Investing.com’s stocks of the week

Short-range airborne threats, particularly from drones, are becoming increasingly severe. RADA’s primary growth engine products are light-weight, software-defined tactical radar systems that can detect and target airborne threats and have proved highly effective in active combat. Active protection and short-range air and missile defence for mobile forces have been identified by the US and other militaries as urgent priorities. Over the past two years, RADA has seen initial pilot orders for new defence programmes. The recently increased guidance of 54%+ revenue growth in 2019 reflects the conversion of initial orders to more significant ones. Rada Electronic Industries Ltd (NASDAQ:RADA) also has a legacy product line of avionics systems.

An urgent threat

On 18 July the USS Boxer, an assault ship in the Strait of Hormuz, destroyed two threatening Iranian drones with a soft-kill electronic warfare weapon. RADA’s radars were pictured in the press on top of a navy vehicle as part of the US Marine Corps LMADIS system, which successfully tracked and targeted the drones. The low cost and ease of acquiring a drone that can deliver a deadly payload combined with the difficulty of tracking them have made them ideal offensive weapons.

RADA’s radars form the heart of active protection systems including Iron Fist by Elbit Systems/IMI, which recently won an Israeli army tender. Upcoming catalysts include the Bradley APS, Stryker (NYSE:SYK) M-SHORAD and USMC LMADIS becoming US DOD Programs of Record, leading to an expected significant ramp up in orders to equip brigades rather than small numbers of units, which has been the case so far. Management estimates its addressable market at ~$5bn with less than 1% of that currently served. It believes its technology is 18 months ahead of competition.

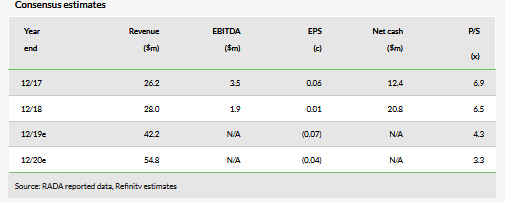

Significant growth expectations ahead

Recently increased guidance expects 2019 revenue of over $43m (up 54% year-on-year). Given the importance of the current US programmes that RADA serves and the significant potential to expand sales globally, management expects strong growth to be maintained into 2020. While profitable in 2017 and 2018, RADA strategically ramped R&D and opened a US manufacturing subsidiary to meet the demand, bringing it to report a net loss so far in 2019, although opex should level out at year-end 2019. In addition, note that RADA had $15m cash on the balance sheet at the end of Q2. Given the revenue growth and stable gross margins it expects, this implies a return to profitability in 2020, with strong profitability in 2021.

Business description

RADA is an Israel-based defence technology company whose primary growth engine is tactical software-defined radars for the manoeuvre force.