower e-Commerce sales were hampered by the planned decline of inventory, SKU count and promotional activities.

Europe: Revenues here witnessed a 14% decline year over year to $323 million, while currency-neutral revenues dropped 10%. This was accountable to unfavorable shipment timing shift, brand exits and lower markdowns. Currency neutral comps dropped 8%, including 8% decline in stores and 5% dip in e-Commerce.

Asia: Revenues at this segment dipped by 1% to $209 million, while it climbed 1% on a currency neutral basis. Comps rose 2% on a currency neutral basis, thanks to increased traffic.

Margins

Ralph Lauren's adjusted gross profit margins expanded 210 bps to 63.2%, driven by enhanced quality of sales, favorable geographic and channel mix shifts, lower promotions and reduced product costs. However, the improvement was partly offset by foreign currency headwinds.

Adjusted operating income margin expanded 200 bps to 10.2%. The year-over-year increase can mainly be attributed to gross margin expansion, partly negated by higher fixed expenses and 50 bps impact from currency.

Financials

Ralph Lauren ended the quarter with cash and investments of $830.4 million, total debt of $590 million and total shareholders’ equity of $3,360.1 million. Inventory declined 31% to $860 million as of Jul 1, 2017. This was backed by restructuring activities as well as enhanced operating methods.

Further, the company incurred $42 million as capital expenditure in the quarter under review. Capital expenditures are estimated to be roughly $300 million in fiscal 2018.

Store Update

As of Jul 1, 2017, Ralph Lauren had 467 directly-operated stores and 624 concession shops globally. The directly-operated stores included 106 Ralph Lauren, 79 Club Monaco and 282 Polo factory stores.

Additionally, the company’s global licensing partners operated 105 Ralph Lauren stores and 59 Club Monaco stores, bringing the total number of licensed stores to 164. Additionally, the company had 99 licensed concession shops in operation.

Guidance

Management remained impressed with its first quarter performance, wherein it continued to enhance sales quality by reducing promotions and markdowns, alongside reducing SKU count to drive productivity. Further, the company managed to improve inventory turns by curtailing inventory levels, and also achieved cost savings by cutting down on operating costs. Management has also been keen on optimizing its wholesale distribution, by shutting down underperforming points of distribution. Finally, the company’s efforts to evolve product and marketing bodes well.

Ralph Lauren provided outlook for second-quarter and fiscal 2018. The company expects fiscal second-quarter reported revenues to be down 9–10%, excluding currency impact. Operating margin for the fiscal second quarter is expected to rise by 40–60 bps, on a currency neutral basis. The company expects currency headwinds to hurt revenue growth and operating margin by nearly 40 bps, each.

For fiscal 2018, the company still expects revenue to decline 8–9%, excluding currency. Operating margin is estimated to be 9–10.5% on a currency-neutral basis. Foreign currency is now anticipated to have a minimum effect on revenue growth. Earlier the company expected currency to pull down revenue growth by 150 bps. Operating margin in fiscal 2018 is now expected to be dented by foreign currency by 40–50 bps, compared with 50–75 bps predicted earlier.

Excluding ASU 2016-09, fiscal 2018 tax rate is now expected to be 21–22%, down from the old forecast of 25%. Based on the current share price, the adoption of ASU 2016-09 is now expected to increase fiscal 2018 tax rate to 24%-25%, lower than the old projection of 28%.

Ralph Lauren currently carries a Zacks Rank #3 (Hold).

Interested in Retail? Check these 3 Trending Picks

Barnes & Noble Inc. (NYSE:BKS) , with a long-term EPS growth rate of 10% has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Build-A-Bear Workshop Inc. (NYSE:BBW) , also carrying a Zacks Rank #2, has long-term EPS growth rate of 22.5%,

Five Below Inc. (NASDAQ:FIVE) , with a long-term EPS growth rate of 28.5%, flaunts a Zacks Rank #2.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Barnes & Noble, Inc. (BKS): Free Stock Analysis Report

Build-A-Bear Workshop, Inc. (BBW): Free Stock Analysis Report

Five Below, Inc. (FIVE): Free Stock Analysis Report

Ralph Lauren Corporation (RL): Free Stock Analysis Report

Original post

Zacks Investment Research