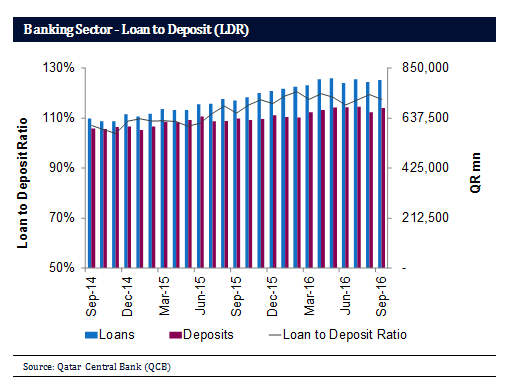

The loan book increased by 1.1% MoM after declining by 1.7% MoM in August 2016 (gaining by 2.0% MoM in July 2016). Deposits followed suit, growing by 2.6% MoM (declining by 3.4% MoM in August 2016). Public sector drove total credit growth with a gain of 2.2% MoM (down 5.6% MoM in August 2016). Moreover, public sector deposits expanded by 3.2% MoM after dropping by 10.5% MoM in August 2016. Thus, the LDR was broadly unchanged at118% vs. 119% at the end of August 2016 (117% in July 2016).

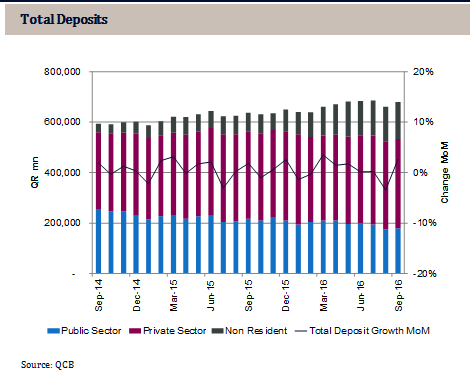

The public sector deposits rebounded by 3.2% MoM for the month of September 2016 after a decline of 10.5% and 2.5% MoM in August and July, respectively. Delving into segment details, the government segment (represents ~32% of public sector deposits) led the growth,increasing by 8.1% MoM (flat YTD). Moreover, the semi-government institutions’ segment gained by 6.7% MoM vs. a 3.7% MoM drop in August 2016(down 12.3% YTD). On the other hand, the government institutions segment continued its negative trajectory,receding by 0.7% MoM after dropping by 1.4% and 3.7% MoM in August and July, respectively (down 21.4% YTD). On the Private sector front, the companies & institutions’ segment climbed up by 1.3% MoM after a flattish performance in August (down 6.7% YTD). On the other hand, the consumer segment exhibited flat performance MoM (+8.1% YTD). Non-resident deposits expanded by 6.6% MoM (+69.1% YTD).

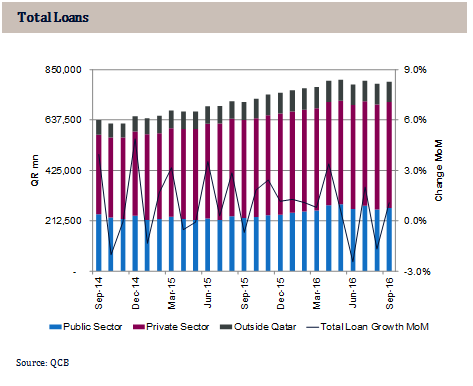

The overall loan book climbed up 1.1% MoM in September 2016 led by the public sector. Total domestic public sector loans increased by 2.2% MoM (+12.1% YTD). The government segment’s loan book led the growth, expanding by 4.8% MoM (+36.4% YTD). Moreover, the government institutions’ segment (represents ~53% of public sector loans)ticked up by 0.7 MoM during September vs. a flat performance MoM in August (+0.2% YTD). On the other hand, the semi-government institutions’ segment slightly dipped MoM (-0.2%). Hence, the government sub-segment pulled the overall loan book up for the month of September 2016.

Private sector loans inched up by 0.7% MoM in September vs. a flat performance (+0.4%) MoM in August.The Real Estate segment aided the uptick in private sector loans (contributes ~28% to private sector loans), moving up by 0.8% MoM (+4.1% YTD). Moreover, the Consumption & Others segment (represents ~28% of private sector loans) also helped loan growth, increasing by 0.7% MoM (flat YTD). On the other hand,Services exhibited flat performance MoM (+16.9% YTD). It should be noted that on a YTD basis, this segment contributed the most to the growth in total private sector loans.