OPEC deal looks to maintain oil’s sweet spot

OPEC and Russia (‘OPEC+’) wound up their meetings last week by agreeing on a production increase for the first time in nearly two years. While details remain cloudy with no formal output targets provided, a supply increase of up to 1 million barrels per day (bpd) over the next six months looks likely. Partly reflecting the agreement’s lack of precision, spot oil prices have been volatile in the aftermath. The key Brent benchmark initially surged around 4% before falling back close to the $75 level seen before the meetings.

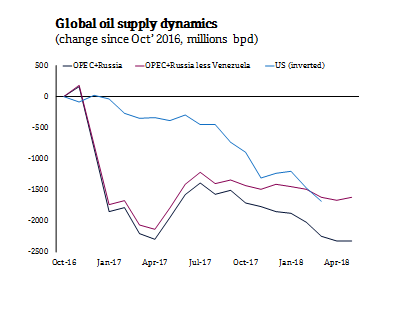

The background to the decision to lift production is, of course, OPEC’s agreement to reduce and then freeze its output by 1.2 million bpd from October 2016 levels with several non-OPEC members (primarily Russia) weighing in with a further 600k bpd of cuts. These reductions were spurred by the cocktail of then sluggish global demand and surging US shale supply which was leading to a supply glut, surging inventories and benchmark prices tumbling below $40/b.

Fast forward 18 months and the output cuts, which were extended to mid-2018,have helped restore balance to the oil market. OECD inventories have pulled back towards longer-run norms and spot prices are back above $70/b. In fact, with Brent crude recently briefly touching $80/b, prices are in danger hitting levels that could crimp global demand and spur a global capex wave that could reignite severe downside risks over the longer haul. The desire to keep oil prices relatively stable around current levels, which are close to a sweet spot, therefore underpins OPEC’s decision to relax its output curbs.

But while the ‘OPEC+’ deal has certainly played a role in returning the oil market to health, it has not been decisive. Over the period of the deal, US oil output has continued to surge. In fact, since October 2016, US supply has surged by almost 1.7 million bpd to over 10.4 million bpd; close to a 20% increase.

The US’ supply surge would have completely nullified the impact of the ‘OPEC+’ deal had the cuts in reality not been substantially deeper than intended. Rather than the combined 1.8 million bpd agreed reduction, the group’s output has actually fallen by over 2.3 million bpd vs. October 2016. The key driver of ‘over-compliance’ has been the collapse of Venezuelan output which has slumped by some 700k bpd; more than 600k bpd less than its agreed commitment!

Global oil supply dynamics

Even with the unprecedented slump in Venezuelan output and OPEC’s resulting ‘over-compliance,’ supply factors have not been decisive in the oil market’s recovery. Key has been booming global demand. With global GDP growth approaching a 7-year high of close to 4% this year, global oil demand is gaining at an annual rate of around 1.4 million bpd.

OPEC and Russia’s willingness to increase production would seem to reflect confidence that at least two of these three key factors, buoyant global oil demand and further short-run supply disruptions, will remain in place. Venezuelan output could easily fall further, risking a spike in spot prices north of $80/b unless other OPEC members pump more. In its recent 2019 forecast, the authoritative International Energy Agency (IEA) warned that Venezuelan output could still plunge by a further 550k bpd.

The other potential supply disruption facing OPEC is the risk of renewed US sanctions removing Iranian barrels from the market. The IEA also estimates that Iranian output could be curbed as much as 900k bpd based on the impact of previous sanctions. While the IEA’s estimates should probably be treated as a worst-case scenarios, the specter of Venezuela and Iran supply disruptions looks to have been key to OPEC’s decision to try to lift aggregate production back to agreed levels and heading off the risk of even greater ‘over-compliance.’

While short-run supply dynamics are a clear upside risk, demand prospects are becoming more uncertain. While booming US GDP growth shows little sign of slowing for now, euro-zone growth momentum has palpably cooled off in recent months. China too is showing clear signs of slowdown with recent retail sales and industrial data disappointing. And the rising threat of a global trade war increases downside risks to the world economy in 2019.

Lastly, the third and final defining feature of the global oil market of recent years – booming US shale supply – looks set to remain in force. Average break-even rates for shale producers continue to drift towards $50 per barrel; well below spot WTI prices. The surge in ‘drilled but uncompleted wells’ over the last year attests to the potential for further hefty output increases.

The Permian basin in Texas and New Mexico is the region delivering the most explosive supply gains and with the greatest future potential. But in the short-term, production bottle-necks, particularly a lack of pipeline capacity, are limiting the flow out of the region. New pipeline projects are underway but a decisive increase in the Permian’s ‘takeaway’ capacity looks unlikely until 2019H2, suggesting a lag before the next wave of US shale supply hits global markets.

The outlook for oil prices remains highly uncertain reflecting the interplay of short-run supply disruptions, still firm but slowing global demand and booming US supply. OPEC’s historic decision to lift production would seem to prioritize the first factor, damping short-term upside risks. But, with global demand now cooling and supply bottlenecks in the Permian basin eventually easing, downside risks still dominate on a longer-term horizon. Accordingly, our oil price assumptions continue to target Brent crude averaging $69/b in 2018, slipping to a $66/b average in 2019.