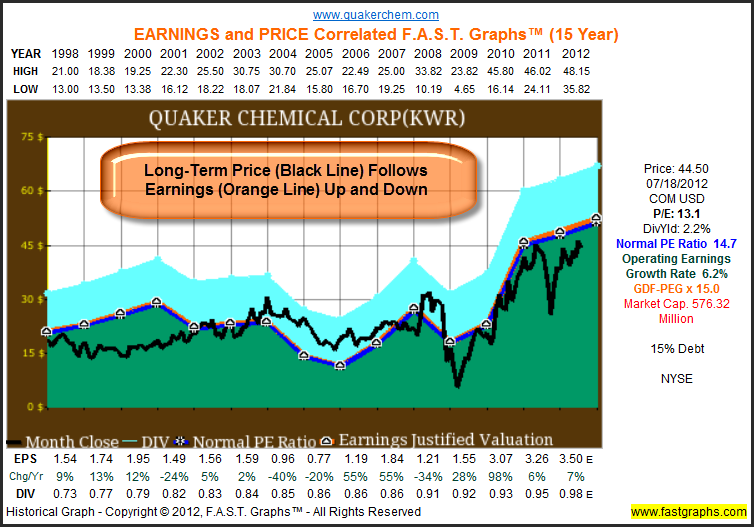

Quaker Chemical Corp’s (KWR) long-term operating history can be described as periodically erratic. The company will string together several years of earnings growth followed by periods of earnings contraction. Therefore, although forecasts for future earnings growth are expected to be strong, prospective investors should be aware of the company’s quasi cyclical business history.

Consequently, investors considering this stock should ask themselves whether or not they feel they can trust the reliability of the forecasts. With this in mind, investors are advised to focus more on the near-term forecasts than the longer-term forecasts. Nevertheless, Quaker Chemical offers a vivid example of how price follows earnings over the long run.

“Quaker Chemical Corporation is a leading global provider of process chemicals, chemical specialties, services, and technical expertise to a wide range of industries including steel, aluminum, automotive, mining, aerospace, tube and pipe, coatings and construction materials. Our products, technical solutions, and chemical management services enhance our customers' processes, improve their product quality, and lower their costs. Quaker's headquarters is located near Philadelphia in Conshohocken, Pennsylvania.”

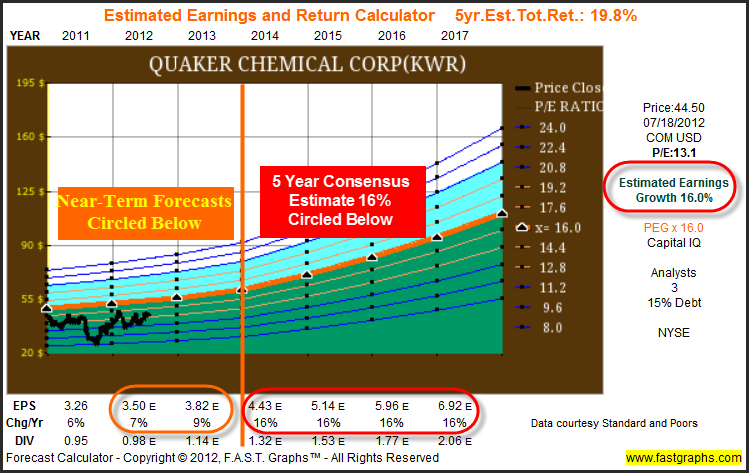

Earnings Determine Market Price: The following earnings and price correlated F.A.S.T. Graphs™ clearly illustrates the importance of earnings. The Earnings Growth Rate Line or True Worth™ Line (orange line with white triangles) is correlated with the historical stock price line. On graph after graph the lines will move in tandem. If the stock price strays away from the earnings line (over or under), inevitably it will come back to earnings.

Quaker Chemical Corp: Historical Earnings, Price, Dividends and Normal PE Since 1998

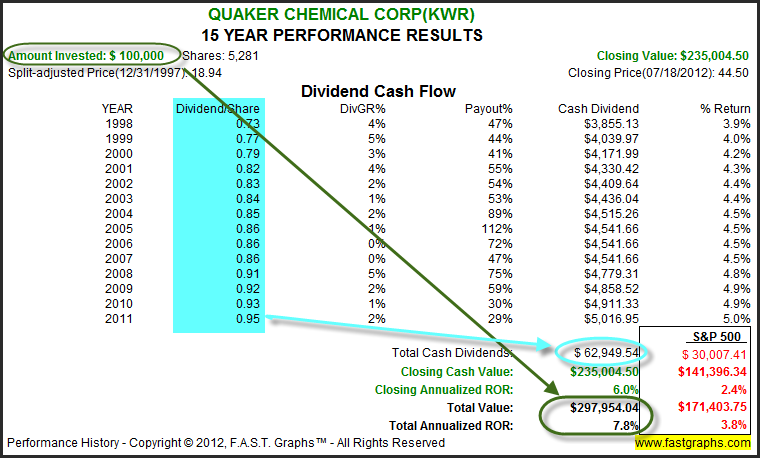

Performance Table Quaker Chemical Corp

The associated performance results with the earnings and price correlated graph, validates the principles regarding the two components of total return; capital appreciation and dividend income. Dividends are included in the total return calculation and are assumed paid, but not reinvested.

When presented separately like this, the additional rate of return a dividend paying stock produces for shareholders becomes undeniably evident. In addition to the 6% capital appreciation, long-term shareholders of Quaker Chemical Corp, assuming an initial investment of $100,000, would have received an additional $62,949.54 in dividends that increased their total return from 6% to 7.8% per annum versus 3.8% in the S&P 500.

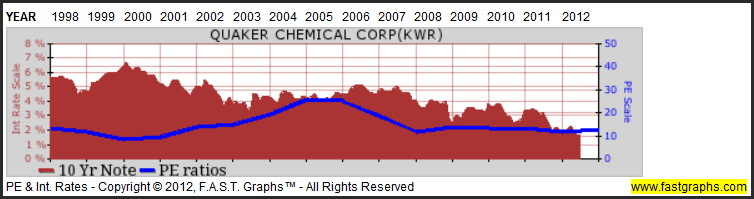

The following graph plots the historically normal PE ratio (the dark blue line) correlated with 10-year Treasury note interest. Notice that the current price earnings ratio on this quality company is as normal as it has been since 1998.

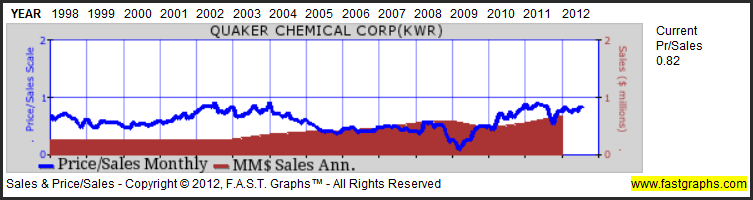

A further indication of valuation can be seen by examining a company’s current price to sales ratio relative to its historical price to sales ratio. The current price to sales ratio for Quaker Chemical Corp is .82, which is historically high.

Looking to the Future

Extensive research has provided a preponderance of conclusive evidence that future long-term returns are a function of two critical determinants:

1. The rate of change (growth rate) of the company’s earnings

2. The price or valuation you pay to buy those earnings

Forecasting future earnings growth, bought at sound valuations, is the key to safe, sound, and profitable performance.

The Estimated Earnings and Return Calculator Tool is a simple yet powerful resource that empowers the user to calculate and run various investing scenarios that generate precise rate of return potentialities. Thinking the investment through to its logical conclusion is an important component towards making sound and prudent commonsense investing decisions.

The consensus of 3 leading analysts reporting to Capital IQ forecast Quaker Chemical Corp’s long-term earnings growth at 16%. Quaker Chemical Corp has low long-term debt at 15% of capital. Quaker Chemical Corp is currently trading at a P/E of 13.1, which is inside the value corridor (defined by the five orange lines) of a maximum P/E of 19.2. If the earnings materialize as forecast, Quaker Chemical Corp’s True Worth™ valuation would be $110.67 at the end of 2017, which would be a 19.8% annual rate of return from the current price.

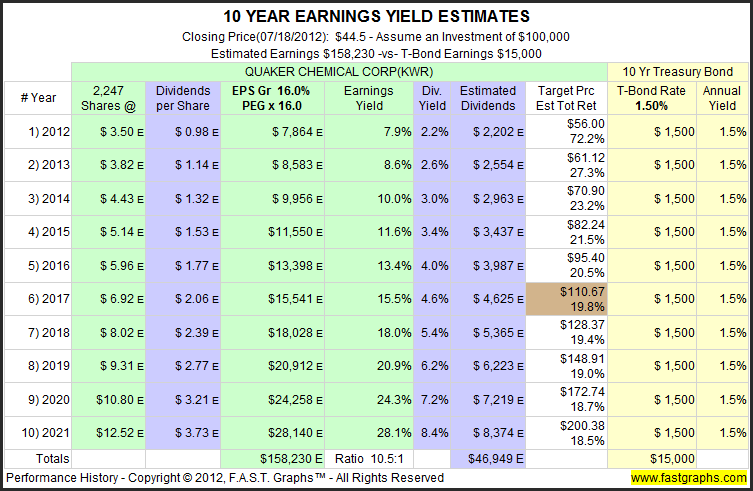

Earnings Yield Estimates

Discounted Future Cash Flows: All companies derive their value from the future cash flows (earnings) they are capable of generating for their stakeholders over time. Therefore, because Earnings Determine Market Price in the long run, we expect the future earnings of a company to justify the price we pay.

Since all investments potentially compete with all other investments, it is useful to compare investing in any prospective company to that of a comparable investment in low risk Treasury bonds. Comparing an investment in Quaker Chemical Corp to an equal investment in 10 year Treasury bonds, illustrates that Quaker Chemical Corp’s expected earnings would be 10.5 times that of the 10 Year T-Bond Interest. (See EYE chart below). This is the essence of the importance of proper valuation as a critical investing component.

Summary & Conclusions

This report presented essential “fundamentals at a glance” illustrating the past and present valuation based on earnings achievements as reported. Future forecasts for earnings growth are based on the consensus of leading analysts. Although, with just a quick glance you can know a lot about the company, it’s imperative that the reader conducts their own due diligence in order to validate whether the consensus estimates seem reasonable or not.

Disclosure: No position at the time of writing.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation. A comprehensive due diligence effort is recommended.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Quaker Chemical Corp: Price And Earnings Analysis

Published 07/22/2012, 01:40 AM

Updated 07/09/2023, 06:32 AM

Quaker Chemical Corp: Price And Earnings Analysis

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.