Qualcomm Incorporated ( (NASDAQ:QCOM) ) just released its fiscal first-quarter financial results, posting adjusted earnings of 98 cents per share and revenues of $6.07 billion.

Currently, QCOM is a Zacks Rank #3 (Hold) and is down 0.37% to $68.00 per share in trading shortly after its earnings report was released.

Qualcomm:

Beat earnings estimates. The company posted non-GAAP earnings of $0.98 per share, beating the Zacks Consensus Estimate of $0.90 per share. Factoring in a $6.0 billion tax reform charge, the company reported a loss of $4.03 per share.

Beat revenue estimates. The company saw revenue figures of $6.07 billion, beating our consensus estimate of $5.95 billion.

“Our fiscal first quarter results reflect continued strong performance in our semiconductor business, as well as continued strength in 3G/4G handset ASPs,” sad CEO Steve Mollenkopf. “We recently detailed our roadmap for value creation, outlining the significant growth potential for Qualcomm as we enter the 5G world and our products and technologies expand into attractive new markets.”

Qualcomm now expects to post Q2 revenues in the range of $4.8 billion to $5.6 billion. Non-GAAP earnings are expected to fall between $0.65 per share and $0.75 per share. This guidance is lower than what analysts expected. Our current consensus estimates are calling for earnings of $0.88 per share and revenues of $5.61 billion.

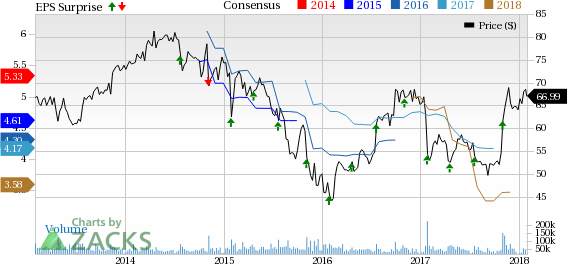

Here’s a graph that looks at Qualcomm’s recent earnings performance:

Qualcomm Incorporated is a world leader in 3G, 4G and next-generation wireless technologies. Qualcomm Incorporated includes Qualcomm's licensing business, QTL, and the vast majority of its patent portfolio. Qualcomm Technologies, Inc., a subsidiary of Qualcomm Incorporated, operates, along with its subsidiaries, substantially all of Qualcomm's engineering, research and development functions, and substantially all of its products and services businesses, including its semiconductor business, QCT.

Check back later for our full analysis on Qualcomm’s earnings report!

Want more analysis from this author? Make sure to follow @Ryan_McQueeney on Twitter!

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

QUALCOMM Incorporated (QCOM): Free Stock Analysis Report

Original post

Zacks Investment Research