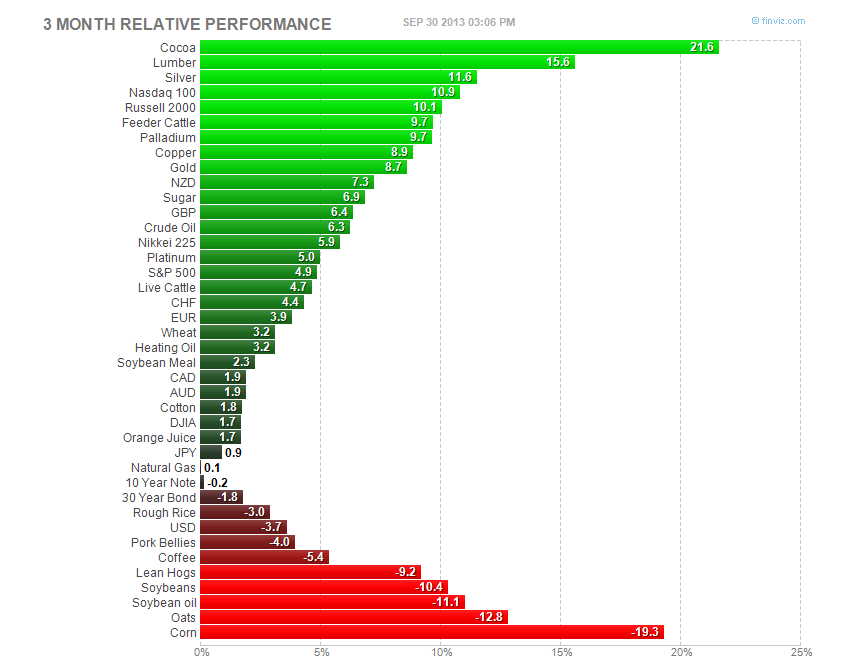

Clearly the Grain complex traded heavy over the past quarter. There was no real weather market (compared to last year's historic drought). The Dollar and Treasuries have also traded heavy as the threat of Taper has weighed on fixed income. Conversely, the Kiwi, Pound, Swiss, Euro, et all have performed well v. the USD in Q3.

Coffee continues to plumb multi year lows with massive crops hit the physical market. Supply and demand do matter. Supplies are ample and the largest global consumption comes from Europe, which continues their economic malaise (and VERY high unemployment rates).

Cocoa, Lumber, Silver, and the Nasdaq 100 top the leader board.

- Weather in the Ivory Coast

- Very strong new home prices/sales

- Rebound after massive liquidation in Q2

- Technology is the belle of the ball again!

The dysfunctional Congress appears to be grinding toward a government shutdown over the spending bill which doesn't bode well for the debt ceiling debate which must be addressed in the next 18 days.

The S&Ps are closing RIGHT AT the 50 day moving average - 1680 on Cash. 1671 on Dec futures.

The 100 day moving average comes in at 1658 on cash. 1649 on Dec futures. (BIG DEAL?)

The 200 day moving average comes in at 1585. 1575 on Dec futures.

Risk Disclaimer: This information is not to be construed as an offer to sell or a solicitation or an offer to buy the commodities and/ or financial products herein named. The factual information of this report has been obtained from sources believed to be reliable, but is not necessarily all-inclusive and is not guaranteed to be accurate. You should fully understand the risks associated with trading futures, options and retail off-exchange foreign currency transactions (“Forex”) before making any trades. Trading futures, options, and Forex involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more than your initial investment. Opinions, market data, and recommendations are subject to change without notice. Past performance is not necessarily indicative of future results. This report contains research as defined in applicable CFTC regulations. Both RCM Asset Management and the research analyst may have positions in the financial products discussed.