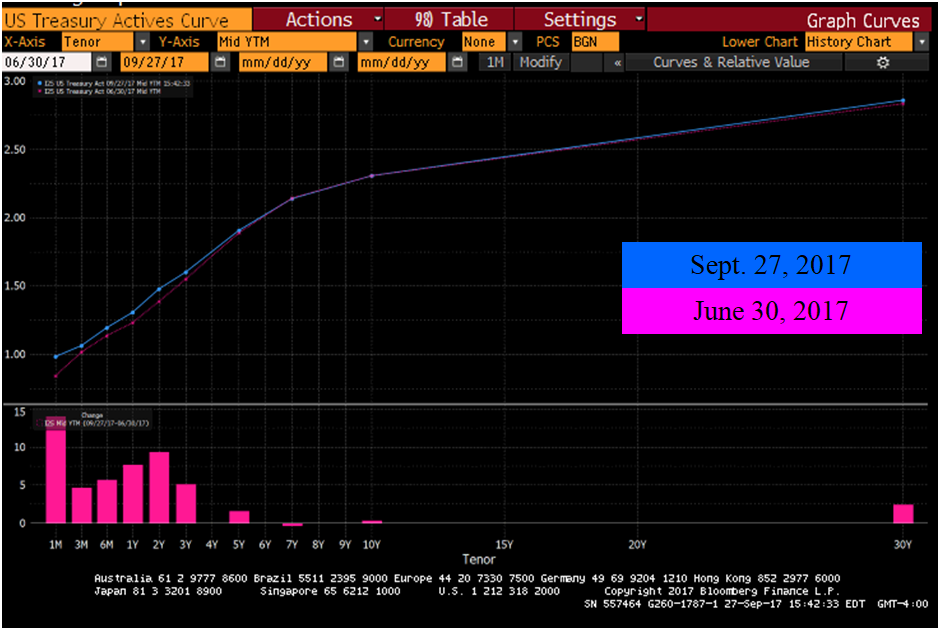

The third quarter of 2017 saw a strong equity market, while yields in the fixed-income market experienced continued volatility. The big picture for the Treasury market during the third quarter was that yields were little changed, with the 1-year Treasury yield increasing by 7.6 basis points and the 10-year and 30-year Treasury yields increasing by 0.5 and 2.7 basis points, respectively. The 10- and 30-year Treasuries did however set 2017 lows on 9/7/17, at 2.04% and 2.66%. These 2017 lows were spurred by lack of supply during the summer months, poor inflation numbers throughout the third quarter, and geopolitical risk surrounding North Korea and the “Rocket Man.” The following table shows the US Treasury actives curve, outlining the movement in yields across the Treasury market from 6/30/17 to 9/21/2017.

Source: Bloomberg

At the third-quarter FOMC meeting the Fed took a much-anticipated break from raising short-term interest rates after it had increased rates a quarter point at each of the past three quarterly meetings. The FOMC’s “dot plot” indicated that they are likely to raise the short-term interest rate another quarter point at year's end and maybe twice next year. The Fed also stressed wanting to normalize its balance sheet and announced an October start to the unwinding process. They will do this in very small increments, resulting in a multi-year process. No one knows exactly how this will impact markets and the economy, but we expect to gain additional clarity as the process unfolds.

The FOMC’s statement following the meeting was mostly unchanged, other than adding a positive note on business investment, stating that “Growth in business investment has picked up in recent quarters.” Other comments in the statement acknowledged that job gains remain solid and that the inflation outlook remains unchanged. The statement also pointed out that the recent hurricanes will temporarily boost headline inflation, but they do not expect it to “materially alter the course of the national economy over the medium term.”

Feeding The Muni Beast

During the third quarter of 2017 we looked to take advantage of the limited supply and the 2017 lows in Treasury yields by selling some of the long tax-free municipal bonds that we purchased at yields greater than 4%. The limited supply throughout the quarter along with retail demand for bonds provided an opportunity to feed the retail beast and take profits in several of our longer holdings. As yields have started to increase over the last couple of weeks and as summer has drawn to a close, it is our expectation that bond supply will pick up and some more attractive opportunities will be available.

As we enter the fourth quarter of 2017, Cumberland’s view is that rates will continue moving upward. We expect that the Fed will raise rates one more time this year, most likely in December and possibly twice next year. As the Fed initiates the unwinding of its balance sheet, it should become clear how markets will react moving forward. Our goal for the near term is to continue structuring portfolios defensively in the face of higher interest rates, while looking for opportunities on the long end of the curve as yields go higher. We will maintain a conservative approach to investing, with a focus on preservation of capital as long as we are faced with a rising-interest-rate environment.