From time to time we reach into our WSD Mailbag to address some key concerns from our loyal readers. And it’s that time again…

Today, I’m putting on my big boy pants to address a trio of tough questions and, of course, my own ineptitude.

(Naturally, whenever someone disagrees with me, they’re right. And I’m wrong and stupid.)

In the end, my answers will hopefully be informative, instructive, profitable and, perhaps, entertaining.

Let me know if I succeed by dropping us a line at feedback@wallstreetdaily.com.

While you’re at it, send us some fodder for a future WSD Mailbag column.

As you’ll see in a hot second, any and all comments, questions and biting criticisms are welcome. So cue up the Pat Benatar and hit us with your best shot!

QUESTION #1

With all due respect, the U.S. dollar is making a comeback? Are you kidding me? Check your facts before spouting crap! You’re obviously too wet behind the ears to read the writing on the walls! – A concerned investor that’s 94% out of U.S.A. owned anything!

I know that reading is supposed to be fundamental. Apparently not for you, though. You’re taking my chart from last Friday completely out of context.

I never said the absolute value of the dollar was making a comeback. Even at 35 years young, I understand that foreign currency valuations fluctuate in relation to one another.

Or, as some people like to say, foreign currencies are a “Least Ugly Contest.” And the U.S. dollar reigns supreme as the least ugly one of the bunch.

So, again, I was merely pointing out the relative strength of the U.S. dollar over the last six months. And the tendency for the U.S. dollar to rally relative to other major currencies over prolonged periods of time (six to 10 years). That’s not crap. Those are facts.

Now that we’ve sorted out that slight misunderstanding, let’s move on to addressing your pride over being “94% out of U.S.A. owned anything.”

As Dr. Phil likes to say, “How’s that working out for you?” My guess? Not so good.

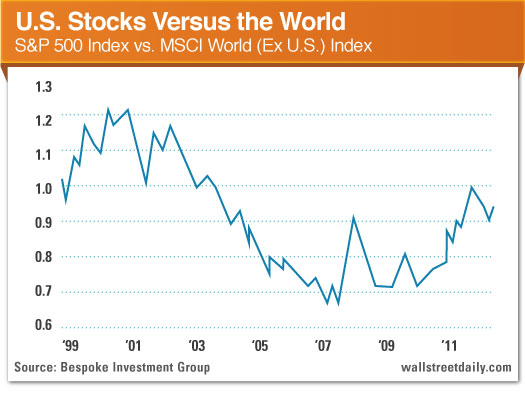

I say that because U.S. stocks continue to outperform the rest of the world. And since you like facts, check out the chart of the MSCI World (Ex U.S.) Index versus the S&P 500 Index for proof.

When the line is rising, it indicates that U.S. stocks are outperforming the rest of the world, and vice versa.

As you can see, U.S. equities “have been on quite a run compared to the rest of the world for the last few years,” according to Bespoke Investment Group.

Indeed!

Truth is, we’re close to hitting new multi-year highs again. (U-S-A! U-S-A!)

In all seriousness, I’d rethink your lopsided allocation. A well-diversified approach always makes the most sense in investing. At least, that’s what they tell this youngin.

QUESTION #2

Can you please address the looming disaster – total disaster – in Italy and the real possibility of another round of global fallout resulting from more EU chaos? – E.P.

If I suffered a panic attack every time bad news cropped up in Europe, I’d be popping Prozacs like breath mints. And we can all agree, that’d be less than ideal.

Instead, I find it’s best to ignore the fear-laden headlines and focus on the market. Specifically, the credit markets.

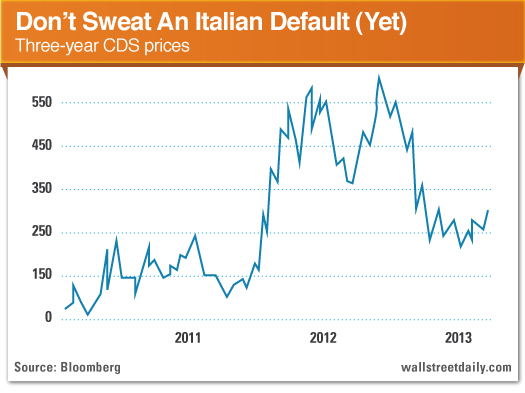

As I’ve shared before, whenever real trouble is brewing, it crops up in credit default swap prices.

Remember, credit default swaps represent the cost of insurance against a default. And costs only rise if a disaster is becoming more likely.

And guess what? They’re not rising to dangerous levels in Italy.

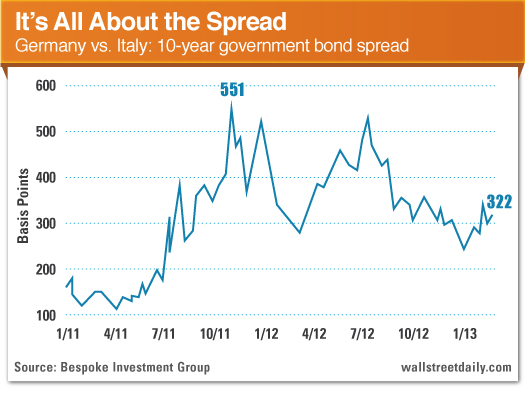

It’s also instructive to track the yields on sovereign debt. Why? Because as a country’s financial woes worsen, investors demand more yield to compensate for the risk. So spikes often precede disasters.

Once again, I’m not concerned.

In relation to safe, German government bonds, yields on 10-year Italian government bonds aren’t getting out of hand.

The spread between both bonds widened by less than five basis points in the aftermath of the disaster in Cyprus. And they’re nowhere near the levels hit the last two summers above 500 basis points.

So keep calm and carry on. No matter how much the journalists try to scare you with their headlines.

QUESTION #3

“Current bull market has lasted four years”…”New highs, no sign of a top”… The ominous point is you have MISSED the point! During the same four years you recap, we have experienced record printing of fiat currency as well as pyramiding of the national debt to record proportions. (Those are verifiable facts.) Now, if you are of the opinion that this is a good situation to run out and purchase homebuilder stocks – then GOOD LUCK!!! Recently, you called bull on Wall Street. Sniff the air Louie, you’re standing in it! – R.G.

Salivate all you want about your real estate call. Another bubble is forming that will bust your gigantic ego. – J.C.

And you thought your job lacked positive reinforcement?

Where to start, where to start? How about with R.G.’s little tirade about “record [money] printing?”

Again, reading must not be fundamental for everyone.

Let the record show, I singled out Fed Chairman Ben Bernanke’s runaway money printing as the single most important factor driving the bull market in equities.

So I should be getting a high-five from you for our total agreement on the cause of the run-up, not a nasty gram. I’ll get over it, though.

What matters most is that our responses to the “verifiable facts” differ. While you disagree with the policy and – in turn – avoid stocks, I’m embracing the reality and profiting from it. I’ll let everyone else decide which approach they prefer. (Bet you mine is more popular. Just saying.)

Moving on to my real estate calls, I assure you it has nothing to do with ego. I’m not that smart. I just understand sentiment. And the fact that so many people are still reluctant to embrace the recovery in housing means there’s absolutely more room to run for homebuilders and other real estate-related stocks.

Again, if you want “verifiable facts” and a more concrete analysis of why, I encourage you to check out my humble writings on the topic.

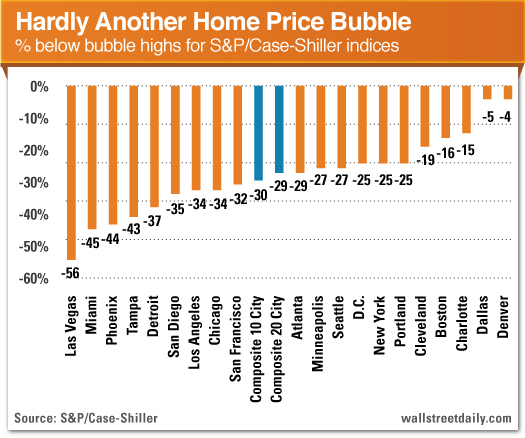

If you don’t have that much time, chew on this data point: Even after the run-up in real estate prices, most markets remain miles away from their peaks.

Sorry, J.C. That’s not what “another bubble” looks like.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Questions Answered: The US Dollar, Italy's Crisis And The Bull Market

Published 04/04/2013, 03:30 AM

Updated 05/14/2017, 06:45 AM

Questions Answered: The US Dollar, Italy's Crisis And The Bull Market

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.