I see that pundits and even Fed FOMC members are believing the labor market "improvement" will allow the FOMC to raise the zero bound federal funds rate when the Fed meets on December 15 later this year. Improvement?????

The October BLS Jobs Report was well over expectations - which seems to me is the proximate cause of all this new belief the Fed will raise rates. I was surprised that the October report was as strong as it was. But the report is seasonally adjusted - and what IF the seasonal factors have changed this year. Basically, one month of data can not be viewed with blinders as there have been a series of disappointing jobs reports beginning in June.

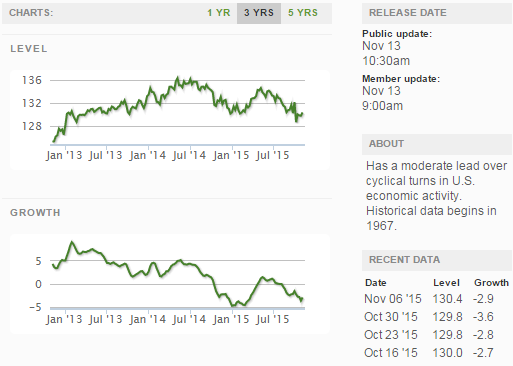

One FOMC member stated this week "... as for the labor market, we’re on pace to add about 2½ million jobs this year ..." Not sure this will be true.

Cumulative Unadjusted Jobs Gains by Year (values times 1000 persons)

It should be obvious from the graph above that jobs growth is slowing. My guess is that the burst of jobs growth has been caused by Christmas and other year end seasonal purchasing starting a month early - and business ramping up to support this early surge. If I am right, November jobs report will be disappointing as this surge normally occurs in November.

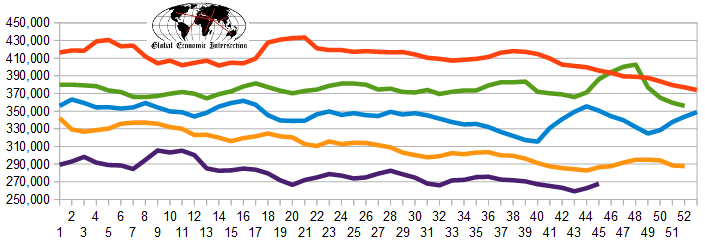

For those folks who like to stare at data (like it do) - the following chart shows the unadjusted gains or losses each month since 2004.

Unadjusted Jobs Gains or Losses by Month

My take from the above graph is that there is little evidence of a strengthening jobs situation. To make any argument, you must exclude data points which do not support your position.

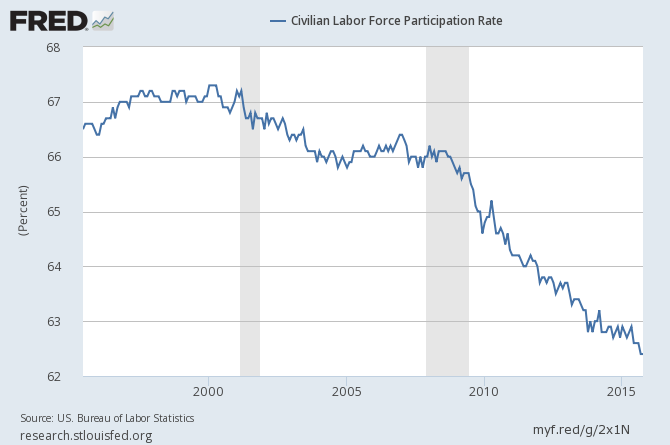

It is hard to understand how the jobs situation is becoming normal. This same October Jobs Report showed the USA labor force participation rate (which measures the share of Americans at least 16 years old who are either employed or actively looking for work) is now at a 38 year low.

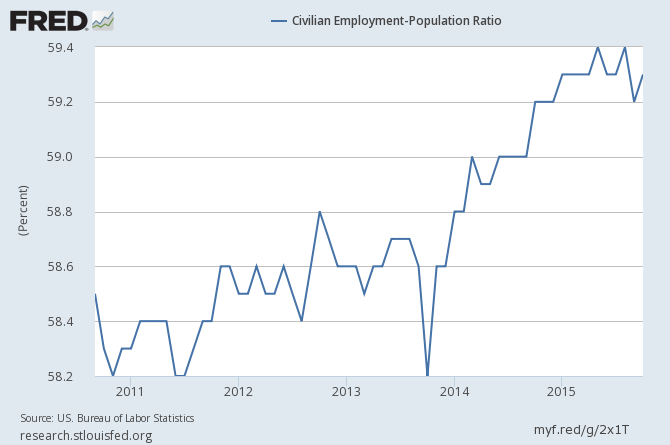

And the employment-population ratio (ratio of the total working age of the labor force currently to the total working age population) growth has stalled in 2015.

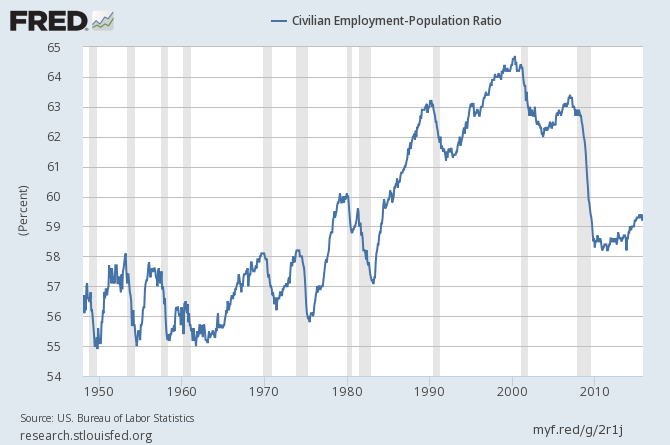

Additionally, does one need to mention that this employment-population ratio is near 30 year lows?

Quite honestly - it does NOT matter if the Fed raises its rates. I suspect the zero bound federal funds rate may actually be creating poor economic conditions. If believing the employment situation is getting better, and that becomes the Fed's reason for raising rates - so be it. Whatever blows the Fed's skirt up.

Other Economic News this Week:

The Econintersect Economic Index for November 2015 marginally improved - but remains in the low range of index values seen since the end of the Great Recession. The most tracked sectors of the economy generally showed some growth. Still our economic index remains in a long term decline since late 2014. Our employment six month forecast continues to forecast weakening employment growth.

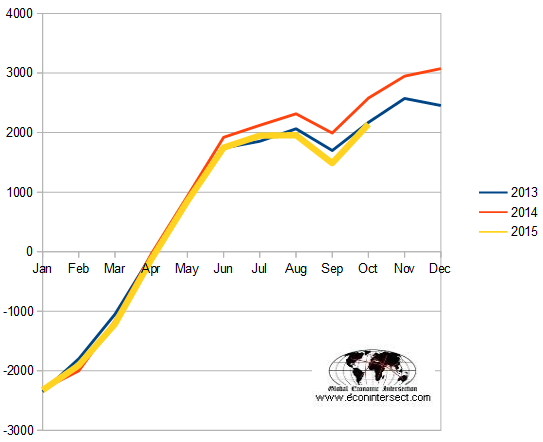

The ECRI WLI growth index is now in positive territory but still indicates the economy will have little growth 6 months from today.

Current ECRI WLI Growth Index

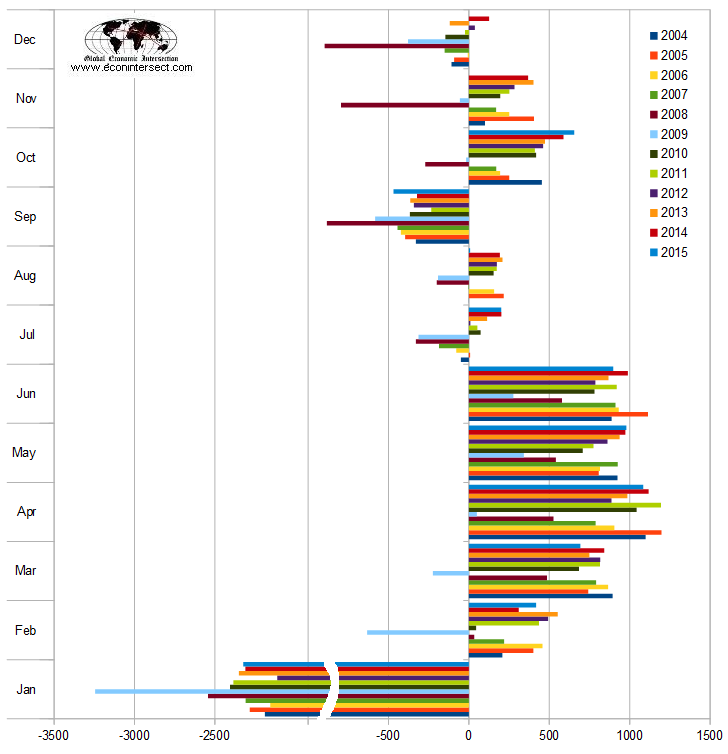

The market (from Bloomberg) was expecting the weekly initial unemployment claims at 260 K to 280 K (consensus 266,000) vs the 276,000 reported. The more important (because of the volatility in the weekly reported claims and seasonality errors in adjusting the data) 4 week moving average moved from 259,250 (reported last week as 259,250) to 262,750. The rolling averages generally have been equal to or under 300,000 since August 2014.

Weekly Initial Unemployment Claims - 4 Week Average - Seasonally Adjusted - 2011 (red line), 2012 (green line), 2013 (blue line), 2014 (orange line), 2015 (violet line)

Bankruptcies this Week: Privately-held Parallel Energy, Canada-based Essar Steel Algoma (chapter 15), Privately-held Millennium Health, Far East Energy (OTC:FEECQ), Privately-held East Orange General Hospital.

Weekly Economic Release Scorecard: