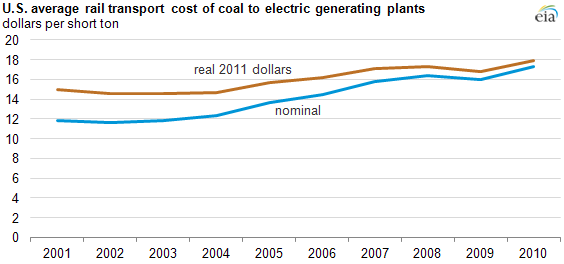

The US Department of Energy yesterday released historical data on costs of transporting coal via rail to electric power plants. Price increases vary considerably across locations, but at the national level these costs are up 50% in the past decade.

EIA: The average cost of shipping coal by railroad to power plants increased almost 50% in the United States from 2001 to 2010. Railroad transport accounts for more than 70% of U.S. coal destined to the electric power sector, so changes in rail rates can have an important impact on the cost of coal delivered to power plants. Though they vary significantly, transportation costs accounted for 40% of the average overall cost of coal delivered at electric power plants in 2010.

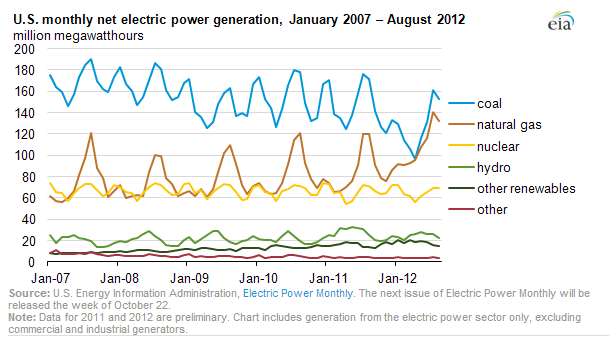

A more up-to-date general rail freight data sets (up to Q2-2012) from the Department of Transportation seem to point to even larger increases. Given the shift toward natural gas by US utilities (chart below), shouldn't rail freight prices stabilize (aside from fuel prices)?

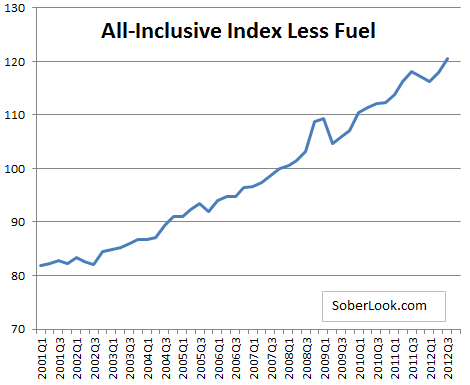

Apparently a great deal of the freight costs have been driven by rising costs of operating railroads. The Association of American Railroads keeps track of price level of inputs to railroad operations: labor, materials, and supplies, and other operating expenses.

Excluding fuel costs (which the rail industry charges separately as a "surcharge") the operating costs seem to have risen about as much (on a percentage basis) as the shipping costs paid by the coal companies. Of course the Association of American Railroads has an incentive to pump up the index, but they claim to have some regulatory oversight.

This is bad news for the coal industry, particularly if rail firms continue to pass their cost increases to the clients. Except in a few cases, rail demand seems to be sufficient to maintain pricing power. The EIA pointed out that in some cases the cost of shipping is higher than the actual price of coal. It is only a matter of time before natural gas takes a larger share of that business.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Rail Freight Prices For Coal Rise; Firms Able To Pass Increasing Costs

Published 11/20/2012, 02:18 AM

Updated 07/09/2023, 06:31 AM

Rail Freight Prices For Coal Rise; Firms Able To Pass Increasing Costs

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.