Friday’s U.S. payrolls report did little to boost the U.S. dollar. Labor conditions returned to normal following the distortions from the hurricanes in September. However, payrolls growth was considerably below expectations of 310K while wage growth slowed in October. Nevertheless, the unemployment rate slid to 4.1 percent - the lowest since December 2000 – which is why the latest NFP report can be regarded as a satisfactory result despite its mixed picture. The greenback weakened in the wake of the report but further strength may be ahead since the jobs market is strong. Friday’s report is unlikely to dissuade the Federal Reserve from its current view towards lifting interest rates next month.

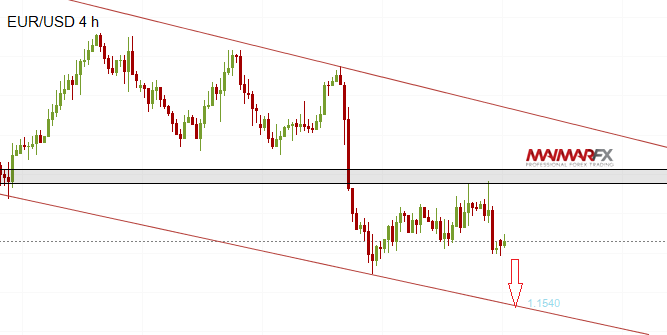

EUR/USD

The euro rejected the 1.17-level and dropped back towards 1.16. With the crucial 1.17-resistance still being unbroken we now expect further losses towards 1.1530. While the risk is tilted to the downside euro bulls should focus on prices above 1.1730 and 1.1780 in order to benefit from fresh upside momentum.

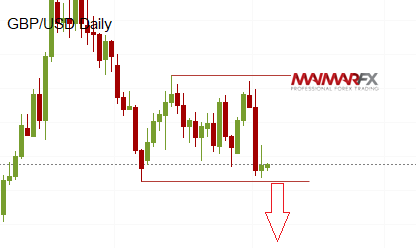

GBP/USD

We still see the cable confined to a sideways trading range between 1.3340 and 1.3025. However, given strong bear candles in larger time frames, we expect accelerated bearish momentum if the pound falls below 1.30. A next lower target could be near 1.2920.

Trading in this week could be quieter as fundamental drivers are lacking.

We wish you a good start to the new week and many profitable trades.

Here are our daily signal alerts:

EUR/USD

Long at 1.1625 SL 25 TP 20, 60

Short at 1.1590 SL 25 TP 15, 60

GBP/USD

Long at 1.3090 SL 25 TP 20, 40

Short at 1.3040 SL 25 TP 15, 40

We wish you good trades and many pips!

Disclaimer: Any and all liability of the author is excluded.