Customer experience management company Qualtrics, two years after being acquired by German software giant SAP (DE:SAPG), filed its S-1 registration statement to go public. The company did not give details as to how many shares it would offer to the public, but it did indicate a price target of $20 to $24 per share.

The registration statement gives a placeholder amount of $100 million for the value of the shares it plans to offer, but this will change once the firm gives more details about how many shares it will offer. The company provides enterprise clients with customer and employee experience management software and related services. The company follows the pattern of many recent IPOs in being profitless, having a high operating cash flow burn and growing revenue at very impressive rates. Qualtrics is spinning out of parent firm SAP a little over two years after being acquired by SAP before its previous IPO.

Qualtrics provides a system that allows companies to gather customer feedback and optimize employee responses based on survey data. The platform brings together customers, and employers, alongside brands and product experiences, allowing executives to take a macro-view of those areas of the business.

A Huge Market Opportunity

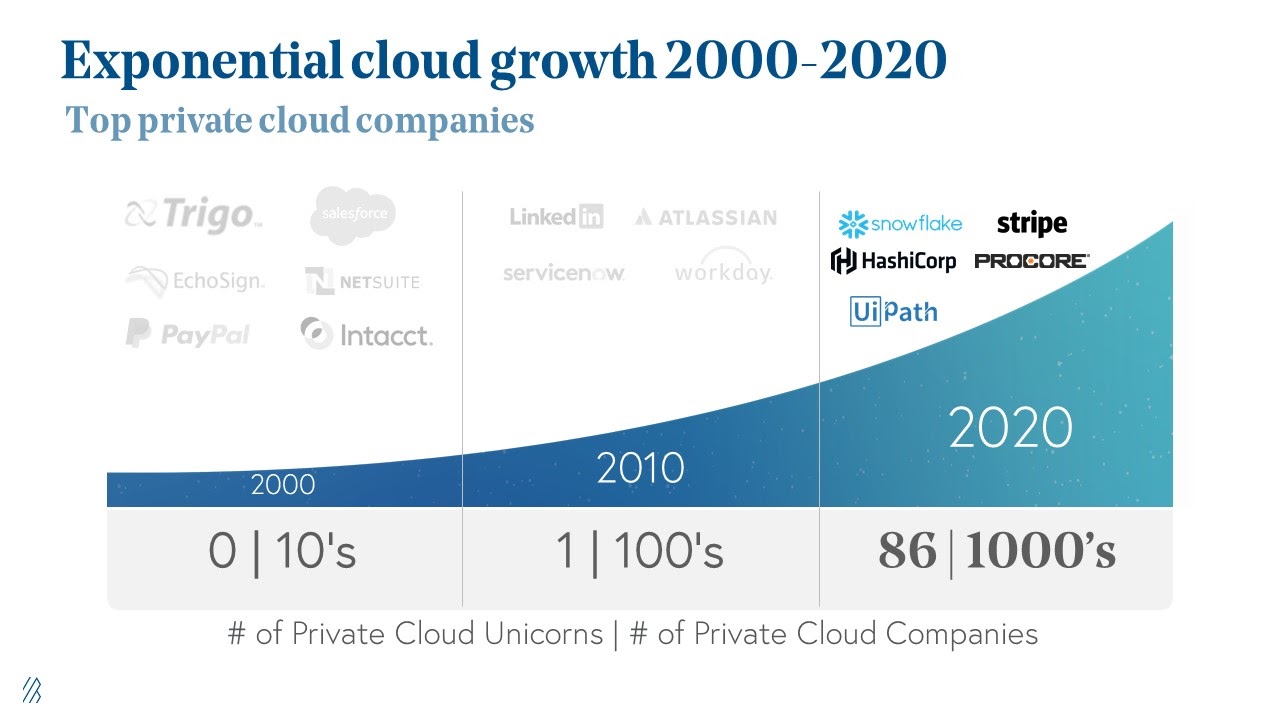

As Bessemer Venture Partners show in the chart below, the cloud computing industry has experienced exponential growth over the last two decades.

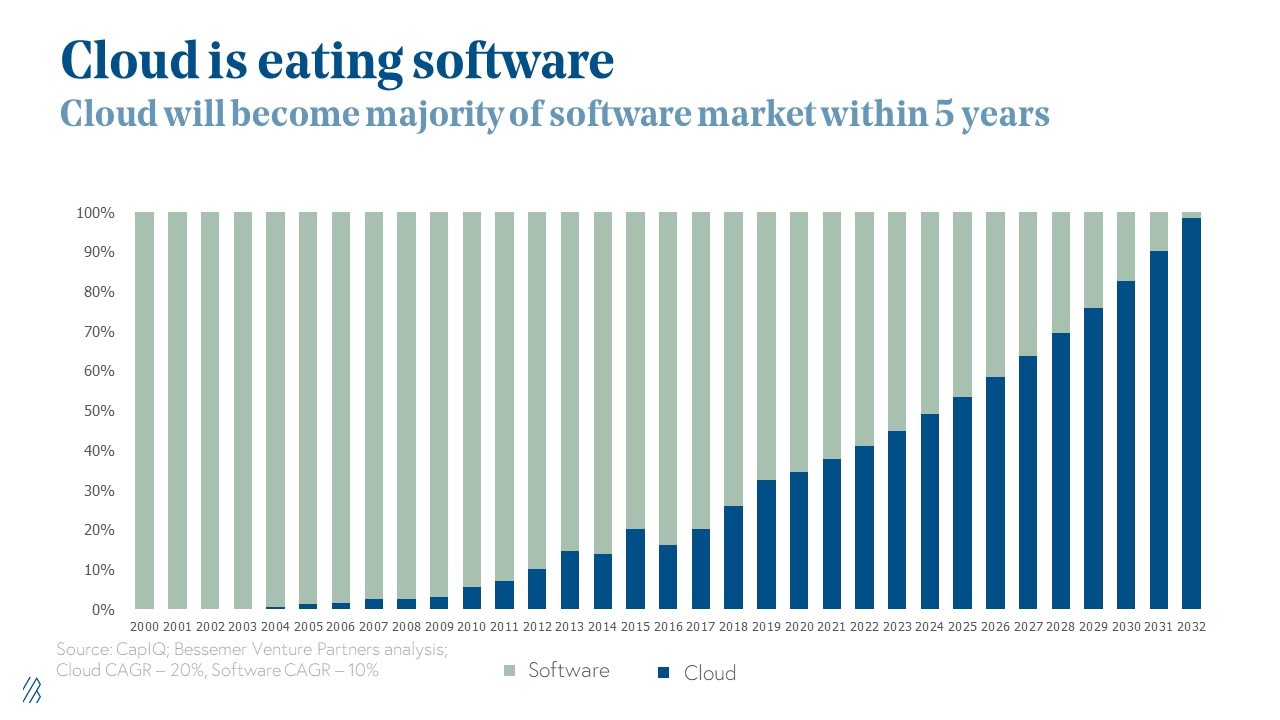

Markets and Markets projects that the cloud computing industry will grow 212% over the next five years, from a value of $266 billion in 2019 to $832 billion by 2025. This is in line with Bessemer Venture Partners’ assertion that cloud computing will become the dominant force in software over the next five years.

Qualtrics estimates that the size of its addressable market within the industry was $60 billion in 2020. An addressable market of that size, with growth rates as appetizing as these, suggests that Qualtrics can expect revenue growth to continue to be very high. Yet, the real question is whether the company will be able to develop the competitive advantages that will allow it to earn economic profits.

This suggests that investors selling their shares on IPO will find a very hungry market. The Wall Street Journal found that“The 52 stocks on the BVP Nasdaq Emerging Cloud index have averaged a gain of 15% this year compared with the S&P 500’s 11% drop.”

A Profitless Business

Revenue growth shows the typical features of a firm that is in a fast growing market. The S-1 filing shows very impressive revenue growth. Revenue has grown from $409 million to approximately $550 million in the nine months ending September 2020. In the same period, gross profit has grown from $299 million to $403 million. Yet, the company continues to fatten its operating losses, which have grown from $33 million to $244 million in the same period, with operating cash flow losses widening from $37 million to $258 million. The company seems to have fallen into the classic trap of growing at the expense of creating value for its shareholders, indeed, the company continues to destroy shareholder value, which is not something that one wants to hear when mulling over one’s family investments.

One suspects that the speed with which SAP decided to spinoff the company is indicative of the company’s long-term prospects. In the two years prior to its acquisition by SAP, the company did not turn a profit. In 2016, it made a $12 million loss having posted revenues of $190.6 million. In 2017, revenues continued to grow, reaching $289.9 million, and generating a meagre $2.6 million profit.That represents a $9.4 million loss across those two years.

Valuation

Using the The BVP Nasdaq Emerging Cloud Index, we can see that cloud computing firms with revenue growth rates of 35.5% and gross margins of 71.3%, are, on average, valued by the markets at an enterprise value/annualized revenue ratio of 17. At present, the company is within touching distance of all those metrics, having marginally slower growth, and marginally better growth margins, and could achieve a 17.0x valuation when it goes public, which would value it at around $13.6 billion (17 times $800 million). The company is not carrying significant levels of debt, but it will have a warchest of cash after IPO, so the enterprise value will be just under its market capitalization.

As we have discussed, cloud computing is big business, and this has resulted in the fact that even though SAP significantly overpaid for Qualtrics, the company is worth far more today than it was two years ago, despite not having solved its profitability issues. This trend is likely to continue in the near-term, but in the long-term, the failure of the company to resolve its profitability issues will likely see a pullback in value.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.