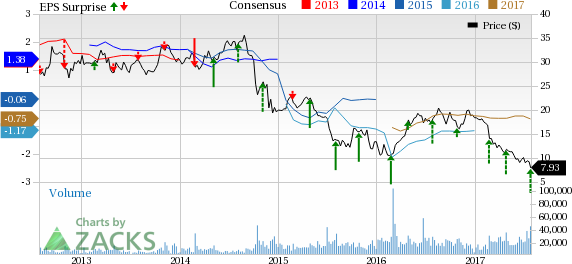

Independent energy explorer QEP Resources, Inc. (NYSE:QEP) reported second-quarter 2017 loss per share – excluding special items – of 12 cents, narrower than the Zacks Consensus Estimate of a loss of 19 cents. The company had reported adjusted loss of 23 cents per share in the year-ago quarter. The improvement in year-over-year results was primarily driven by decrease in overall operating expenses and increased overall realized price.

Quarterly revenues of $383.7 million missed the Zacks Consensus Estimate of $411 million as volumes remained stagnant but increased 15% from second-quarter 2016.

Volume Analysis

QEP Resources’ overall production in the quarter came in at 13,860.6 million barrels of oil equivalent (Mboe) – essentially flat from the year-ago period. Natural gas volumes increased 6.8% year over year to 45.8 billion cubic feet (Bcf), whereas liquid volumes declined 7.5% to 6,225.2 thousand barrels.

Although production in the Permian Basin increased 23% year over year and 38% sequentially, lower production and fewer completions in the Williston Basin and Pinedale dampened overall production in the second quarter.

Notably, QEP Resources had divested its Pinedale assets for $740 million as part of its portfolio optimization process.

Realized Prices

QEP Resources’ average realized natural gas price in the quarter was $2.82 per thousand cubic feet, up 12.4% from the year-ago quarter price of $2.51. Moreover, average oil price realization improved 6.9% year over year to $46.72 per barrel. Overall net realized equivalent price averaged $27.37 per barrel of oil equivalent in the quarter, up 6% year over year.

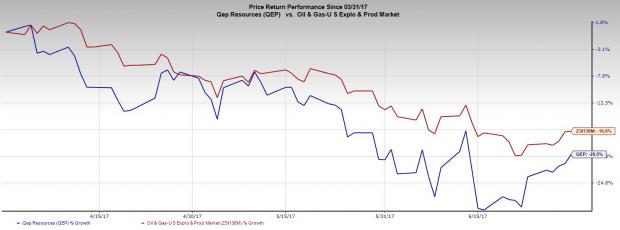

Price Performance

QEP Resources stock has lost 20.5% in the second quarter of 2017, underperforming the 16.9% fall of the industry it belongs to.

Operating Expenses and Capital Expenses

Total operating expenses for the quarter decreased to $404.4 million from $425 million a year ago, reflecting a reduction of 4.9%. The reduction is primarily attributed to a decrease in purchased oil and gas expense along with general and administrative expenses.

Capital investment, excluding acquisitions, was 257% up year over year to $306 million for the second quarter.

Permian Basin in Focus

QEP Resources has shifted its focus to the Permian Basin, for which it invested $41.5 million in its midstream infrastructure in the region. It is following the footsteps of oil companies like American Midstream (NYSE:AMID) , Apache Corporation (NYSE:APA) and Chevron Corporation (NYSE:CVX) . QEP Resources has also agreed to buy $732 million worth of oil and natural gas properties in the area from an undisclosed seller. Net production from the assets is 635 Boe/d, of which 71% is oil. QEP Resources expects total net recoverable resources in the area to be around 295MMBoe. The asset includes 730 potential horizontal drilling locations.

The company carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Balance Sheet

As of Jun 30, 2017, QEP Resources had cash and cash equivalents of $178.8 million. The company’s long-term debt (including current portion) was $1,889 million, which represents a debt-to-capitalization ratio of 34.2%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Chevron Corporation (CVX): Free Stock Analysis Report

American Midstream Partners, LP (AMID): Free Stock Analysis Report

Apache Corporation (APA): Free Stock Analysis Report

QEP Resources, Inc. (QEP): Free Stock Analysis Report

Original post

Zacks Investment Research