Quadrise (QFI.L) is the emerging supplier of multi-phase superfine atomised residue (MSAR), a low-cost alternative to heavy fuel oil for the shipping, refining and power generation industries. It continues to make progress in key projects in Saudi Arabia, Asia and Latin America and with major shipping line Mærsk. Commercialisation of any one of these would result in substantial profits for Quadrise. Material progress towards this has the potential to trigger upwards movement in the share price towards our indicative value of 16.8p/share.

MSAR: A cost-effective alternative to heavy fuel oil

Over 600Mt of heavy fuel oil (HFO) are produced globally each year. Typically refineries mix heavy oil residues with valuable middle distillates to produce HFO. Quadrise’s process uses water and specialist chemicals from AkzoNobel to produce MSAR, an HFO substitute. Refineries and oil-based economies can thus derive much higher value from the middle distillates, potentially enabling oil-producers to reduce distillate imports and their refineries to offer MSAR at a discount to HFO. MSAR is attractive to marine fleet operators, for whom fuel is up to 75% of costs. In addition, MSAR produces significantly lower NOx emissions and no black soot on combustion.

Progress made on key projects

Following feedback from the earlier seaborne trials of MSAR with Mærsk, the world's largest shipping line, an upgraded marine formulation is now ready for further trials and potentially commercial deployment. Quadrise has recently signed a Memorandum of Agreement with Rafid, its Saudi Arabian partner. This follows approval by Saudi Aramco of MSAR for trial across selected refineries. This gives greater scope for MSAR production and utilisation than was initially envisaged. Discussions with partners in Latin America and Asia are also progressing.

Valuation: Appreciation in value through commercialisation

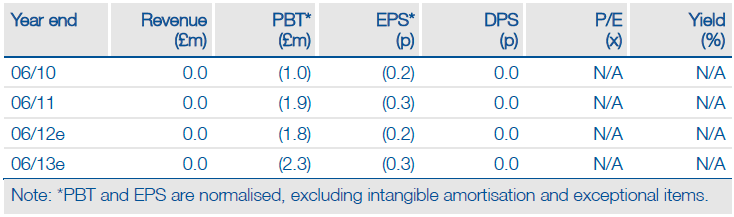

Our valuation is based on potential cash flows from the key projects taken over 15 years and applying a blended discount factor of 15% to reflect country and execution risk across these projects. To these we add the (anticipated lower) value of the Canadian assets. We have adjusted our FY12 pre-tax losses from £1.6m to £1.8m and now look for £2.3m pre-tax losses in FY13, rather than a break-even position, which we now expect to be reached during FY14. We therefore revise our indicative value from £84m (11.6p/share) to £121m (16.8p/share). We see potential for an uplift in share price towards our indicative value as each of the key projects makes material progress towards reaching the commercialisation phase.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Quadrise Fuels International: Value Appreciating Via Commercialization

Published 09/06/2012, 02:38 AM

Updated 07/09/2023, 06:31 AM

Quadrise Fuels International: Value Appreciating Via Commercialization

Innovative heavy fuel oil substitute

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.