Globalization in all its forms, from social to economic to political, has been on the rise since about the 1970s, and I genuinely believe it’s had more benefits than drawbacks. Although it may seem hard to believe right now, the real cost of finished goods has trended down over the decades, and there’s evidence that the world has become more peaceful, with fewer wars and war-related deaths than in years past.

It goes without saying that the events of the past two years, including the U.S.-China trade war, COVID pandemic and now the Russia-Ukraine war and international sanctions, have challenged the merits of globalization. Inflation is at a 40-year high and Western Europe is facing a serious energy crisis, prompting policy-makers and multinational companies to rethink supply chains that crisscross the globe and sourcing materials and labor from unfriendly jurisdictions.

Russia’s invasion of Ukraine “has put an end to the globalization we have experienced over the last three decades,” said Larry Fink, cofounder and CEO of BlackRock (NYSE:BLK), the world’s largest asset management firm. In last week’s letter to shareholders, he adds that “companies and governments will also be looking more broadly at their dependencies on other nations” as a result of not just the war but also the pandemic. “Near-shoring,” the practice of moving business operations closer to home, could benefit Mexico, Brazil and even the U.S.

China Exporting Lockdowns

An important country Fink does not mention is China, but it’s key to understanding the consequences of unchecked globalization. China has long been the world’s factory. Of the 10 busiest seaports in the world, six are in the Asian country. An estimated one-third of global shipping passes through the South China Sea.

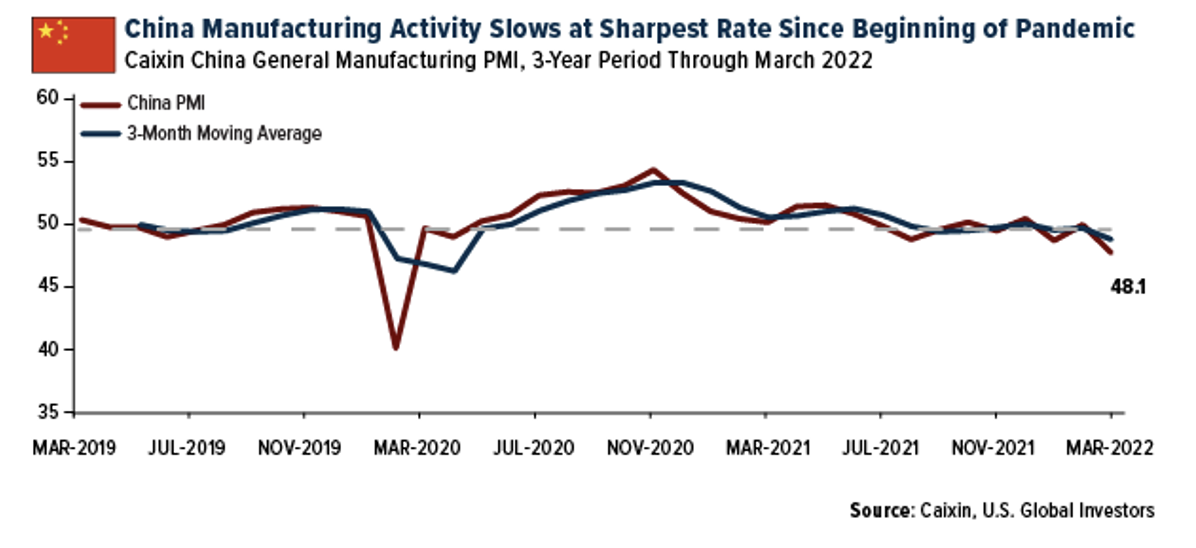

Today we’re seeing the risks of depending so heavily on one country for the movement of goods. China is experiencing an unexpected surge in COVID cases, and since it has a zero-COVID policy, it’s shut down businesses, factories and warehouses, particularly in Shanghai, a major port city that’s home to more than 26 million people. These lockdowns were reflected in the March reading of the Caixin China General Manufacturing PMI, which showed manufacturing activity slowing at the sharpest rate since the beginning of the pandemic two years ago.

China was one of six countries whose Manufacturing PMIs were below the key 50.0 mark in March, the others being Turkey, Mexico, Myanmar, Kazakhstan and with a reading of 44.1, Russia. This was enough to drag down global factory activity, as measured by the JPMorgan Global Manufacturing PMI, to an 18-month low of 53.0.

Expect Higher Shipping Costs

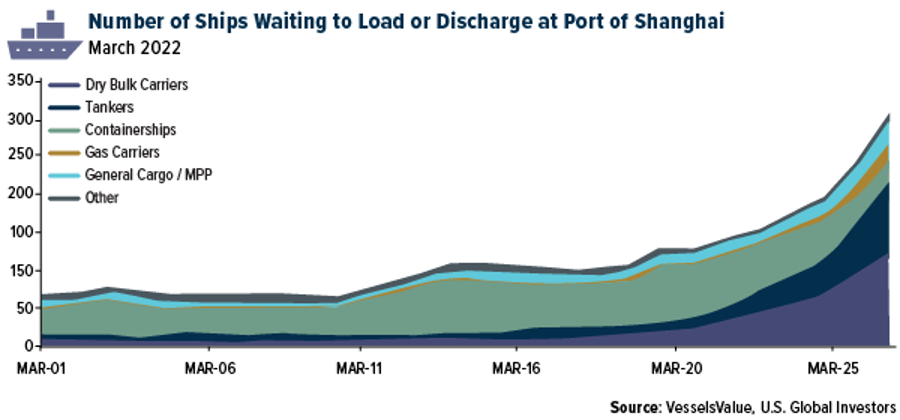

Even though the Port of Shanghai, the world’s busiest port, has reportedly remained open, a shipping logjam is worsening as trucks are not available to move product. According to data from VesselsValue, port congestion is at an all-time high, with the number of ships waiting to load and unload going parabolic.

Shipping giant Maersk warned clients last week that the lockdowns will likely result in even higher shipping costs, writing that “there will be longer delivery times and a possible rise in transport costs such as detour fees and highway fees.” These extra fees will, in turn, be passed down the supply chain to the end consumer, who’s already having to deal with rampant inflation.

Gold And Silver Look Attractive

With shipping rates on the rise, I would be taking a long look at container shipping stocks, including Maersk. The group generated record profits last year as rates tripled on a pandemic-related demand explosion. Global disruptions, from the ongoing pandemic to war in East Europe, means that rates may remain elevated for some time longer.

Precious metals, like gold and silver also continue to look attractive. As of last month’s close, gold posted its best quarter since June 2020 on safe-haven demand.

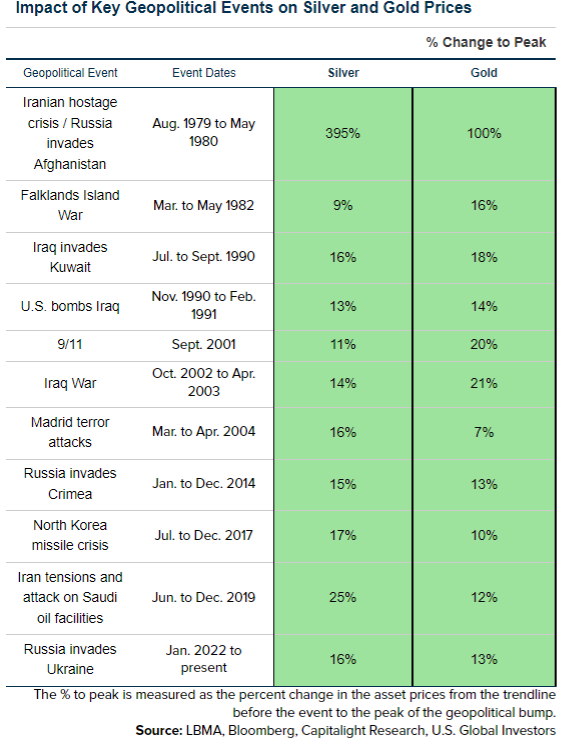

A report by Capitalight Research last week included a compelling table of gold and silver’s performance during select geopolitical crises. The two metals advanced in every instance going back to 1979-1980's double-whammy Iranian hostage crisis and Russia’s invasion of Afghanistan. In that case, gold doubled in price, while silver increased as much as 395%.

Although returns haven’t been as strong during later events, they’ve been in the respectable double digits, highlighting the metals’ haven status. Since Russia invaded Ukraine in January, silver has increased 16%, gold 13%.

Analysts at Capitalight say “that if the current crisis escalates to nuclear/chemical warfare, the price of gold and silver could double.” No one wants to see that, obviously, but I believe it’s only smart to have a hedge in case of such an event.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.