Quest Diagnostics Inc. (NYSE:DGX) second-quarter 2017 adjusted earnings per share (EPS) of $1.55 beat the Zacks Consensus Estimate by 9.93% and the year-ago number by 15.7%.

Adjusted EPS in the reported quarter excluded charges related to restructuring and integration, retirement of debt as well as amortization expenses. The reported EPS came in at $1.37, in line with the year-ago figure.

Reported revenues in the second quarter inched up 1.9% year over year to $1.94 billion. However, it lagged the Zacks Consensus Estimate of $1.95 billion. According to the company, the year-over-year improvement came on the back of extended tie-ups with hospital health systems and strength in several of the company’s advanced diagnostic offerings.

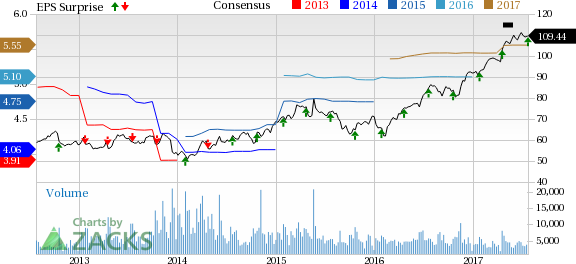

Quest Diagnostics Incorporated Price, Consensus and EPS Surprise

Volume (measured by the number of requisitions) increased 1.8% year over year in the second quarter. Also, revenue per requisition increased 0.7%. Diagnostic information services revenues in the quarter rose 2.5% on a year-over-year basis to $1.86 billion.

Cost of services during the reported quarter was $1.17 billion, up 1.3% year over year. Gross margin came in at 39.8%, reflecting a rise of 40 basis points (bps) year over year.

Among the operating expenses, selling, general and administrative expenses increased 1.6% to $437 million in the reported quarter. Adjusted operating margin showed an improvement of 50 bps to 17.3%.

Quest Diagnostics exited the second quarter with cash and cash equivalents of $314 million, which marked a 14.4% fall from the preceding quarter. Year-to-date net cash provided by operating activities was $490 million, compared with $464 million in the year-ago period.

In the second quarter, the company repurchased 1.4 million shares for $150 million. As of Jun 30, 2017, Quest Diagnostics was left with $1.1 billion of authorization under the previous share repurchase plan.

Outlook

Quest Diagnostics raised its full-year 2017 revenue guidance. The company now expects full-year revenues in the range of $7.69 billion to $7.74 billion (annualized growth of 2.6–3.4%) from the earlier stated range of $7.64 billion to $7.72 billion (annualized growth of 2–3%). The current Zacks Consensus Estimate for revenues is pegged at $7.69 billion, on par with the lower end of the company’s updated guided range.

In addition, the company’s 2017 adjusted EPS range has been raised to $5.62–$5.72 from the earlier forecast of $5.45–$5.60. The Zacks Consensus Estimate of $5.56 is below this range.

Operating cash flow for 2017 is expected at around $1.2 billion, above the previous guidance of $1.1 billion. The current estimates for capital expenditure are pegged at $250–$300 million (unchanged).

Our Take

Quest Diagnostics’ second-quarter earnings exceeded the Zacks Consensus Estimate, while revenues lagged the same. On a positive note, the company is currently refocusing on its core diagnostic information services business and working on disciplined capital deployment. Also, the raised guidance for adjusted earnings, revenues and net cash from operating activities buoy optimism about the company’s performance.

We are also highly optimistic about the company’s focus on its new two-point strategy. According to Quest Diagnostics, its planned divestiture of the Focus Diagnostics products business is part of its strategy to refocus on diagnostic information services. In addition, several new collaborations with hospitals and integrated delivery networks were major growth drivers. In this regard, we are looking forward to the company’s deal with Walmart (NYSE:WMT). Particularly, the company is positive about its recent agreement with PeaceHealth in the Pacific Northwest, which is expected to bolster growth in 2017. Also, management is upbeat about its latest acquisitions of Med Fusion and ClearPoint to advance in the diagnostics space.

However, over the past several quarters, the overall soft industry trends, leading to a low volume environment, acted as a dampener for the company.

Zacks Rank & Key Picks

Currently, Quest Diagnostics carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the broader medical sector are PetMed Express, Inc. (NASDAQ:PETS) , Becton, Dickinson and Company (NYSE:BDX) and Thermo Fisher Scientific Inc. (NYSE:TMO) . Notably, PetMed sports a Zacks Rank #1 (Strong Buy), while Becton, Dickinson and Company and Thermo Fisher Scientific carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

PetMed has a long-term expected earnings growth rate of 10.00%. The stock has gained around 108.5% over the last three months.

Becton, Dickinson and Company has a long-term expected earnings growth rate of 11.25%. The stock has gained around 14.4% over the last three months.

Thermo Fisher Scientific has a long-term expected earnings growth rate of 12.25%. The stock has gained around 8.4% over the last three months.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artifical intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

PetMed Express, Inc. (PETS): Free Stock Analysis Report

Thermo Fisher Scientific Inc (TMO): Free Stock Analysis Report

Quest Diagnostics Incorporated (DGX): Free Stock Analysis Report

Becton, Dickinson and Company (BDX): Free Stock Analysis Report

Original post

Zacks Investment Research