Quanta Services Inc. (NYSE:PWR) reported second-quarter 2017 adjusted earnings (including adjustments for stock-based compensation expense) of 46 cents per share, missing the Zacks Consensus Estimate of 50 cents by 8%.

The company’s non-GAAP earnings from continuing operations came in at 50 cents, up 177.8% from the prior-year quarter’s 18 cents. The bottom-line growth is attributable to a robust top line and sound execution of projects.

Inside the Headlines

Total revenue in the quarter came in at $2,200.4 million, up an impressive 22.8% on a year-over-year basis. In addition, the figure trumped the Zacks Consensus Estimate of $2,138 million. Robust revenues generation at the Oil and Gas Infrastructure segment acted as the primary catalyst. Fast pace of work at the large electric transmission and pipeline projects proved supplemented sales during the quarter.

Of the total quarterly revenue, the Electric Power Infrastructure segment accounted for 59.1%, and the Oil and Gas Infrastructure segment represented 40.9%.

Segment wise, revenues from Electric Power Infrastructure were up 12.2% year over year to $1,300.7 million. Oil and Gas Infrastructure segmental revenues were up a whopping 42.5% to $899.6 million.

In second-quarter 2017, operating income came in at $109.8 million, more than double compared with the prior-year figure of $35.5 million.

At the end of Jun 30, 2017, Quanta Services’ consolidated total backlog was $9,182.8 million, down from $9,755.5 million at the end of last year.

Liquidity

Quanta Services exited the quarter with cash and cash equivalents of $99.6 million, down from $112.2 million as of Dec 31, 2016. At quarter end, the company’s long-term debt and notes payable was $483.6 million, up from $353.6 million as of Dec 31, 2016.

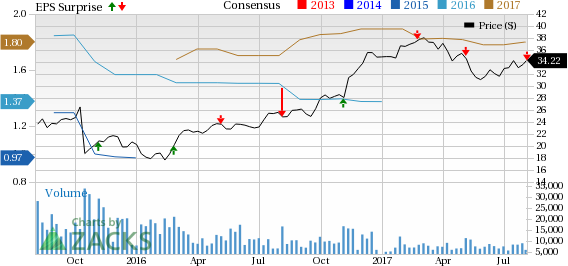

Quanta Services, Inc. Price, Consensus and EPS Surprise

Notable Developments

Subsequent to the end of the quarter, Quanta Services was chosen by American Electric Power (AEP) to provide engineering, procurement and construction (EPC) solutions for the Wind Catcher Generation Tie Line (Wind Catcher Tie Line). Also, it was selected by Enbridge Pipelines Inc. to build two spreads of the Canadian section of the Line 3 Replacement Program. This apart, Quanta Services booked approximately $150 million of new work for several major North American communications companies.

Moreover, the company completed two bolt-on acquisitions to expand its market share. It acquired specialized services company, Stronghold Specialty, Ltd. (Stronghold), which provides high pressure and critical path solutions to the downstream and midstream energy markets. The transaction was done by an upfront payment of approximately $450 million. Quanta Services’ Oil and Gas Infrastructure Services segment is expected to benefit from this acquisition.

Also, Quanta Services acquired a communications infrastructure services contractor during the quarter. The company provides construction and maintenance services in the southeast and other regions of the United States.

Guidance Raised

Concurrent with second-quarter 2017 results, the company revised its full-year top- and bottom-line guidance. Quanta Services now expects revenues to lie in the range of $8.65–$9.05 billion compared with the previously guided range of $8.1–$8.6 billion. In addition, the company raised its full-year adjusted earnings per share guidance from $1.82–$2.07 to $1.92- $2.10.

The company remains confident that Stronghold will generate approximately $240 million to $260 million of revenues and approximately $6.0 million to $7.5 million of net income attributable to common stock. This will be accretive to non-GAAP adjusted earnings per share growth by $0.06 to $0.07.

Our Take

Quanta Services reported better than expected second-quarter results on the back of solid top-line growth. Going forward, the company expects a strong rebound in its end markets as it enters a renewed multiyear up-cycle for businesses. Quanta Services’ optimism stems from healthy backlog levels which are expected to grow further.

Going forward, the company continues to expect healthy levels of base load work including supporting midstream infrastructure, downstream support services and natural gas distribution. Over the past two years, state-of-the-art infrastructure solutions offered by the company has helped it garner approximately $2 billion of project revenue across core competencies in electric power, oil and gas and telecom in all end markets.

In addition, the company’s bolt-on acquisitions are expected to help it grab a greater market share. In 2016, the Zacks Rank #2 (Buy) company completed five acquisitions, four of which were integrated in its Electric Power Infrastructure Services segment and one in the Oil and Gas segment. We believe these buyouts will stoke inorganic growth, going forward.

Stocks to Consider

KB Home (NYSE:KBH) sports a Zacks Rank #1 (Strong Buy) and has an average positive earnings surprise of 12.5% for the past four quarters, having beaten estimates all through. You can see the complete list of today’s Zacks #1 Rank stocks here.

NCI Building Systems, Inc. (NYSE:NCS) also boasts a Zacks Rank #1 and has an average earnings surprise of 11.3% for the last four quarters.

EMCOR Group (NYSE:EME) has a decent earnings beat history, having surpassed estimates thrice over the trailing four quarters. The Zacks Rank #2 has an average positive surprise of 11.7% over the same time frame.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

NCI Building Systems, Inc. (NCS): Free Stock Analysis Report

Quanta Services, Inc. (PWR): Free Stock Analysis Report

EMCOR Group, Inc. (EME): Free Stock Analysis Report

KB Home (KBH): Free Stock Analysis Report

Original post

Zacks Investment Research