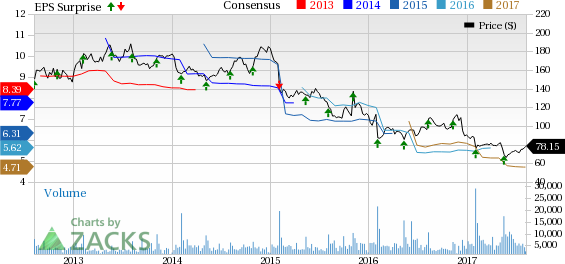

Ralph Lauren Corporation (NYSE:RL) , a designer, marketer and distributor of lifestyle products, released first-quarter fiscal 2018 results, wherein adjusted earnings of $1.11 came substantially ahead of the Zacks Consensus Estimate of 96 cents, and climbed 4.7% from $1.06 earned in the year-ago quarter.

Earnings Estimate Revision: The Zacks Consensus Estimate for fiscal 2018 has declined by 2 cents in the last 30 days. However, Ralph Lauren’s performance over the trailing four quarters, excluding the quarter under review, remains encouraging with an average beat of 14.2%.

Revenues: Ralph Lauren’s net revenues dropped 13% to $1,347.1 million, which also fell short of the Zacks Consensus Estimate of $1,349 million. On a currency neutral basis, revenues fell 12%. Revenue decline was attributable to the exit of brand, lower shipments and promotional activity and soft consumer demand.

Outlook: The company continues to project currency neutral net revenues to decline 8–9% in fiscal 2018. Foreign currency is estimated to have minimal impact on revenues in the fiscal. For second-quarter fiscal 2018, management envisions currency neutral net revenue to decrease 9-10%. Foreign currency is estimated to hurt revenue growth by nearly 40 basis points in the second quarter. Further, the company adopted Accounting Standard Update (ASU) 2016-09 in the first quarter of fiscal 2018, which is likely to have an impact on its effective tax rate, among other things.

Zacks Rank: Currently, Ralph Lauren carries a Zacks Rank #3 (Hold), which is subject to change following the earnings announcement.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stock Movement: Ralph Lauren’s shares are up nearly 5.2% during pre-market trading hours following the earnings release.

Check back later for our full write up on Ralph Lauren’s earnings report!

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Ralph Lauren Corporation (RL): Free Stock Analysis Report

Original post

Zacks Investment Research