Qualitative vs. Quantitative

1. A Qualitative Analysis seeks out the ‘why’, not the ‘how’ of its topic, seeking out the quality not quantity. A Quantitative Analysis seeks out the ‘How’, not the ‘Why’ of its topic, seeking out the quantity not quality.

2. In market analysis, fundamental is qualitative and technical is quantitative.

3. Technical analysis which is quantitative in nature can also become qualitative or 100% quantitative.

4. Qualitative analysis is predictive (biased) in nature and Quantitative analysis is reactive (unbiased) in nature.

5. Qualitative analysis is a kind of art while Quantitative analysis is pure scientific.

6. In general, discretionary trading is qualitative and mechanical trading is quantitative.

7. In technical analysis, qualitative method gains an understanding of underlying reasons and motivations like why the trend is bullish or bearish and also to determine its quality. Quantitative method does not focus on underlying reasons and motivations but reacts 100% to preprogrammed parameters. It doesn’t care for quality but seeks out the “quality in quantity”.

8. Chart pattern analysis, Elliott wave analysis, support and resistance levels all are qualitative examples. The signals generated from these are subjective and opinions may change. Relying solely on one indicator or combination of indicators generating mechanical signals are quantitative examples. There is no second opinion in quantitative analysis.

9. Emotions may influence entry & exit decisions for qualitative methods. There is no place for emotions in quantitative decisions.

10. Experience is required for making entry & exit decisions every time for trade execution in qualitative analysis and only experienced traders are able to make profitable decisions. In Quantitative analysis, experience is only required for making preprogrammed logic or strategy. Once a profitable methodology is set, no experience is required for application.

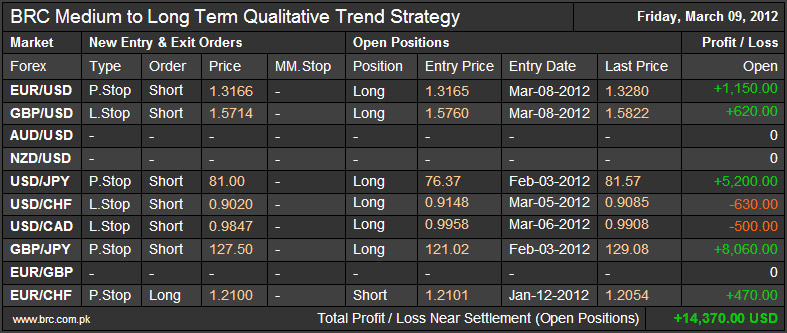

BRC Long Term Qualitative Trend Analysis

BRC long term qualitative trend analysis seeks out qualitative methodology for trend analysis in short to medium and long term time frame. We use technical analysis to gauge the trend. As technical analysis it self is quantitative in nature so we are using its qualitative factors for our analysis. The tools used in our analysis are Pivot Point, Chart Price Patterns, and Elliott Waves. Our proprietary strategy for this analysis is primarily based on chart patterns, so it makes the whole process qualitative.

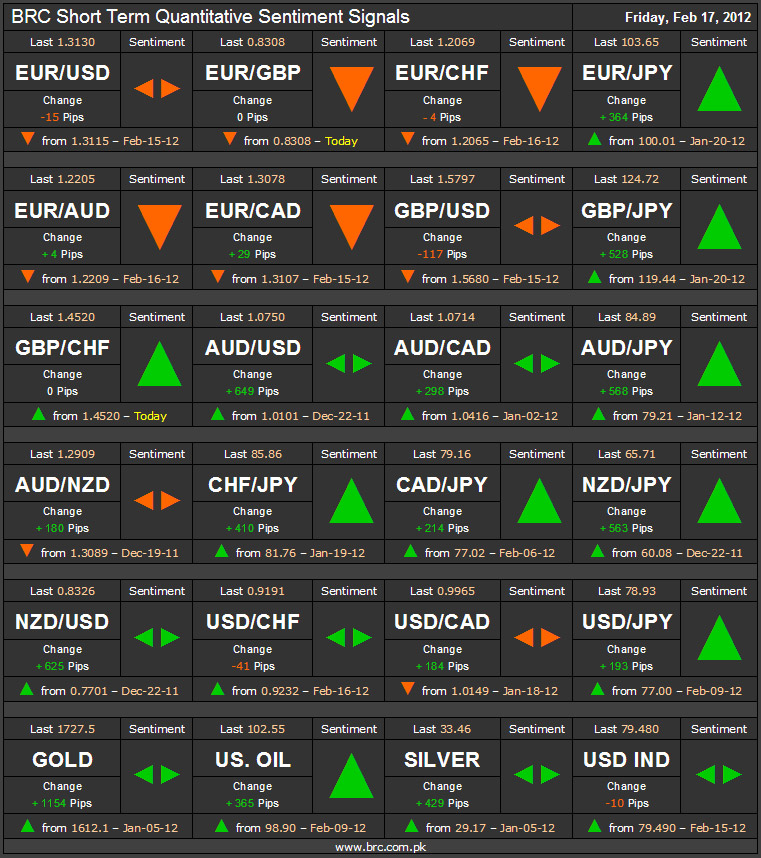

BRC Short Term Quantitative Sentiment Analysis

BRC short term quantitative sentiment analysis seeks out quantitative methodology for sentiment analysis in short term time frame. We use technical analysis to gauge the sentiment. As technical analysis it self is quantitative in nature so we are using its pure quantitative factors for our analysis. We completely avoid any biased or qualitative factors for making decisions. Bullish, Bearish & Neutral sentiments are gauged utilizing preprogrammed logic without any emotional interference.The only tool used for the strategy is short term dynamic demand & supply lines which then guages Bullish, Bearish and Neutral quantitative sentiments.