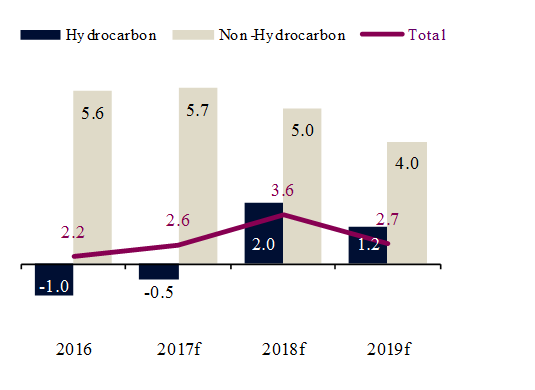

Despite the halving of oil prices from their 2014 highs, Qatar’s economy continued to grow robustly in 2016, particularly in the non-hydrocarbon sector where key infrastructure projects maintained progress. Going forward,we expect higher oil prices over 2017-19 to have two key effects.First, they will help to boost government income and ease fiscal constraints. Second, higher oil prices will help support the government’s continued investment spending programme which will be one of the key drivers to underpin growth in non-hydrocarbon sector. In terms of the hydrocarbon sector, we expect this to gradually recover as production picks up over the medium term. Overall, we expect headline real GDP growth to accelerate to 2.6% in 2017 and 3.6% in 2018 before slowing to 2.7% in 2019(see our recently published Qatar Economic Insight Report).

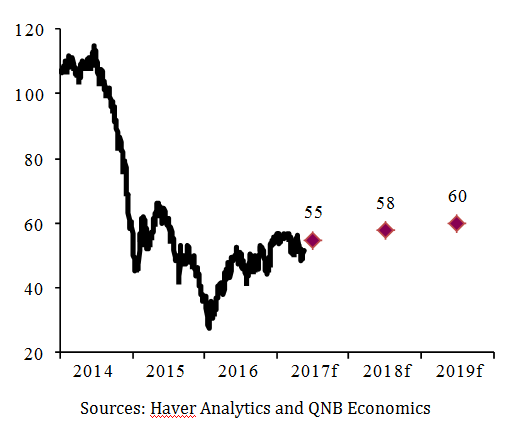

Brent crude historical and forecast oil prices (USD/b)

Sources: Haver Analytics and QNB Economics

We expect the outlook on oil to improve over 2017-19 as excess supply in oil markets clears. We forecast Brent crude oil to average USD55/b in 2017, from USD45/b in 2016, and rise to USD60/b by 2019. Higher oil prices should boost government revenue and thereby help to ease fiscal constraints. Revenues will also be helped in 2018 by the expected implementation of VAT. On the expenditure side, we expect that the bulk of the government’s adjustments to the oil price shock have already taken place, thereby making cuts to current spending in 2017 less severe than they were in 2016. Furthermore, the government has announced significant capital spending plans over the next three years. We expect the budget deficit to narrow from 7.2% of GDP in 2016 to 1.5% in 2017 before switching to a surplus of 1.0% and 2.3% in 2018-19.

Higher oil prices and the positive fiscal outlook should provide a lift to Qatar’s economy, particularly in the non-hydrocarbon sector. The government’s plans to increase capital spending over the next three years are mainly focused on the implementation of Qatar’s longer-term 2030 vision as well as on the preparation of the upcoming 2022 FIFA World Cup. This will boost non-hydrocarbon sectors such as transportation,construction, education and health.Growth in the non-hydrocarbon sector will also be helped by the expected recovery in the manufacturing sector as a new refinery has begun production in 2017. Alongside this, the expected increase in oil prices should help ease liquidity constraints and boost incomes in the wider economy. In 2018-19, non-hydrocarbon growth is expected to slow to 5.0% and 4.0% as investment generates less growth than in the past given the larger size of the economy.

In terms of the hydrocarbon sector, we expect a contraction of 0.5% in 2017, less than the 1.0% decline seen in 2016. Natural declines at mature oil fields and output cuts to meet OPEC targets will slow growth, but should be partially offset by initial gas production from Barzan, expected in Q4 2017. In 2018-19, we expect hydrocarbon growth to rise to 2.0% and 1.2% in line with the ramp up in Barzan production and as long-term investments offset natural declines in oil output.

Real GDP growth (%, year on year)

Sources: Ministry of Development Planning and Statistics, Haver Analytics and QNB Economics

Having weathered the oil price shock well due to strong macroeconomic fundamentals, Qatar’s economy should continue to grow as authorities pursue diversification plans over the medium-term. Real GDP growth, driven by the non-hydrocarbon sector, should pick up as higher oil prices improve Qatar’s fiscal balance and facilitate government spending plans.