SEK: quality pays off

The mere fact that the Swedish krona is trading stronger, rather than weaker, when the global business cycle is on the defence is at odds with normality – the krona is an inherently pro-cyclical currency – and must be viewed in the context of relative fundamentals with sound public finances in Sweden contrasting sharply with the poor fiscal backdrop elsewhere and a solid Swedish current account surplus.Sweden, together with Norway and the US, has the world’s lowest CDS rates (sovereign default risk). Stable AAA is a privilege of the few: only nine countries in the world that remain on AAA have not been put on the watch list for downgrade.Hence, quality seems to be paying off in the exchange rate. Foreign accounts have continued to add Swedish bonds to their holdings and in October the foreign sharebreached 50% (at 51%) for only the second time ever. We also expect further strong foreign demand for Swedish debt in 2012.

Although EUR/SEK and the TCW index trade some 3% below historical averages, the levels are far from stretched in terms of long-term valuation, particularly not if compared with other high-quality currencies within the G10 universe (AUD, CAD, NOK, etc.). Indeed, it can be argued that what we see is a removal of persistent misalignment (undervaluation). Interestingly, it lies within the Riksbank’s forecast that the krona will appreciate further in the next two to three years. The target is 119, which, all else being equal, corresponds to EUR/SEK 8.50. It goes without saying that these and even lower levels would not be utopian or unbearable for the Swedish surplus economy. At some

point, the Riksbank is likely to become uncomfortable though (strong SEK weighing on exports and inflation) and start to intervene verbally but we are not there yet.

If the euro crisis lingers, with risks of a break-up being priced in, the Swedish krona remains a good hedge and if fundamentals and quality arguments stay at the forefront of investors’ focus in 2012 too there is a strong case for continued SEK appreciation. Technically, a break of 8.78 would open the way for key support at 8.70, which is where we have medium-term fair value.

Temporary correction on the cards?

That said we do not accept a full SEK decoupling from the business cycle, or

monetary policy, or risk sentiment. Indeed, we are able to explain some of the recent downtrend in EUR/SEK with precisely these factors. However, we must admit that we are surprised by the fast pace with which EUR/SEK has fallen recently. There have been only few and minor corrections on the way. Our short-term models suggest that the sell-off is partially overdone and that a correction could be on the cards.

EUR/SEK" title=" EUR/SEK" width="630" height="375" />

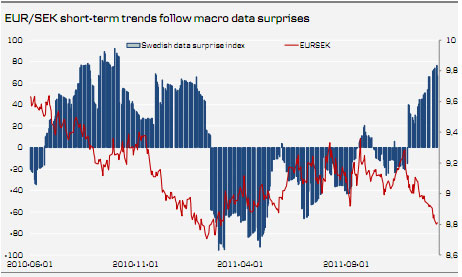

EUR/SEK" title=" EUR/SEK" width="630" height="375" />First, Swedish macro data have, since November, generally surprised on the upside and the trend reversal in EUR/SEK (lower) coincided with data surprises switching from negative to positive (see chart). A sign indeed that macro data (growth outlook) matters! However, and importantly, yesterday’s industrial orders and production could be seen as a warning bell of what might lie ahead – namely a period of weaker-than-expected data: First, we have a sub-consensus macro forecast for 2012 and that would be consistent with

a series of sub-consensus data readings over the next few months and, second, the surprise index has reached historical highs, which signals that we will enter a period of negative surprises. We expect CPIF inflation to approach near zero in 2012 and undershoot the Riksbank forecast by one percentage point this summer.

Negative GDP growth in 2012 and low inflation will provide ample room to ease

monetary policy. We have the repo rate at 0.5% in Q3, which is below market pricing at 0.9%. However, we expect the Riksbank to move in small 25bp steps, which is in line with what the market is pricing for its next three meetings. Hence, these moves could fail to surprise the markets on the soft side even as the Riksbank delivers a series of rate cuts – it will be seen as slow movers. Part of the decline in EUR/SEK has been related to the relative play between Norges Bank (very dovish) and the Riksbank (less dovish), which sent NOK/SEK sharply lower. We see no repeat of this going forward.

EUR/SEK spot is trading close to two standard deviations below fair value as implied by relative yields, something that is not sustainable. Either the money market, contrary to our expectations, will price in less cuts from the Riksbank/more from the ECB or the exchange rate moves higher.

GBP: more QE from BoE in Februar

Buoyant UK data – December spending strongUK numbers have been quite good recently – far better than expected by most. Data yesterday showed BRC’s like-for-like sales climbed 2.2% in December, the best since April, and the RICS house price balance increased to -16%, the best since July 2010. Consumer spending was quite strong in December, which makes the weaker November more tolerable. Last week, manufacturing and service PMIs both surprised on the upside, with the latter even sending a clear expansionary signal. The UK data surprise indicator is almost as high as the US indicator and well above the European and Japanese ones, both

in negative territory. Our preliminary estimate for Q4 growth is 0.0-0.2%, which means that the UK might not be in recession contrary to popular belief.

BoE will not increase asset purchase target in January It is in our view unlikely that the Bank of England will increase the asset purchase target when the Monetary Policy Committee ends its two-day meeting on Thursday. As we pointed out in our last BoE preview, the BoE acknowledges the economy needs more stimulus but it might be afraid the market cannot absorb accelerated Gilt buying: “Market capacity made it difficult to increase the monthly rate of purchases substantially above what was already under way” the latest Minutes said. We interpret this as meaning more QE will surely come but not at a ‘run rate’, i.e. we believe the current speed, around £5bn per week, will be maintained going forward.

We think the Bank of England will continue to buy Gilts for most of 2012. The first increase will be announced in January and could be either £50bn or £75bn. The former would signal the bank is levelling off, while the latter would indicate that stimulus continues unabated and more might be coming. We think total asset purchases will amount to £400bn by end-2012. It is difficult to estimate the total programme but we expect the economy to expand in H2 12 after having backpedalled for some time. Our base rate indicator will be an important tool.

Strong support for EUR/GBP at 0.82

We argue the pound’s strength is not entirely due to the euro’s weakness but could also be explained by some domestic support. EUR/GBP still needs to test 0.82, rejected twice in 2010 and a key level in 2008. Without another move in relative rates, e.g. caused by a surprise move from the ECB on Thursday which is not our call, it will be hard to push EUR/GBP below 0.82. Ongoing negative eurozone headlines are likely to be held in check by more QE from the BoE and perhaps even attempts to improve liquidity in UK money markets.

Accordingly, we find it likely that EUR/GBP will trade broadly flat around the current level for most of Q1. Volatility could easily rise a bit though.

HUF: rocky start for the forint

If the negotiations between the Hungarian government and the EU/IMF get underway in an orderly fashion, this week’s recovery in the forint might continue. However, we would rather take a chance on the Polish zloty as potentially gaining when the “Hungarian storm” calms down, as in our view the zloty has been somewhat unfairly hit by spill-over from the Hungarian markets.It has been a rocky start to the year for the Hungarian forint, which has been under quite some pressure. This week the forint recovered somewhat but it still seems quite fragile.

The turmoil in the Hungarian markets has attracted attention in the wider European markets and there have been considerable spill-over effects on other Central and Eastern European (CEE) markets. Whether or not this is fair is open to debate but with this kind of volatility some spill-over to, for example, the Polish markets appears difficult to avoid.

The Hungarian markets have remained under serious pressure and at some point last week it looked as though investors were indiscriminately exiting their positions in the Hungarian markets. Ten-year government bond yields rose well above 10% and the forint sold off dramatically.

There is, in our view, only one reason for the escalation of the sell-off in the Hungarian markets: the erratic communication from the Hungarian government. The Hungarian government’s rhetoric has become increasingly hostile towards international investors, the EU, the IMF, rating agencies and the country’s own central bank. Unsurprisingly, this is scaring international investors.

Two weeks ago the Hungarian parliament passed a law that fundamentally threatens the independence of the Hungarian central bank (MNB). Both the EU and the IMF have reacted strongly to the attack on the MNB’s independence and talks of a new loan agreement seem to have de facto been suspended by the EU and the IMF.

The significant pressure on the forint, however, seems to have had some impact on the Hungarian government’s attitudes and on Friday comments from Hungarian officials indicated that the government would be open to changing the central bank law once again – so to fulfil EU rules. It is still a very open question whether this will happen or not. After all, over the past year the Hungarian government has often confused investors with “promises” to do one thing, only to do something else shortly after. Therefore, we find it unlikely that international investors will be willing to accept blindly “promises” from the Hungarian government.

However, it now seems that the EU and the IMF are at least willing to meet with the Hungarian government and the first meetings are planned for next week. That said, the recent turmoil and actions from the Hungarian government can hardly have pleased the EU and the IMF, so the negotiations are likely to be challenging. Patience with the Hungarian government is clearly running out in Brussels and Washington.

The turmoil is leading investors to wonder whether Hungary could default. Our main scenario is not for a Hungarian sovereign default but we also acknowledge that this scenario can no longer be ruled out, particularly if the Hungarian government does not make serious concessions to ensure the speedy return of investor confidence and open the door for IMF-EU negotiations.

We do not believe that Hungarian economic fundamentals justify this kind of sell-off. Furthermore, we believe that the forint is trading at levels that we consider to be fundamentally undervalued. However, as long as the Hungarian government maintains its anti-market rhetoric and seems to be stepping up its attacks on international lenders and the MNB, it is difficult to be optimistic. If, however, negotiations between the Hungarian government and the EU/IMF get underway in an orderly fashion and we get calming remarks from EU and IMF officials, this week’s recovery in the forint might continue. However, we would rather take a chance on the Polish zloty as potentially gaining when the “Hungarian storm” calms down, as, in our view, the zloty has been somewhat unfairly hit by spill-over from the Hungarian markets. In our view, the risks are still too big for the forint for us to recommend outright buying the forint at these levels.