Although 2015 is only a couple weeks in the books, the beaten down gold developers have so far been on a tear!

The Market Vectors Junior Gold Miners (ARCA:GDXJ) index is up 19% year-to-date with many of the more leveraged names up even further.

Integra Gold Corp (TO:ICG), which is developing the Lamaque South mine in Val D’or Quebec has kept pace with the GDXJ’s performance so far this year, but that may be about to change as the company announced some bullish news this afternoon.

Integra released its much anticipated updated PEA which includes the recently acquired neighbouring Sigma-Lamaque mine and mill complex (read our report: Integra Gold: Way Undervalued and Seriously De-risked).

The news is likely to catch the attention of the street as the headline numbers are pretty impressive. The company is covered by six research analysts including Cormark and Edgecrest.

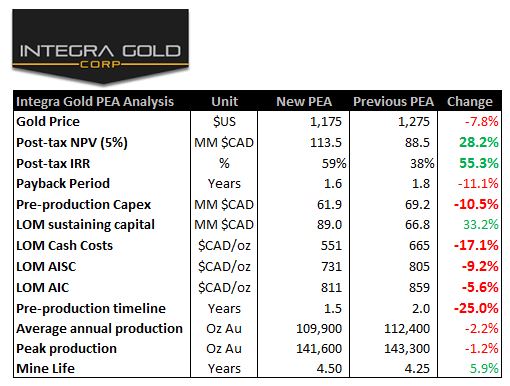

A comparison of the previous PEA to the updated one released today is in the table below:

(Source: CEO.ca, Company Reports)

With numbers like this, the market should take notice of this developer, which has been seemingly thrown out with the bathwater, despite its shares having a solid start to the year.

Integra had a transformational end of 2014. They completed the creative acquisition of the Sigma-Lamaque mill complex, which saw them acquire a fully-functional and permitted 2,200 tonnes per day gold mill worth over $100 million for a net cash payment of just $775,000 and $7.225 million worth of stock. They also beefed up their operational team with veteran mining engineer Langis St-Pierre (COO), closed an expanded $8 million financing and expedited the Federal permitting process.

The company trades at a market capitalization of $55 million (based on a closing price of $0.225 per share today) and has $12 million in cash on the books. Additionally, in Quebec, companies are eligible for certain tax refunds associated with mineral exploration. For their exploration spend in 2013, the company received back $445,000 from the Québec Resource Tax Rebate program.

In the first full year of production, the company will generate its market cap (~$52 million) in pre-tax cash flows on 111,100 ounces of gold, assuming US$ 1,175 per ounce gold. The company expects to receive approval from MERN (the Ministère de l’Énergie et des Ressources naturelles) for the updated mine and reclamation plan by the end of Q2/2015. This will allow the company to finance and start construction of the ramp and drift to access the Parallel zone. The company still needs the Certificate of Authorization for the Triangle zone.

CEO.ca reached out to President and CEO Steve de Jong for comment but he was busy on a well-attended site visit. A spokesman for the company told us they aren’t giving official guidance at this point on the Triangle zone permit, but they don’t foresee any roadblocks given the jurisdiction they are working in.

Although the company could “piecemeal” the build-out of the mine – finance construction of the Parallel zone and then finance the Triangle zone – that can create problems because the ore would be coming from only one portal which leaves the company open for potential delays. The spokesman told us: “that isn’t the ideal plan.”

While hitting the road and conducting site visits to garner financier’s interest, the company has begun drilling again. There will be a heavy focus on the Triangle zone but the company is also looking at exploration targets that they were unable to get to in last year’s program due to thawing ground.

By the end of the first half of 2015 (likely before), management expects to release an updated mineral resource estimate which includes an additional 40,000 metres of diamond drilling of which roughly 60% was dedicated to an infill program at the Triangle zone and the other 40% was for other exploration targets.

One knock against the company is the relatively short mine-life of four and half years. Although a four year mine-life is typical of these high-grade underground mines in Quebec, management understands the market likes to see longer life mines as it allows them to put numbers to future production. This updated mineral resource estimate will likely help to increase analysts’ confidence that there is plenty of gold to be mined at Lamaque, well-beyond the 4 years of planned production.

The plans for 2015 are as follows:

- Infill and exploration drilling focused on Triangle zone (ongoing)

- Obtain MERN approval for Parallel zone permit amendment (Q2/2015)

- Updated mineral resource estimate (Q2/2015)

- Obtain MERN approval for Triangle zone (ongoing)

- Financing for the development of mine (ongoing)

Note, the company has 35 million warrants that expire at the end of June next year at an exercise price of $0.30 which could bring in an additional $10.5 million to the kitty.