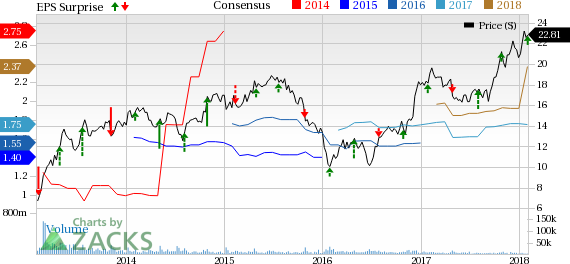

Radian Group Inc.’s (NYSE:RDN) fourth-quarter 2017 operating income of 51 cents per share beat the Zacks Consensus Estimate by 15.91%. The bottom line also improved 24.4% year over year.

Radian Group Inc. Price, Consensus and EPS Surprise

The company benefited from a solid performance at its Mortgage Insurance segment.

Shares gained 3.35% in the trading session on Feb 1, reflecting the outperformance.

Behind the Headlines

Operating revenues grew 4% year over year to $280 million, courtesy of higher net premiums and investment income. Revenues outpaced the Zacks Consensus Estimate by 3.15%. Total revenues (including services revenues and net loss on investments and other financial instruments) came in at $317.9 million, up 15.6% year over year.

Total net premiums earned were $245.2 million, up nearly 5% year over year.

New mortgage insurance written grew 4% year over year to $14.4 billion in the quarter under review. As of Dec 31, 2017, total primary mortgage insurance in force was $200.7 billion, up 9% from $183.5 million as of Dec 31, 2016.

Persistency — percentage of mortgage insurance in force that remains in the company’s books after a 12-month period — was 81.1% as of Dec 31, 2017. The company reported persistency of 76.7% as of Dec 31, 2016.

Primary delinquent loans were 27,922, up 4% year over year in the quarter.

Total expenses decreased 13% year over year to $153.2 million, primarily on lower provision for losses, cost of services, interest expenses and amortization and impairment of other intangible assets.

Full- Year Highlights

Operating earnings of $1.82 per share for 2017 beat the Zacks Consensus Estimate of $1.75. The bottom line rose 17% over 2016.

Revenues of $1.06 billion surpassed the consensus mark of $1.05 billion and also improved 1.9% year over year.

Segment Update

Net premiums earned by Mortgage Insurance segment were $245.2 million, up nearly 5% year over year. Claims paid were $85.5 million in the reported quarter, down 26.6% year over year. Loss ratio improved 900 basis points to 14.4%.

The Mortgage and Real Estate Services segment reported 22.6% year-over-year decline in total revenues to $40.7 million. Pretax operating loss of nearly $5 million compared unfavorably with $2.6 million loss incurred in the year-ago quarter.

Restructuring charge was of $5.2 million in the quarter. Additional pretax charges of about $4 million, primarily in cash, are expected to be recognized in a year’s time.

Financial Update

Radian Group ended 2017 with a cash balance of $96 million, up 54.8% year over year.

Long-term debt was $1 billion, down nearly 4% year over year.

Book value per share, a measure of net worth, grew 4% year over year to $13.90 as of Dec 31, 2017.

Zacks Rank

Radian Group sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Performance of Other Insurers

Among other players from the insurance industry that have reported third-quarter earnings so far, the bottom line of The Progressive Corporation (NYSE:PGR) , The Travelers Companies, Inc. (NYSE:TRV) and RLI Corp. (NYSE:RLI) beat the respective Zacks Consensus Estimate.

Breaking News: Cryptocurrencies Now Bigger than Visa

The total market cap of all cryptos recently surpassed $700 billion – more than a 3,800% increase in the previous 12 months. They’re now bigger than Morgan Stanley (NYSE:MS), Goldman Sachs (NYSE:GS) and even Visa! The new asset class may expand even more rapidly in 2018 as new investors continue pouring in and Wall Street becomes increasingly involved.

Zacks has just named 4 companies that enable investors to take advantage of the explosive growth of cryptocurrencies via the stock market.

Click here to access these stocks >>

Radian Group Inc. (RDN): Free Stock Analysis Report

RLI Corp. (RLI): Free Stock Analysis Report

The Travelers Companies, Inc. (TRV): Free Stock Analysis Report

Progressive Corporation (The) (PGR): Free Stock Analysis Report

Original post

Zacks Investment Research