As budget season comes to a close, there were 14 states joining Illinois that still had not finalized their budgets by the time of this writing. Illinois, which has received numerous downgrades because it has not had a budget in two years and has amassed a large backlog of receivables, could possibly lose its investment-grade rating if it does not pass a budget.

On a somewhat positive side, Morgan Stanley’s Muni Early Tax Analysis (META) indicator of state general fund collections rose 4% in May, reversing three months of weak data. This trend is consistent with their economists’ predictions of 2Q economic growth at 2.9%, compared with 1Q growth of 1.2%. The authors caution that it may be too early to declare an end to the trend of revenue weakness, especially with summer upon us; but we will keep an eye on this.

State Rating Actions

Again the quarter was highlighted by a number of state downgrades, including a few repeat offenders that by now may not surprise our readers.

Illinois has been downgraded three times since the beginning of the year. The most recent actions were triggered by the state’s failure to pass a budget by May 31. Moody’s and S&P both downgraded the state to Baa3/BBB-; and, significantly, appropriation-backed debt was downgraded to non-investment-grade. If the state does not arrive at a budget, S&P has indicated that it could downgrade the state again, bringing it to non-investment-grade. The state average is in the AA category.

New Jersey was downgraded by Moody’s to A3 on March 27, the day our Q1 2017 commentary (http://cumber.com/municipal-credit-first-quarter-2017-review/) was released. The downgrade reflects the continued negative impact of significant pension underfunding, persistent structural imbalance, and weak fund balance. The outlook on the state’s rating was changed to stable over the next 12 to 18 months, on the expectation that, in the short term, economic performance will be solid and any budget gaps manageable, whereas in the long run the credit profile will weaken as long-term liabilities (pensions and debt) grow.

Connecticut’s rating was cut in May to A1/A+/A by Moody’s, S&P, and Fitch, respectively. The downgrades were essentially based on an erosion of the state’s finances, including the drawing down of its rainy day fund, and reduced expectations for economic and revenue performance over the medium term, leading to reduced fiscal flexibility. The trend on the ratings was changed to stable, based on the state’s broad economic base and expectations that it will proactively manage its financial operations. Although the state is losing population, it remains the wealthiest state in the nation, based on per capita personal income.

Massachusetts was downgraded to AA from AA+ by S&P as a result of the state’s failure to replenish reserve funds as planned, highlighting to S&P that the state may be moving away from its stated fiscal policies. Large reserves help states and municipalities move through a cycle.

Alaska’s AA+ rating was placed on CreditWatch negative by S&P on June 19, reflecting its view that the state could remain structurally imbalanced for fiscal 2018 based on its budget negotiations impasse. Without structural fiscal reforms in the 2017 legislative session, S&P would likely lower the state’s debt rating.

Mississippi’s S&P outlook on its AA rating was changed to negative from stable on weakness in the state’s revenue trends, even as the state manages budget reductions and incremental revenue loss from the implementation of recent tax changes. The negative outlook also reflects the declining trajectory of the state's pension-funding ratios.

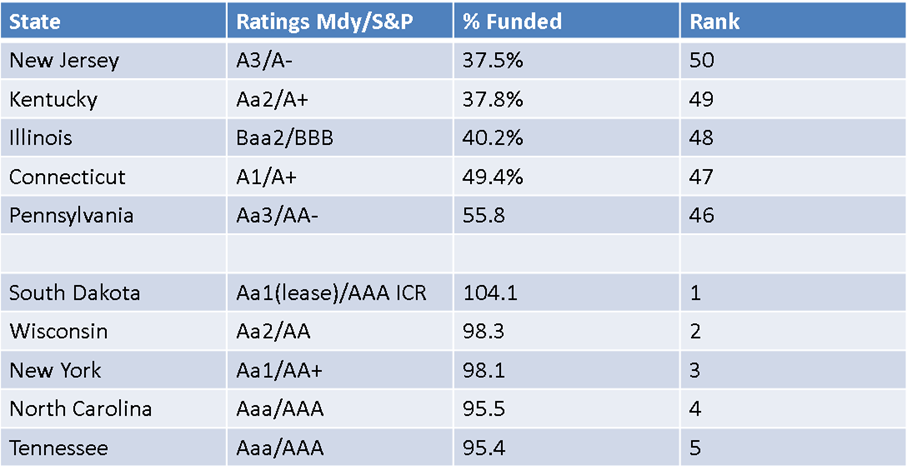

Pension Funding

One of the continuing and pressing issues for state and local governments is pension funding. The chart below, from the most recent (April 2017) Pew Charitable Trust report, shows the states with the best- and worst-funded pension plans. When states experience low investment returns compared with earnings assumptions, unfunded pension liabilities balloon, increasing the size of required annual contributions to pension funds. These annual contributions compete with other expenditures; and because they are not immediate needs, states sometimes postpone the contribution or make one smaller than required to correct the shortfall. California recently bucked that trend by approving a budget that includes $12 billion in payments to its largest pension fund to help reduce future unfunded liabilities. As the following chart shows, not all states have low pension funded ratios.

Bond Insurance

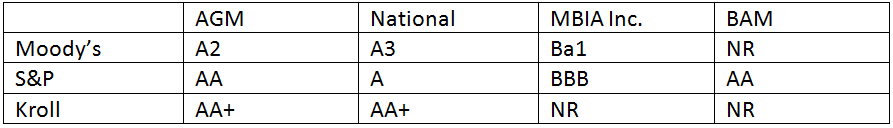

S&P downgraded National Public Financial Guarantee to A from AA- based on its weak market share. National’s insured bonds are now rated A/A-/AA+ by S&P, Moody’s, and Kroll bond rating agencies, respectively. At the same time, S&P noted National’s very strong claims-paying resources. In its recent stress-testing scenarios of the company’s capital adequacy, all claims could be paid.

Prior to the financial crisis, the bond insurance industry insured over 50% of municipal bond new issues. In Q1 2017, National insured about 2% of new issues, with competitors Assured Guarantee Municipal (AGM) AA/A2/AA+ at 56% and Build America Mutual (BAM) insuring a 42% share. Municipal bond insurance provides more saving to issuers when interest rates and credit spreads are wider, because the bond insurance helps the bonds to have lower relative yields and thus cost savings. The expectation is that bond insurance usage will increase at some time in the future, though not soon enough to help National’s rating at this time. Insurance helps investors feel more secure because the bonds are generally more secure, having two sources of repayment. Headline and contagion risk can affect trading, as we discussed in our commentary dated June 27 (http://cumber.com/headline-risk-a-one-two-punch-and-contagion-risk/).

Municipal Bonds Default Rates Are Extremely Low

Moody’s released its annual “Municipal Default and Recoveries Study for 1970–2016.” Although municipal defaults have become more common in the last decade, they are still rare overall. The five-year municipal default rate since 2007 increased to 0.15% from 0.07% in 2015, mostly due to defaults in Puerto Rico. This rate compares with the comparable global corporate default rate of 6.92%. Per the results of the study, lower-rated bonds have higher default statistics, similar to corporates.

At Cumberland we invest in high-quality municipal bonds, emphasizing revenue bonds over general obligation bonds, because we feel they tend to be less affected by economic activity and trickle-down pressures from states in the form of reduced funding for programs and services when states need to make budget cuts. We especially like essential-service utilities bonds such as those issued to finance water and sewer systems. The table below shows the S&P rating distribution for the water and sewer sector, with over 50% of bonds in the AA or higher category. ![]()