EUR/USD has edged lower in the Monday session. Currently, the pair is trading just below the 1.07 level. On the release front, Germany releases Preliminary CPI later in the day, with the estimate standing at -0.5%. In the US, today’s key event is Pending Home Sales, with the indicator expected to rebound with a strong gain of 1.6%. On Tuesday, German releases retail sales and the Eurozone will publish GDP and CPI reports. Mario Draghi will deliver remarks at a joint conference of the ECB and European Commission. In the US, we’ll get a look at CB Consumer Confidence.

As Europe’s largest economy, Germany’s economic data is considered the bellwether of the Eurozone, and key German indicators should be treated as market-movers. Last week, German GfK Consumer Climate rose to 10.2 points in December, climbing for a third consecutive month. On the inflation front, Eurozone indicators have been rising, but the markets are bracing for a decline of -0.5% from German Preliminary CPI. The index has posted consecutive gains since May 2016. Germany will release retail sales on Tuesday. The key consumer spending indicator has struggled, posting three declines in the past four months. However, the estimate for December is 0.6%. As for the Eurozone, the bloc enters January 2017 in decent shape, but there are risks ahead. On Thursday, an IMF report found that economic growth in the Eurozone was improving and projected growth of 1.6 percent in 2017 and 2018. However, the report also warned that political instability could on the Eurozone economy, with Britain’s departure from the EU and elections in several Eurozone countries where many voters are skeptical about European integration.

US economic growth was expected to soften in the fourth quarter, and GDP fell a bit short of the forecast. The economy expanded 1.9%, shy of the estimate of 2.1%. Business investment and consumer spending remains solid and should continue into 2017. However, Trump’s protectionist rhetoric and action, which saw tensions escalate with Mexico last week, could cloud the bright picture for the US economy.

Donald Trump has just started his new position, but he has already signed a host of controversial executive orders which have been condemned both domestically and abroad. Trump has withdrawn from the Trans-Pacific Partnership and declared he will reopen the NAFTA trade agreement with Canada and Mexico. He has also ordered work to begin on a wall with Mexico and banned immigrants from seven Moslem countries. Trump’s unconventional and disjointed approach to international politics and trade could have major ramifications on global trade and could lead to financial instability in global markets, triggering volatility in the currency markets. Just a few days before being sworn in as president, Trump stated that the US dollar was “too strong”, blaming a weak Chinese currency. Predictably, the greenback lost ground after Trump’s remarks. Still, Trump’s shock election win in November has boosted the US dollar, with EUR/USD dropping 2.1% during that time.

Monday (January 30)

- All Day – German Preliminary CPI. Estimate -0.5%

- 3:00 Spanish Flash GDP. Estimate 0.7%. Actual 0.7%

- Tentative – Italian 10-year Bond Auction

- 8:30 US Core PCE Price Index. Estimate 0.1%

- 8:30 US Personal Spending. Estimate 0.4%

- 8:30 US Personal Income. Estimate 0.4%

- 10:00 US Pending Home Sales. Estimate 1.6%

- Tentative – US Loan Officer Survey

Upcoming Key Events

Tuesday (January 31)

- 2:00 German Retail Sales. Estimate 0.6%

- 3:00 ECB President Mario Draghi Speech

- 5:00 Eurozone CPI Flash Estimate. Estimate 1.5%

- 5:00 Eurozone Preliminary Flash GDP. Estimate 0.4%

- 10:00 US CB Consumer Confidence. Estimate 112.6

*All release times are EST

*Key events are in bold

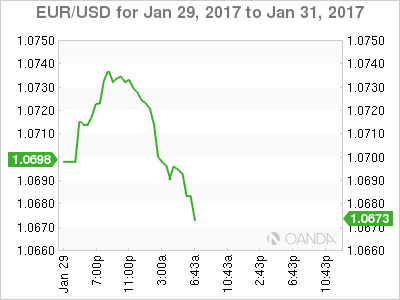

EUR/USD for Monday, January 30, 2017

EUR/USD January 30 at 6:20 EST

Open: 1.0727 High: 1.0740 Low: 1.0687 Close: 1.0692

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.0414 | 1.0506 | 1.0616 | 1.0708 | 1.0873 | 1.0985 |

EUR/USD posted small gains in the European session but retracted. The pair has posted slight losses in European trade

- 1.0616 is providing support

- 1.0708 is fluid. Currently, it is a weak resistance line

Further levels in both directions:

- Below: 1.0616, 1.0506 and 1.0414

- Above: 1.0708, 1.0873, 1.0985 and 1.1114

- Current range: 1.0616 to 1.0708

OANDA’s Open Positions Ratio

EUR/USD ratio starts the week little changed from the Friday session. Currently, short positions have a slight majority (53%), indicative of trader bias towards EUR/USD reversing directions and moving higher.