In early April, Qatar lifted a moratorium on the development of the North Field, the world’s largest non-associated gas reservoir. The moratorium had been in place since 2005 and its removal clears the way for anincrease in production and export of liquefied natural gas (LNG). A new development from the North Field would produce 15.2m tons per year in 5-7 years, an increase of 10% from current total gas production levels.

The lifting of the moratorium might be motivated by the dynamics in the global LNG market over the next decade. A wave of new LNG supply is expected up to 2020, but then the market is expected to tighten beyond that. The return to the market of the world’s largest LNG producer should deter potential investment from other sources, allowing Qatar to maximise better compete forits market share in the 2020s.

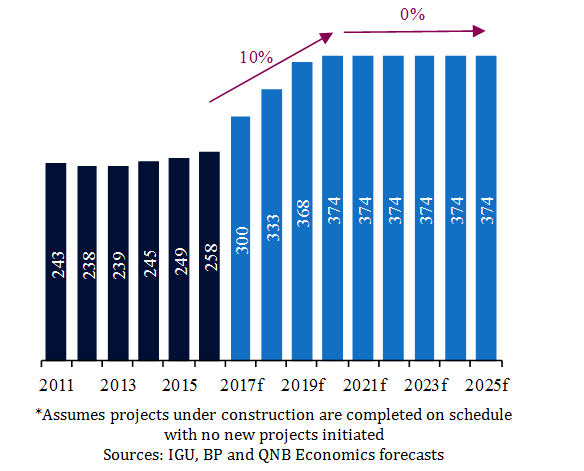

Global LNG markets are expected to be oversupplied until 2020, but become undersupplied thereafter. New LNG supply is expected up to 2020 mainly from the US and Australia, boosting global production by around 10% per year over the period, which will outstrip demand growth, expected to be around 6% per year in line with recent historical growth. However, beyond 2020 the market is expected to tighten with supply broadly flat as few new LNG projects (which take 5-7 years to complete) have been given the green light since the sharp decline of oil prices in 2014.

Nonetheless, there are a huge number of potential projects waiting on the side-lines, which could increase supply if prices recover. The International Gas Union (IGU), a global association to support the gas sector, estimates that existing project proposals amounted to 879m tons, or 3.4 times the current market size.

Given recent low prices, most of these projects have been unable to progress. However, the last few months have seen a turnaround in LNG spot prices, which have risen from USD4.1 per million British thermal units (mbtu) in May to USD10.0 in February. If these higher prices are sustained, itwould increase the likelihood that producers can achieve agreements for long-term sales contracts at prices above the break even level for new projects. There is a risk that some of the proposed projects could get the go ahead.

Global LNG supply* (million tons per year)

*Assumes projects under construction are completed on schedule with no new projects initiated

Sources: IGU, BP (LON:BP) and QNB Economics forecasts

Hence, now is a good time for Qatar to step back into the market to deter new investments elsewhere given its comparative advantages. First, Qatar already has existing infrastructure and LNG facilities that could help keep costs down. The total cost of new production is estimated to be USD2-5 per mbtu, below the level at which other potential new projects are viable.

It is possible that Qatar could increase production of LNG by simply “debottlenecking” (upgrading) existing facilities, which would keep costs at the low end of its range. Second, as the world’s largest producer, Qatar already has the reputation for reliability and the relationships to agree long-term supply agreements with importers.

Qatar’s decision to lift the moratorium came as a surprise to markets. After 12 years with little word on when it would likely be lifted, many had begun to assume that it could remain in place indefinitely. However, the decision to lift the moratorium could help cement Qatar’s position as a leading global LNG exporter. It will also help to boost growth and national income when production comes on stream, probably just after the World Cup in 2022.