QIAGEN N.V. (NASDAQ:QGEN) reported second-quarter 2017 adjusted earnings per share (considering restructuring expenses as one time item) of 30 cents, up 25% year over year. The reported figure beat the Zacks Consensus Estimate by a penny.

At constant exchange rate or CER, the company reported adjusted earnings per share (EPS) of 25 cents, which failed to meet the company’s guidance of 27–28 cents at CER.

Considering one-time items, QIAGEN’s reported EPS in the quarter was 6 cents, down 33.3% year over year.

Revenues in Detail

Net sales at actual rates in the first quarter grew 4% on a year-over-year basis to $349.0 million (up 6% at CER). The top line surpassed the Zacks Consensus Estimate of $347.0 million. Adverse currency translation impacted the top line by 2%.

Meanwhile, considering the acquisitions of OmicSoft in January, revenues increased 5%. Adverse currency translation impacted the top line by 2%.

Organic expansion drove 4% of total CER growth. Also, the company faced no headwinds from U.S. HPV test sales in the reported quarter. Moreover, 3% of the total CER growth came from the Jun 2016 acquisition of Exiqon A/S and to a lesser extent from the OmicSoft buyout.

Region-wise, sales from the Americas (47% of revenues) grew 4% at CER, while revenues from Europe-Middle East-Africa (32%) and Asia-Pacific/Japan (21%) increased 8% and 12%, respectively, at CER. Sales in the top seven emerging markets (17%) exhibited growth of 12% year over year at CER in the quarter.

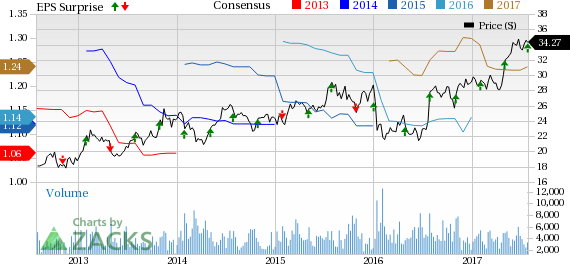

Qiagen N.V. Price, Consensus and EPS Surprise

Segments in Detail

QIAGEN primarily generates revenues from Molecular Diagnostics, Applied Testing, Pharma and Academia, which represented 48%, 10%, 20% and 22% of net sales, respectively, during the reported quarter.

Molecular diagnostics sales were up 6% at CER driven by substantial growth in QuantiFERON latent TB tests, QIAsymphony automation system consumables portfolio and Personalized Healthcare. Sales derived from Applied Testing rose 12% at CER, on increased uptake of new products in human ID and forensics.

Pharma sales rose 8% at CER in the second quarter and Academia sales improved 4% at CER backed by growing demand.

Operational Update

Adjusted operating income in the second quarter increased 7% year over year to $74.5 million. Also, the adjusted operating margin expanded 50 basis points to 21.3%.

Financial Update

QIAGEN exited the second quarter with cash and cash equivalents of $542.8 million, up from $439.1 million in the sequentially last quarter. Year-to-date net cash from operating activities was $129.5 million, up from $147.8 million a year ago. Moreover, the company reported year-to-date free cash flow of $91.6 million compared with $107.9 million in the year-ago period. .

In Jan 2017, QIAGEN completed a synthetic share repurchase that combined a direct capital repayment with a reverse stock split as part of a commitment to return $300 million to shareholders. The transaction was announced in Aug 2016 and involved an approach used by various large, multinational Dutch companies to provide returns to shareholders in a faster and more efficient manner than traditional open-market purchases. QIAGEN intends to repay the balance of the commitment through open-market share repurchases in 2017. At present, the company is left with $55 million under its $300 million return commitment, which the company intends to complete by the end of 2017.

2017 Guidance

Banking on a solid second-quarter performance, QIAGEN has raised its full-year 2017 guidance for adjusted net sales growth to 7% at CER, pegged at the high end of the previously projected range of 6–7%.However, the adjusted EPS guidance has been reiterated at the band of $1.25–$1.27 at CER.

This is based on operating and financial leverage which includes benefits from completion of the $300 million share repurchase plan by the end of 2017 and efficiency actions taken in 2016. This, however, excludes the expected 7 cents per share of restructuring costs planned for 2017. The Zacks Consensus Estimate for 2017 earnings of $1.24 is below the guided range. The Zacks Consensus Estimate for 2017 revenues is pegged at $1.40 billion.

The company also provided its financial guidance for the third quarter of 2017. Net sales are expected to grow 7% at CER. Adjusted EPS is expected at around 32–33 cents at CER on an underlying basis. Also, adverse currency translation is expected to have a penny of negative impact on the bottom line. The Zacks Consensus Estimate for third-quarter revenues is pegged at $355.59 million, while earnings estimates remain stable at 32 cents.

Our Take

QIAGEN ended the second quarter on a solid note, with earnings and revenues beating the Zacks Consensus Estimate. We are impressed with balanced growth across all of the company segments. However, adverse foreign currency translation continues to be a drag on overall sales. Furthermore, on the profitability front, QIAGEN delivered strong performance with respect to operating margin.

Meanwhile, its commitment to return more to its shareholders through increased share repurchases reflects its solid cash position.

We are also upbeat about the company’s strategic focus to drive growth through Sample to Insight offerings. In this space, the company recently received FDA approval for its QuantiFERON-TB Gold Plus. Also, the company experienced increased momentum in its GeneReader NGS System. The company is also forming collaborations to drive growth in the personalized homecare space. Recently, it collaborated with Bristol-Myers Squibb to investigate the use of NGS technology for the development of gene expression profiles (GEPs) as predictive or prognostic tools to be used with novel Bristol-Myers Squibb novel BMS immuno-oncology (I-O) therapies in cancer treatment.Also, the company’s QIAsymphony, continued to grow substantially towards the target of more than 2,000 cumulative placements by the end of 2017. Moreover, by the end of the second quarter, the systems portfolio was widened with two new FDA approved tests especially, the JAK2 assay.

Zacks Rank & Other Key Picks

Currently, QIAGEN has a Zacks Rank #2 (Buy).

Other top-ranked medical stocks are Mesa Laboratories, Inc. (NASDAQ:MLAB) , INSYS Therapeutics, Inc. (NASDAQ:INSY) and Align Technology, Inc. (NASDAQ:ALGN) . Notably, INSYS Therapeutics sports a Zacks Rank #1 (Strong Buy), while Mesa Laboratories and Align Technology carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

INSYS Therapeutics has a long-term expected earnings growth rate of 20%. The stock has gained around 1.9% over the last three months.

Mesa Laboratories has a positive earnings surprise of 2.8% for the last four quarters. The stock has added roughly 2.6% over the last three months.

Align Technology has an expected long-term adjusted earnings growth of almost 24.1%. The stock has added roughly 16.8% over the last three months.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early. See Zacks' 3 Best Stocks to Play This Trend >>

Mesa Laboratories, Inc. (MLAB): Free Stock Analysis Report

Insys Therapeutics, Inc. (INSY): Free Stock Analysis Report

Qiagen N.V. (QGEN): Free Stock Analysis Report

Align Technology, Inc. (ALGN): Free Stock Analysis Report

Original post

Zacks Investment Research