It has been about a month since the last earnings report for Qualcomm Incorporated (NASDAQ:QCOM) . Shares have lost about 3.2% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important drivers.

Qualcomm Tops Q3 Earnings and Revenues Estimates

Qualcomm’s third-quarter 2017 net income (on a GAAP basis) came in at $866 million or $0.58 per share compared with $1,444 million or $0.97 in the year-ago quarter. Adjusted earnings per share (excluding special items) were $0.70, ahead of the Zacks Consensus Estimate of $0.67.

Revenue

Quarterly total revenue of $5,371 million was down 11.1% year over year while surpassing the Zacks Consensus Estimate of $5,221 million.

Segment-wise, Qualcomm Code Division Multiple Access (CDMA) Technologies contributed $4,052 million revenues compared with $3,853 million in the prior-year quarter. EBT (earnings before tax) margin was 14% compared with 9% in the prior-year quarter. Qualcomm Technology Licensing generated $1,172 million, down a whopping 42.5% year over year. EBT margin was 73% compared with 86% in the prior-year quarter.

Chipset Statistics

During the fiscal third quarter, Qualcomm shipped approximately 187 million CDMA-based MSM (Mobile Station Modem) chipsets, reflecting a decline of 7% year over year. This was also below the midpoint of 190 million, which was the third-quarter chipset outlook given by management earlier.

Operating Metrics

Quarterly operating income came in at $773 million compared with $1,592 million in the year-ago quarter. Quarterly operating margin was 14.4% compared with 26.3% in the prior-year quarter. Quarterly EBT was $858 million compared with $1,693 million in the year-ago quarter.

Cash Flow

During the third quarter of fiscal 2017, Qualcomm generated $82 million of cash from operating activities compared with $1,840 million in the prior-year quarter. Free cash flow in the reported quarter was a negative $95 million compared with a positive $1,704 million in the prior-year quarter.

Liquidity

At the end of the third quarter of fiscal 2017, Qualcomm had $20,863 million of cash, cash equivalents and marketable securities compared with $18,648 million at the end of fiscal 2016. Total outstanding debt was $21,898 million at the end of the reported quarter compared with $10,903 million at the end of fiscal 2016. The debt-to-capitalization ratio at the end of the reported quarter was 0.38 compared with 0.24 at the end of fiscal 2016.

Dividend Payment to Stockholders

During the third quarter of fiscal 2017, the company returned nearly $1.1 billion to stockholders. This included $844 million (57 cents per share) of cash dividend and another $300 million through repurchases of 5.2 million shares of common stock.

Fourth-Quarter Fiscal 2017 Outlook

Revenues for the fourth quarter of fiscal 2017 are estimated in the range of $5.4–$6.2 billion. GAAP earnings per share are estimated between 55 cents and 65 cents. Non-GAAP earnings per share are estimated between 75 cents and 85 cents. Qualcomm is expected to ship 205–225 million MSM chipsets in the ongoing quarter.

How Have Estimates Been Moving Since Then?

Analysts were quiet during the last one month period as none of them issued any earnings estimate revisions.

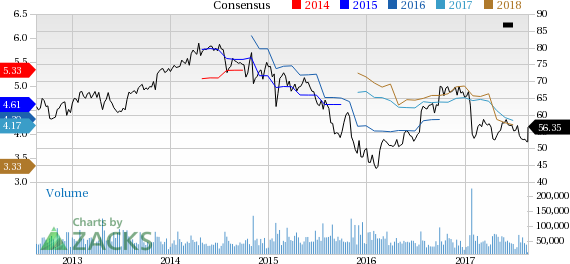

Qualcomm Incorporated Price and Consensus

VGM Scores

At this time, Qualcomm's stock has a poor Growth Score of F, a grade with the same score on the momentum front. However, the stock was allocated a grade of B on the value side, putting it in the top 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of F. If you aren't focused on one strategy, this score is the one you should be interested in.

The company's stock is suitable solely for value investors based on our styles scores.

Outlook

Notably, the stock has a Zacks Rank #3 (Hold). We expect in-line returns from the stock in the next few months.

QUALCOMM Incorporated (QCOM): Free Stock Analysis Report

Original post

Zacks Investment Research