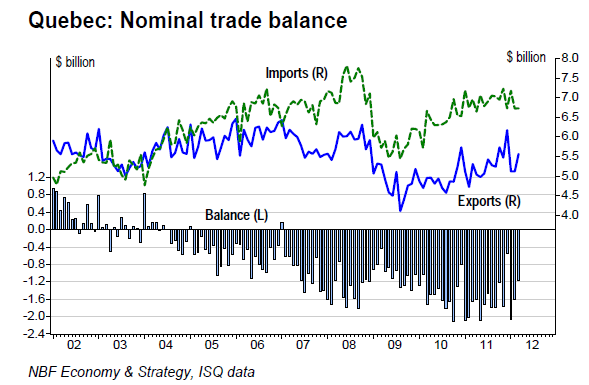

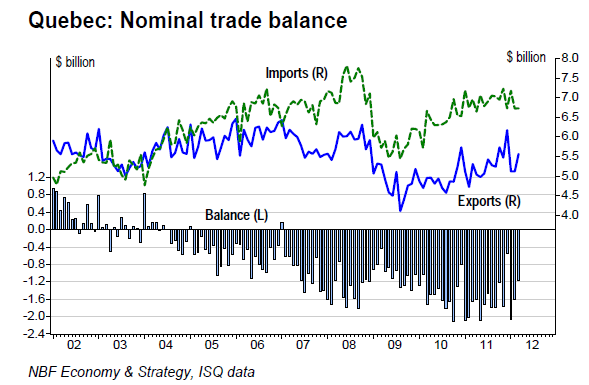

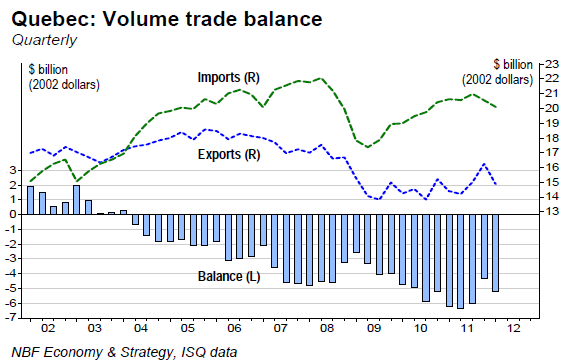

FACTS: The Institut de la statistique du Québec reports that Quebec’s trade deficit narrowed $444 million in December to $1.16 billion (top chart). The value of exports rose $445 million (8.7%) to $5.6 billion. The largest contributions to the gain were from aerospace products (+$145 million), metal ores and scrap (+$117 million) measuring and medical and optical equipment (+$74 million). But the rise was broad-based, with increases reported in 14 of 23 product groups accounting for 70% of all exports.

Imports were flat in March, with rises in imports of crude oil, transportation equipment, food and beverages offset by declines in imports of petroleum and coal products. In constant dollars, the trade deficit narrowed $211 million to $1.56 billion. Exports rose $433 million (9.0%) to $5.3 billion. Imports rose $222 million (3.4%) to $6.8 billion. Export prices fell 0.3% and import prices fell 3.2%.

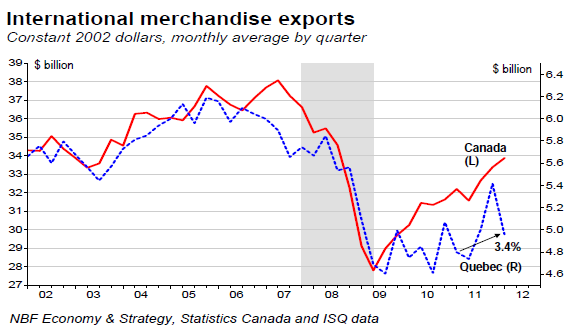

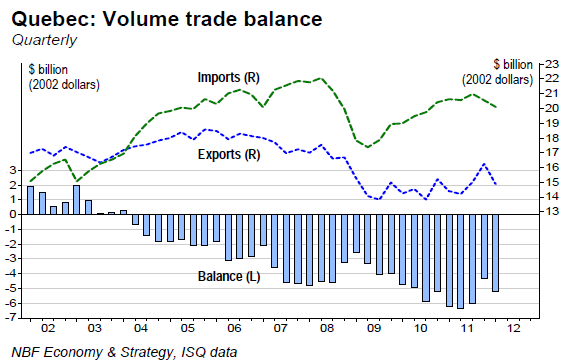

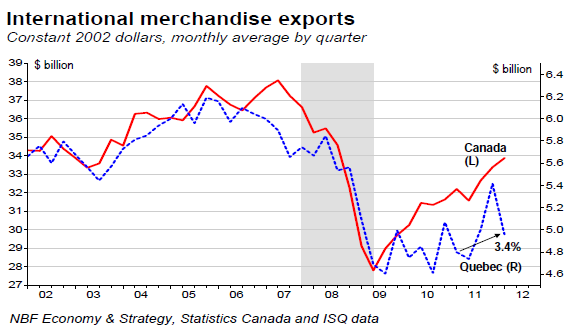

OPINION: The breadth of export growth in March is indisputably encouraging. Though it is too early to declare the export doldrums a thing of the past, Quebec volume exports in the first quarter were up 3.4% from a year earlier (middle chart). This is less, to be sure, than the 5.2% gain of Canada as a whole, a gain that -- in contrast to Quebec’s -- came on top of a strong post-recession advance. Nevertheless, Quebec volume exports are, without fanfare, well on the way to our forecast growth of 5% to 6% in 2012. Meanwhile, the December spike in exports means that trade subtracted from GDP growth in Q1 (bottom chart).

Imports were flat in March, with rises in imports of crude oil, transportation equipment, food and beverages offset by declines in imports of petroleum and coal products. In constant dollars, the trade deficit narrowed $211 million to $1.56 billion. Exports rose $433 million (9.0%) to $5.3 billion. Imports rose $222 million (3.4%) to $6.8 billion. Export prices fell 0.3% and import prices fell 3.2%.

OPINION: The breadth of export growth in March is indisputably encouraging. Though it is too early to declare the export doldrums a thing of the past, Quebec volume exports in the first quarter were up 3.4% from a year earlier (middle chart). This is less, to be sure, than the 5.2% gain of Canada as a whole, a gain that -- in contrast to Quebec’s -- came on top of a strong post-recession advance. Nevertheless, Quebec volume exports are, without fanfare, well on the way to our forecast growth of 5% to 6% in 2012. Meanwhile, the December spike in exports means that trade subtracted from GDP growth in Q1 (bottom chart).