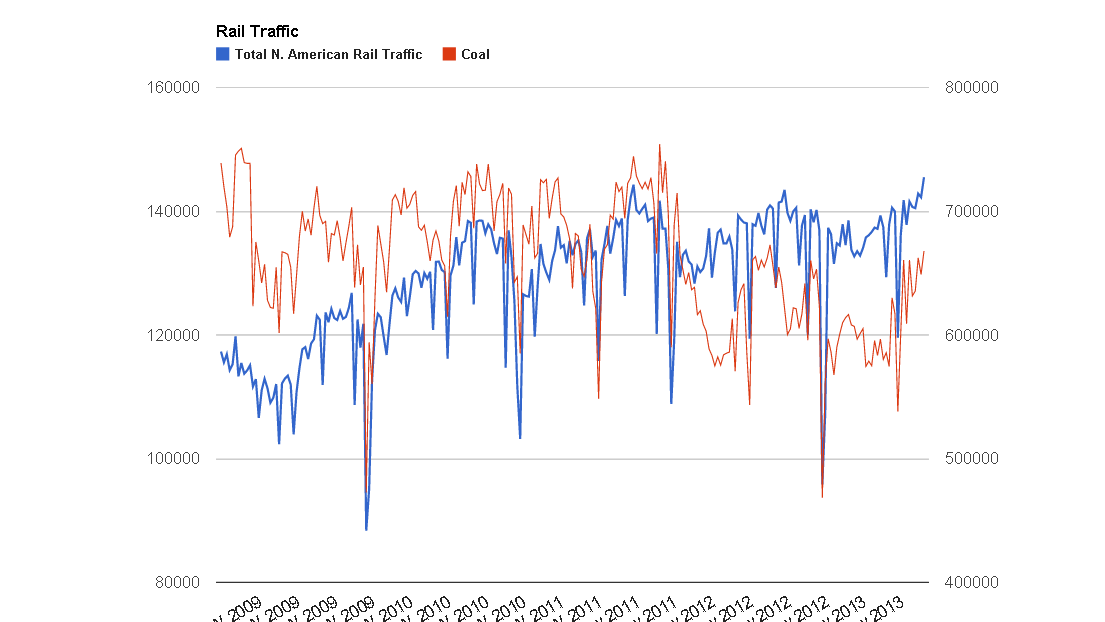

Total North American rail traffic jumped to 727k carloads last week, the strongest reading in the 5 years I have been tracking the series. This is significant as the steady and increasing rise in traffic signals not only a stable economy but one that seems to be accelerating. When you couple this data with recent auto and housing data, you have a recipe for increasing GDP growth for Q4.

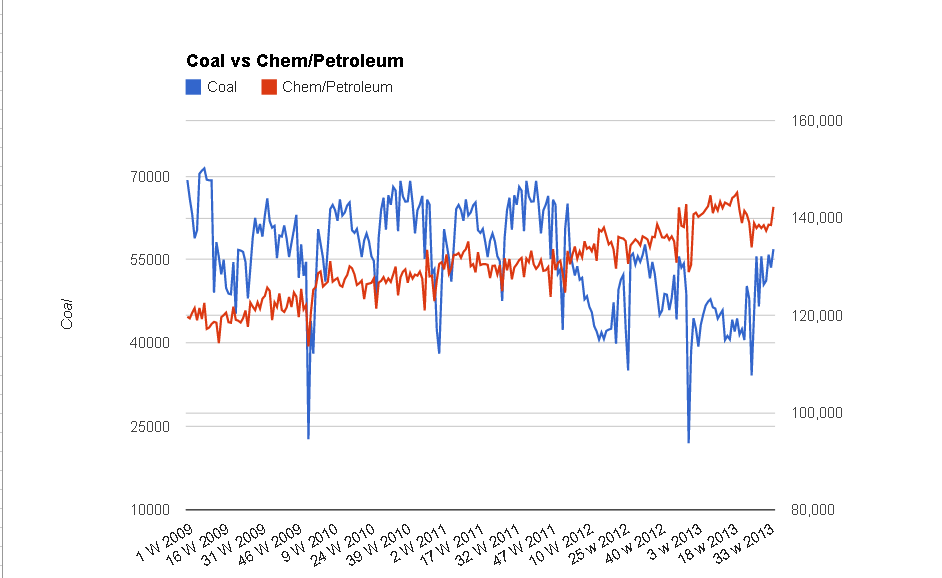

Again, to those doubting the recovery and rail traffic strength, they will claim that it is solely due to increase in oil shipments.

While chemical/petroleum shipments have increased ~5k-10k carloads/wk since 2011, coal traffic has decreased ~10k-20k carloads/wk (due to increase use of natural gas shipped by pipeline). So all that chemical/petroleum increases (note all of the increase is not solely due to oil) have done is helped to offset to larger decline in coal. In the current record week, coal shipments were down 16k vs the previous weekly high set late in 2011 and petroleum/chemicals are only up 10k vs ’11 for a net 6k decline in total traffic due to the fracking/Bakken effects. This means the surge in traffic is NOT due to Bakken oil but to underlying economic strength.

In fact the largest YOY increase vs the previous record week in 2011 are in autos, stone and related products (think construction) , forest products (think housing) and intermodal traffic. All of these point directly to increases manufacturing, construction and retail. This increasing activity will lead to higher equity prices in the future (SPY).

As always the disclaimer that one weeks data does not a definitive judgment make. One must continually follow the series to ensure the trend remains in tact that one weeks strength (or weakness) is not simply reversed in the following week. All that said, it is hard to deny that based on the metrics I follow the overall economy is not accelerating at what seems to be an increasing rate.

To see more posts on any of the companies mentioned in this article, enter their stock ticker symbol in the search box.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Rail Traffic Surges To 5-Year High

Published 09/06/2013, 10:27 AM

Updated 07/09/2023, 06:31 AM

Rail Traffic Surges To 5-Year High

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.