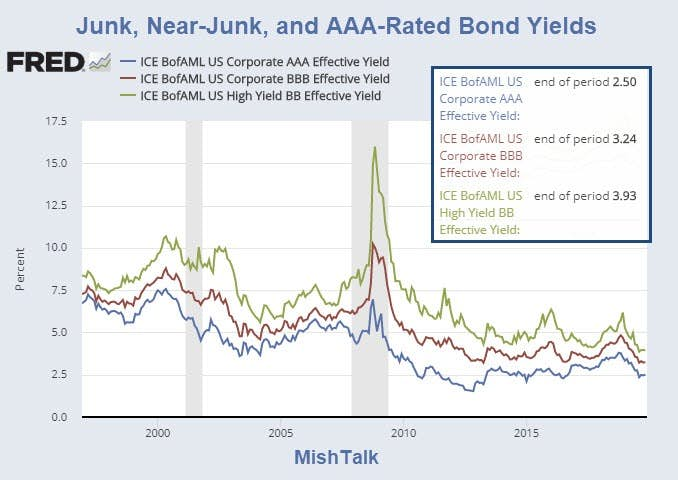

I am in awe at how little extra yield investors are willing to take for junk bonds vs AAA-rated Bonds.

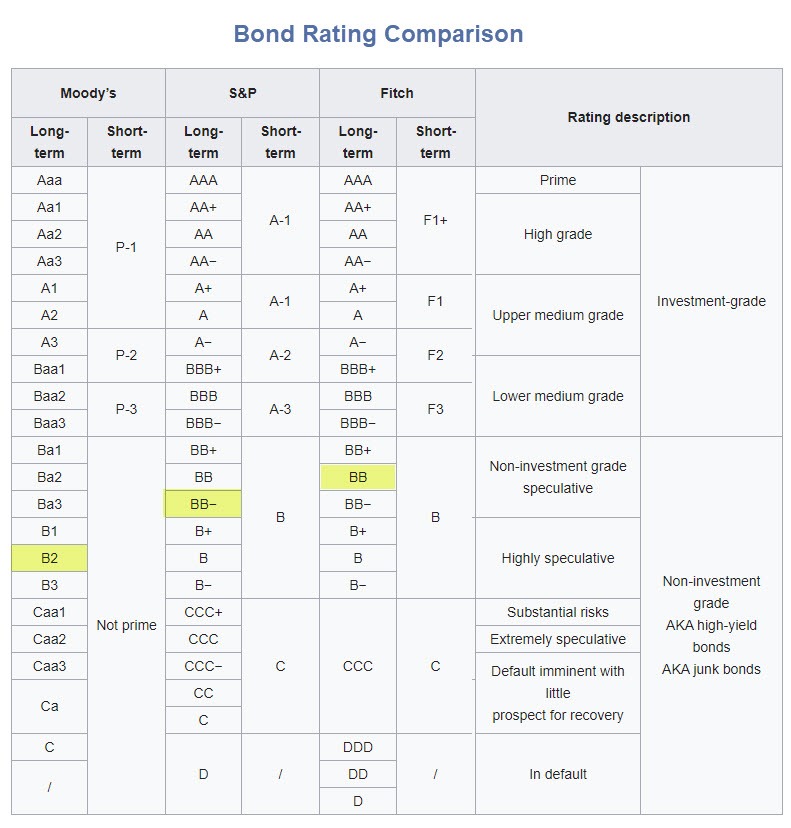

BBB-rated bonds are just a step away from junk. If you count BBB- then its two steps.

BBB-rated bonds yield just 74 basis points more than AAA-rated bonds

BB-rated bonds, two steps into junk, yield 3.93% a measly 69 basis points more.

Bond Ratings

Bad Credit? Who Cares?

The Financial Times reports Yield-Crazed Investors Pile Into US Subprime Car Loans

Deals have been “going gangbusters” in subprime auto asset-backed securities (ABS), said Jennifer Thomas, an analyst at Loomis Sayles, a Boston-based firm managing $286bn of assets. At $29bn so far this year, issuance of subprime auto ABS is on track to surpass 2018’s record haul of $32bn, according to data from Finsight, despite softer sales of new cars and trucks this year.

These subprime card offerings are five or six times over subscribed.

Fed Watching Over You

Everyone seems to be assuming the Fed will not let another bond disaster as we saw in the Great Recession ever happen again.

Feelin' Lucky?