A small floor is emerging in indices. US markets have logged two consecutive days in the green, Europe has worked as a whole for the first time in 2016 with all majors adding value overnight, and the RMB stabilised further. CNH stabilising to the CNY fix for a full 24 hours now. Positive equity leads.

The only ‘slight’ issue with the CNY fix is the fact the HIBOR (Hong Kong Interbank Overnight Rate) is now sitting at 66.82%, having added a further 53 percentage points to the borrowing rate yesterday. It’s a ridiculous rate. However, it does add to the PBoC’s want of stabilisation as no one will be borrowing offshore RMB at that rate, meaning CNH selling will diminish.

In fact, it probably explains why USD/CNH is now stronger than USD/CNY for the first time since October as it’s too expensive to hold long positions. So, the ‘stability’ of the Chinese currency should remain in the short term. Which should also be a positive for risk.

What’s catching my attention in the AM

Oil remains the biggest story in the current market; the supply issues are well documented. However, the part that is leading this second leg lower is Chinese demand – or lack of it.

Oil has now had its biggest decline in history, having lost 72.2% since the beginning of the slide in June 2014. In AUD terms it’s down 68% - the fallout on domestic economies will only sharpen this year.

I fully expect to see oil in the US$20 a barrel handle. However, the uber-bears are now suggesting US10 a barrel is a real possibility. That would be a dire problem as it will bring the bankruptcy question to bare – there are several estimates that sub-US$30 a barrel would mean one third of US oil and gas plays would go broke in six months.

‘Breakeven’ figures closest to home are harder to derive as most Australian producers are LNG exposed, which blends the breakeven price. However, if we use internal rates of return (IRR), expectations for projects need to be around 13% or more to be of worth. This explains why Woodside, for example, halted the Browse project as IRR fell below this level.

Sharpening the focus to an ORG or STO and the Gladstone projects they operate, both need oil to be averaging US$70 a barrel to make the projects’ IRR stack up. The pressure here is going to make several eyes water.

Oil and gas plays are likely to take the place of iron ore plays in the first half of 2016, broke firms will right the supply/demand equation. The question is where the supply cuts will come from. BP (L:BP) announced 4000 job cuts last night, so the question is who will blink first.

The commodities complex is now at 1991 levels in USD terms – in fact, the Bloomberg commodities index in AUD terms is now at its lowest level since the index began.

Interestingly, the BCOM hasn’t been saved by gold – one would expect that in a high volatility market where risk-off havens are normally sort after Au would be heading higher. Au spot, however, has lost US$24 an ounce since Friday and is still very much in a bear market with no real conviction buying behind it.

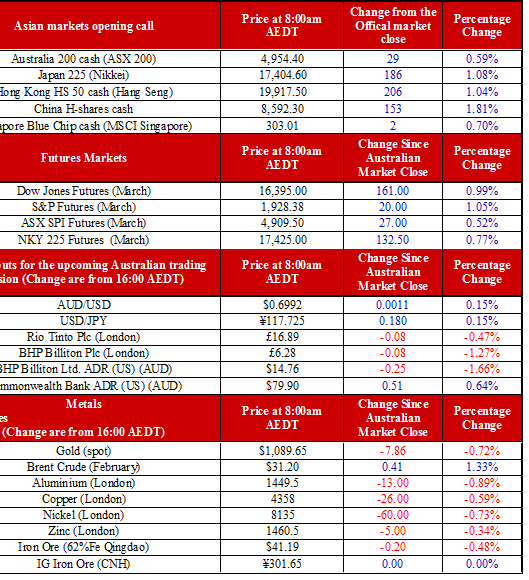

Copper: most mining companies’ ‘great red hope’ has fallen to US$4,358 a tonne on the LME. The Chinese demand story for the red metal looks a distant possibility in 2016. Adding to corporate woes.

Iron ore fell again for delivery into Qingdao – sixth day of losses and is on track to fall back below US$40 a tonne

Risk-off in currencies continues – AUD, CAD, EUR and NOK continue to be shelled as long USD and JPY trading continues. This is not what US corporates want and is likely to be laid bare in the US earnings season over the coming few weeks.

Ahead of the Australian open

Ahead of the open, we are calling the ASX up 0.7% to 4947. I remain cautious of positioning heading into the CNY fix as it has moved the ASX strongly in the post-release session.

The ASX is yet to register a positive print for 2016 and, considering the crude and commodities story on Chinese demand issues, afternoon trade may overrun the ASX once more.

A fourth retest of the 4910 level would be a negative implication for the direction over the coming weeks.