A year of progress

Quadrise Fuels International, (QFI) is the supplier of MSAR, an emerging low-cost alternative to heavy fuel oil for the shipping, refining and power generation industries. It continues to make progress in key projects with major shipping line Maersk and in Saudi Arabia and Asia. It has broadened its project portfolio to include programmes with Ecopetrol in Colombia and a global oil major. Commercialisation of any one of these projects would result in substantial profits for Quadrise. Further progress regarding any of these key projects has the potential to drive upwards movement in the share price beyond our indicative value of 28.8p/share towards 39.1p.

MSAR, a cost-effective alternative to heavy fuel oil

Over 600Mt of heavy fuel oil (HFO) are consumed globally each year. Typically, refineries mix heavy oil residues with valuable middle distillates to produce HFO. Quadrise’s process uses water and specialist chemicals from AkzoNobel to produce MSAR, an HFO substitute. Refineries and oil-based economies can thus derive much higher value from the middle distillates, potentially enabling oil-producing economies to reduce distillate imports and their refineries to offer MSAR at a discount to HFO. MSAR is also attractive to marine fleet operators, for which fuel is up to 75% of operating costs. In addition, MSAR produces significantly lower NOx emissions and negligible black soot on combustion.

Progress de-risks investment proposition

Over the last 12 months, Quadrise has passed major milestones in the development of a marine fuel, so that management is looking to commence commercial roll-out in calendar 2014. Confirmation that MSAR is now approved for application in Saudi Aramco refineries has given added impetus to activities in Saudi Arabia. The selective addition to the portfolio of projects with Ecopetrol in Colombia and a global oil major de-risks the cumulative opportunity.

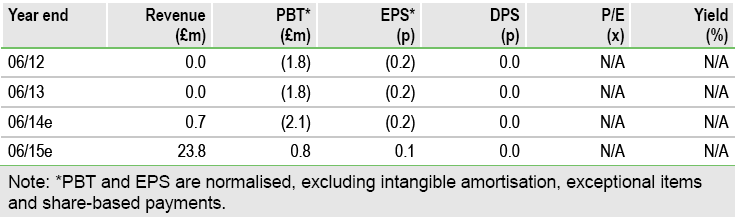

Valuation: Increase in value with commercialisation

Our valuation is based on potential cash flows from the key projects, applying a blended discount factor to reflect specific country and execution risk. We reduce this blended discount rate to 13.8%, reflecting progress made in the marine, Saudi and Asia programmes, revising our indicative value from £150m (19.4p/share) to £223m (28.8p/share). Further progress could reduce it further, implying up to 39.1p/share. Management has noted that it may seek additional funding, depending on the timing of first commercial revenues. A placing similar in magnitude to October 2012 (£3.5m gross) would not be materially dilutive to our indicative value.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Quadrise Fuels International: A Year Of Progress

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.