About a month has gone by since the last earnings report for Radius Health, Inc. (NASDAQ:RDUS) . Shares have lost about 12.7% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important drivers.

Radius Q2 Loss Wider Than Expected on Higher Expenses

Radius posted a loss of $1.58 per share in the second quarter of 2017, wider than the loss of $1.01 per share in the year-ago quarter and the Zacks Consensus Estimate of a loss of $1.35. The year-over-year increase in net loss was attributable to an increase in general and administrative expenses.

The company reported sales of Tymlos (abaloparatide) of $1.0 million from the first four weeks of launch, missing the Zacks Consensus Estimate of $1.96 million.

Quarter in Detail

Research and development expenses for the reported quarter were $19.6 million, down 27% year over year due to a decrease in regulatory and professional fees associated with abaloparatide-SC regulatory applications, decrase in elacestrant (RAD1901) project costs and a decrease in development costs associated with abaloparatide-TD.

General and administrative expenses for the reported quarter jumped to $50.1 million from $17.2 million. The increase was attributed to growth in professional support costs, including the costs associated with increasing headcount for the commercialization of Tymlos. Higher compensation expenses, including stock-based compensation, due to an increase in headcount were also responsible for increased costs.

Pipeline Updates

On Apr 28, the FDA approved Tymlos injection for the treatment of postmenopausal women with high risk osteoporosis for fracture – defined as history of osteoporotic fracture – multiple risk factors for fracture, or patients who have failed or are intolerant to other available osteoporosis therapy.

The company is developing two formulations of abaloparatide- abaloparatide-SC and abaloparatide-transdermal.

Meanwhile, Radius Health’ European Marketing Authorisation Application (MAA) for Eladynos (abaloparatide-SC) for the treatment of postmenopausal women with osteoporosis is under review by the Committee for Medicinal Products for Human Use (CHMP) of the European Medicines Agency. The company however suffered a setback when the CHMP issued a second Day-180 List of Outstanding Issues. Consequently, Radius is working with the CHMP to address these issues and the company expects a response to the same for Eladynos prior to the end of 2017.

In May, Radius Health announced positive top-line results from the completed 24-month ACTIVExtend clinical trial on Tymlos, which met all of its primary and secondary endpoints. The company expects to submit a sNDA to the FDA in connection with the ACTIVExtend results by year end.

The company reported positive data from its ongoing phase I dose-escalation and expansion study on elacestrant in advanced metastatic breast cancer. The company discussed these data from the ongoing phase I studies with the FDA to determine the next steps for elacestrant breast cancer program, including the design of a phase 2 trial.

Following this discussion, the FDA agreed that a single-arm monotherapy phase II study of under 200 patients is appropriate. The agency also provided additional feedback on the proposed clinical protocol, including confirmation that the primary endpoint will be objective response rate, along with durability of response. The FDA also stated that if the study results demonstrate superiority to the then available therapies, the single-arm phase II trial could be considered a pivotal study for accelerated approval as long as the company has also commenced a confirmatory study by the time of its new drug application (NDA) submission.

In addition, elacestrant is also being evaluated at low doses as an estrogen receptor ligand for the potential relief of the frequency and severity of moderate to severe hot flashes in postmenopausal women with vasomotor symptoms. The company expects to report results from its phase IIb clinical study of elacestrant for the potential treatment of postmenopausal vasomotor symptoms in the second half of 2017.

Furthermore, the company submitted an investigational NDA to the FDA for RAD140, which is a selective androgen receptor modulator. The application has been accepted. Moving ahead, it expects to commence a first-in-human phase I study in women with hormone receptor positive breast cancer in 2017.

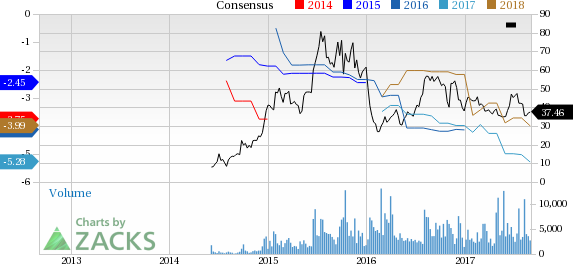

How Have Estimates Been Moving Since Then?

It turns out, fresh estimates flatlined during the past month. There has been one revision higher for the current quarter compared to one lower.

VGM Scores

At this time, the stock has a poor Growth Score of F, however its Momentum is doing a lot better with a C. However, the stock was allocated a grade of F on the value side, putting it in the bottom 20% quintile for this investment strategy.

Overall, the stock has an aggregate VGM Score of F. If you aren't focused on one strategy, this score is the one you should be interested in.

The company's stock is suitable solely for momentum based on our styles scores.

Outlook

The stock has a Zacks Rank #3 (Hold). We are looking for an inline return from the stock in the next few months.

Radius Health, Inc. (RDUS): Free Stock Analysis Report

Original post

Zacks Investment Research